#DontBeFooled

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#FollowTheMoney

#FollowTheLaw

#DontBeFooled

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#FollowTheMoney

#FollowTheLaw

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#FollowTheMoney

#FollowTheLaw

When I wake up in the morning at my home in Austin, Texas, I turn on the lights, and thereby provide a few cents to the city government’s electric company. I flush the toilet, owing a few more to Austin’s sewer service. When I pour myself a glass of water, the city water department gets a piece. After I get dressed and step outside, I watch the city take my trash, my recycling, and my compost—each pickup costs a few dollars. Sometimes, I discover a $25 ticket for parking my car in the wrong spot. Then I swallow my anger and drive down the MoPac highway, where I pay a toll to the Central Texas Regional Mobility Authority. I park in a garage downtown owned by the Austin Transportation Department, pay them a few bucks, and walk to my office. If I need to take a trip out of town, I pay $1.25 for a Capital Metro District bus to the city-owned Austin-Bergstrom International Airport, where, along with the price of my plane ticket, I pay a $5.60 fee for the benefit of being patted down by a TSA agent, a Passenger Facility Charge, and a small part in any rents the city charges restaurants and retailers. Only when I’m in the air does the drain to the government stop.

In one typical morning, I handed over money to several government bodies. But I didn’t pay any taxes—only fees, charges, and fines. These are the future of government in the United States.

The idea that government operates just by taxing and spending money is anachronistic. A growing share of its revenue comes from charges that the government imposes in exchange for its services or as a penalty for breaking its rules. In 1950, about 1 percent of Americans’ income went to charges from state and local governments. Today, that number is 4 percent. Include federal fees and charges, themselves the fastest-growing part of federal revenue, and that number rises to over 5.5 percent. Though largely hidden from the public, fees and charges account for most of the growth in government over the past 70 years and have become the top source of revenue for state and local governments.

Two factors drive this new reliance on special charges. First, governments are expanding the “businesses” they run—hospitals, universities, airports—and forcing users to pay more for them.

To continue reading this story, please click (HERE) to go to The City Journal.

PAID FAMILY LEAVE

By Shelly Bradbury

The Denver Post

The Colorado Supreme Court next week will consider whether the state’s fledgling family and medical leave program violates the Taxpayer’s Bill of Rights amendment to the Colorado Constitution.

The legal challenge, to be argued on Tuesday, focuses on funding for the newly voter-approved program, which will, beginning in 2024, offer up to 12 weeks of paid time off to most Colorado workers who are either sick or caring for their newborns or seriously ill family members.

Also known as Proposition 118, the $1.2 billion program was approved in 2020 by voters in a 57% to 43% vote.

The state will begin funding the program in January 2023 by collecting between 0.45% and 0.9% of employees’ annual pay from employees and their employers, with some exceptions.

That premium could be increased to as much as 1.2% of wages after 2025.

Those premiums are at the center of the legal challenge by Chronos Builders, a Grand Junction homebuilding company, which argues the fees are surcharges on income that violate TABOR, which requires that all income “be taxed at one rate … with no added tax or surcharge.” Continue reading

Senate Bill 260, passed by Democrats in 2021, enacted new fees on gasoline purchases, deliveries and Uber and Lyft rides to raise billions for transportation projects

Colorado’s new transportation fees violate the Taxpayer’s Bill of Rights and several other state finance laws and should be invalidated, two conservative groups and Republican state Sen. Jerry Sonnenberg claim in a long-promised lawsuit filed late Thursday in Denver.

Senate Bill 260, passed by Democrats in the legislature last year, enacted a host of new transportation fees — including on gasoline purchases, deliveries and Uber and Lyft rides — to raise money for road and transit projects across the state.

DENVER — Legislative Democrats are poised to kill a Republican effort to increase transparency for their constituents where fees and spending are concerned.

While Colorado Democrats and Governor Jared Polis continue to tout new state and federal regulations that went into effect Jan. 1 requiring all emergency medical costs to be disclosed before a patient is treated, an opaque charge collected on hospital stays, passed under previous Democrat legislation isn’t getting the same reception.

The fallout is leading two GOP lawmakers to call foul on their Democrat counterparts for not requiring government to follow the same transparency rules they force private industry into.

Senate Bill 22-038, the “Healthcare Affordability and Sustainability Fee,” sponsored by Sen. Jerry Sonnenberg, R-Sterling has been assigned to the State Veterans & Military Affairs Committee, where ideas that majority Democrats don’t agree with go to die.

It’s dubbed the “kill committee” because it’s where Senate leadership sends bills it doesn’t want debated among all the senators on the floor.

Click (HERE) to continue reading this story

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteOnTaxesAndFees

#TABOR

#FollowTheMoney

#FollowTheLaw

#UnlessLiberalsIgnoreTheLaw

Amendment 78 would transfer the power to appropriate custodial funds (state revenue not generated through taxes) from the state treasurer to the state legislature.

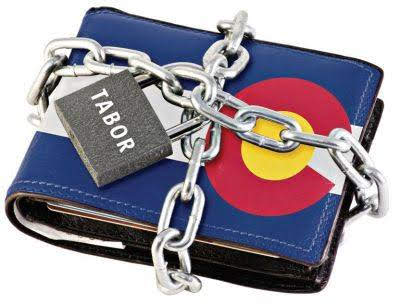

Plaintiffs alleged that the amendment is not substantially related to Colorado’s Taxpayer’s Bill of Rights (TABOR) and therefore should not appear on the 2021 ballot. Measures that can go on the ballot during odd years in Colorado are limited to topics that concern taxes or state fiscal matters arising under TABOR. This requirement was added to state law in 1994. The Colorado Taxpayer’s Bill of Rights (TABOR) requires voter approval for all new taxes, tax rate increases, extensions of expiring taxes, mill levy increases, valuation for property assessment increases, or tax policy changes resulting in increased tax revenue. TABOR limits the amount of money the state of Colorado can take in and spend. It ties the annual increase for some state revenue to inflation plus the percentage change in state population. Any money collected above this limit is refunded to taxpayers unless the voters allow the state to spend it

To continue reading this story, please click (HERE):

Tails should not wag dogs. It defies physics, not to mention the will of the dog. Tails should wag dogs no more than politicians should decide the size and scope of a government established by the governed to serve the governed. A roaring economy should never increase the size and scope of government unless the people demand it.

The residents of Colorado have made clear they don’t want more government. They believe the state has all the money it needs. They reiterated this conviction just two years ago when they trounced Proposition CC, a proposal to let the state keep revenues above a floating state spending cap determined by an equation of inflation and population growth.

Just last year, voters went a step further and lowered the Property tax from 4.63% to 4.55%, and probably would have voted for a lower rate had they been given the option.

One reason this center-left blue state wants to throttle back government spending is the general discontent the public has with the way politicians treat their money.

To read the rest of this editorial, please click (HERE):