#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

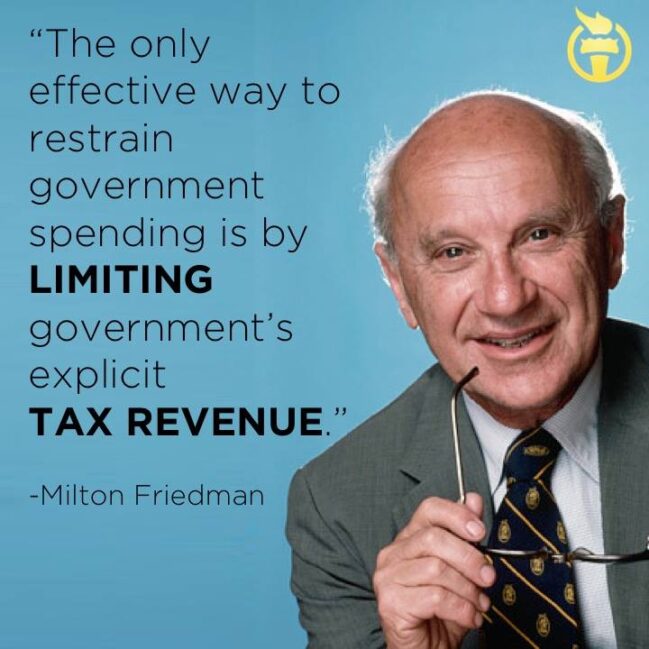

No wonder they have “Tax and Spend,” “Spend and Tax” agenda.

They don’t like being constrained.

No wonder we don’t like their policies.

They try to undermine TABOR at every instance.

They now call them “fees” instead of “taxes,” or categorize them as “enterprises” to skirt TABOR.

They believe that “your” money is “their money.”

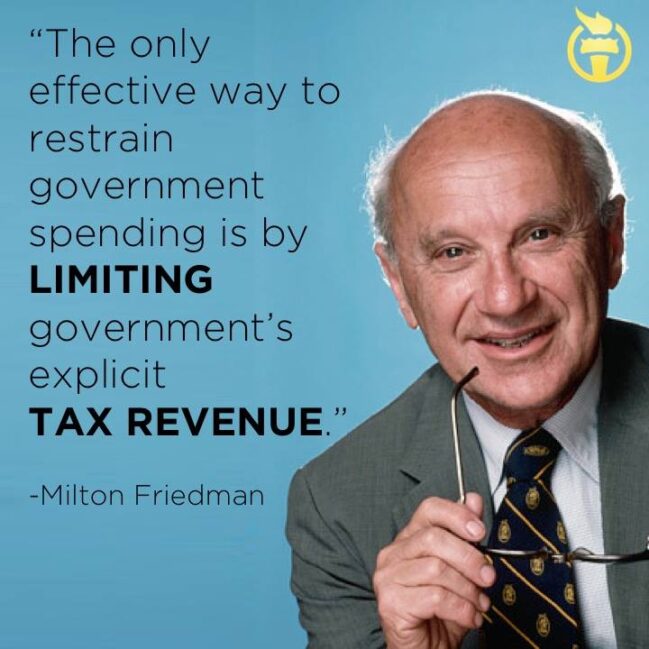

If you don’t believe us, here’s a screenshot of page 9 of their 2022 platform:

Pay attention, Colorado, pay attention….

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

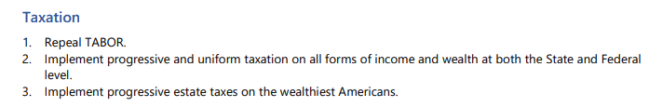

The column above provides how-to and then links to this website which has the local TABOR ballot issue list:

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

#DontBeFooled

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#FollowTheMoney

#FollowTheLaw

#DontBeFooled

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#FollowTheMoney

#FollowTheLaw

A small housing complex in Lyons. (Moe Clark/Colorado Newsline)

Colorado voters will decide this November whether to boost state spending on affordable-housing initiatives by tapping into funds that could otherwise be returned under the Taxpayer’s Bill of Rights.

Initiative 108, which officially qualified for the 2022 ballot last month, would dedicate an additional $300 million annually to the state’s affordable housing efforts. It would protect the additional revenue by exempting the funds from the annual limits set by TABOR, the 1992 constitutional amendment that places restrictions on Colorado’s taxation and spending levels.

“This measure is desperately needed if we want future generations of Coloradans to thrive,” Brian Rossbert, the executive director of the nonprofit Housing Colorado, part of a coalition supporting the measure, said in a statement.

“Too many Coloradans can no longer afford to live in the neighborhoods where they set down roots,” he said. “That’s forcing families to make difficult relocation decisions, robbing communities of essential services and intensifying our homelessness crisis.”

If approved by voters, Initiative 108 would establish a new State Affordable Housing Fund and exempt it from TABOR limits. Each year, 60% of its funding would support a housing program overseen by the state’s Office of Economic Development and International Trade, with the remaining 40% distributed by the Department of Local Affairs.

The measure requires the bulk of the OEDIT funding to be directed towards “equity investments in low- and middle-income multi-family rental developments.” Efforts overseen by DOLA would include grants to assist first-time homebuyers with their down payments and a separate program to provide rental assistance and housing vouchers to people experiencing homelessness.

A state issue committee in support of Initiative 108, Coloradans for Affordable Housing Now, raised $2.8 million to fund its campaign earlier this year. Its largest donor by far is Denver-based charitable organization Gary Community Ventures, which has contributed $2 million. Other donors include Habitat for Humanity Denver and the National Association of Realtors.

The measure has drawn opposition from Advance Colorado Action, a deep-pocketed, “dark money” nonprofit that has helped fund and coordinate a wide range of conservative causes in recent Colorado elections.

“There is nothing ‘affordable’ about taking $300 million of our TABOR tax refunds for a flawed housing measure,” Advance Colorado’s Michael Fields said in a statement last month. “To fix our state’s housing crisis, we need to build more, not tax more.”

Backers say the measure could help fund the construction of 170,000 new homes in the coming years, offsetting what is projected to be a worsening housing crunch in fast-growing Colorado.

In May, a fiscal impact statement by the nonpartisan Legislative Council Staff noted that the measure’s TABOR impact would vary from year to year depending on revenue levels and how lawmakers choose to distribute refunds.

“If refunds are paid via current law mechanisms, the measure is expected to reduce refunds by approximately $40 per taxpayer, on average, for tax year 2023 and $80 per taxpayer, on average, for tax year 2024,” analysts wrote.

“The measure will increase investments in affordable housing developments, boosting incomes for developers and construction firms,” nonpartisan staff wrote in a separate fiscal summary. “Some households that would otherwise face housing insecurity may find stable housing under the measure, increasing their financial security and opportunities for employment.”

Other measures up for a vote on Colorado’s 2022 ballot include three proposals to change the state’s liquor laws.

https://coloradonewsline.com/2022/09/07/affordable-housing-reduce-tabor-refunds-2022-ballot/

SPECIAL TO THE DENVER POST

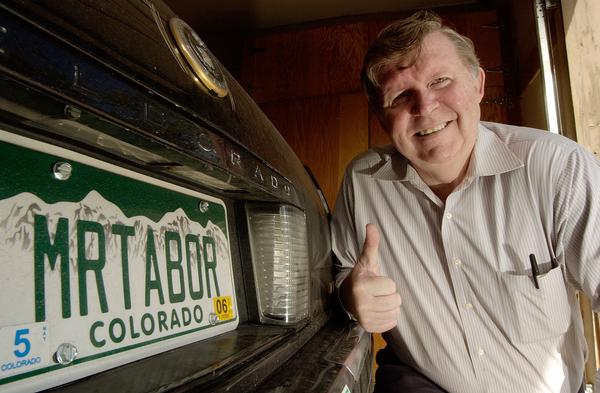

Anti tax crusader and El Paso County commissioner Douglas Bruce next to his Mr.Tabor licsence plate. 8/19/05 THE DENVER POST/Chuck Bigger

#DouglasBruce

#TheAuthorOfTABOR

#DontBeFooled

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#FollowTheMoney

#FollowTheLaw