Economist Dr. Paul Prentice explains Colorado’s Taxpayer Bill of Rights (TABOR) amendment. TABOR allows the state budget to grow each year at population plus inflation, while giving taxpayers the ability to vote on all tax and debt increases.

Category Archives: Fees

Freedom Minute | Everything You Ever Wanted to Know about TABOR

Rob Natelson wrote THE BOOK on Colorado’s Taxpayer’s Bill of Rights. As he puts it, “It’s everything you could ever want to know about TABOR.” Check it out here: https://www.i2i.org/the-colorado-taxp…

A History of Colorado’s Taxpayers Bill of Rights

The Importance of Colorado’s Taxpayers Bill of Rights

TABOR Explained In 90 Seconds

Will The Left Abolish TABOR?

Friday @CompleteCO update:

@JonCaldara, @MichaelCLFields and @benamurrey on defending and strengthening the Taxpayer’s Bill of Rights

#copolitics

http://CompleteColorado.com

https://twitter.com/CompleteCO/status/1636728225970946048?s=20

Click this link, https://www.youtube.com/watch?v=gGkh2Kg-MJU, to watch Jon Caldara, Michael Fields, and Ben Murrey discuss TABOR;

Americans For Prosperity Supports the Taxpayer’s Bill of Rights

TABOR supporter,

Did you know Americans For Prosperity has been promoting and protecting TABOR, the Taxpayer’s Bill of Rights?

Attached is a brochure with their latest activities.

You can learn more by checking their website, https://americansforprosperity.org/state/colorado/

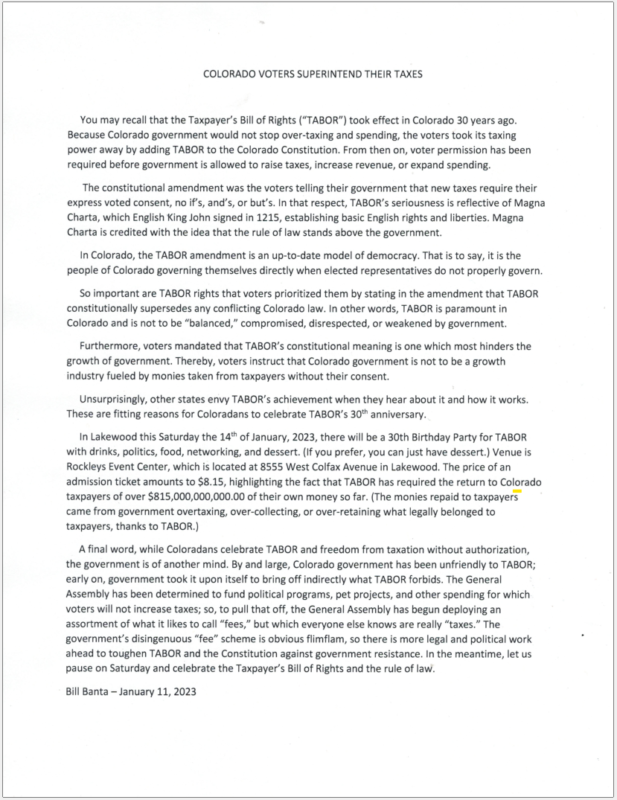

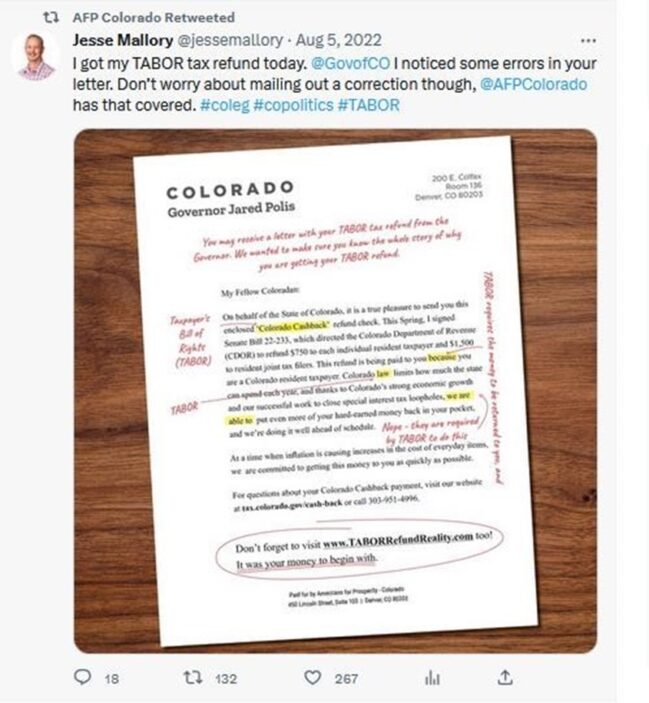

The purpose of this letter is to share a list of Americans for Prosperity’s vigorous activities educating the public about TABOR over the last several months.

Since not everyone may have witnessed those efforts (much is visible on facebook and twitter), I’m including some social blurbs and photos. These blurbs just span back to the July-August 2022 period and I certainly haven’t included all their activities, though there’s more available.

AFP mailers to voters that refunds were thanks to TABOR.

Then, AFP engaged in a gas promotion with unleaded at $2.38 per gallon. AFP covered the difference between the $2.38 and the going rate of $4.45. While drivers waited in line to get the promo gas price, AFP shared information about the Taxpayer’s Bill of Rights, handed out promo materials and water. Continue reading

AFP at the state capitol – this Thursday, March 2nd

With looming attacks on our Taxpayer’s Bill of Rights, Americans for Prosperity (AFP) has organized a Lobby Day at the Colorado State Capitol for Thursday, March 2nd from 8:30 am – 3:00 pm. Your participation is welcome, even if you have just a couple hours available.

The focus will be communicating directly with state legislators to:

- Protect TABOR refunds

- Stop the gas tax from going into effect

- Protect Coloradans from soaring energy bills.

The group will be meeting 8:30 am next to the south entry to the capitol at 14th Avenue.

Contact Michael Alarcon with AFP at 303-483-3217 if you have questions or need to meetup with the group through the day.

AFP will provide lunch.

“The Only Effective Way To Restrain Government Spending Is By LIMITING Government’s Explicit TAX REVENUE” – Milton Friedman

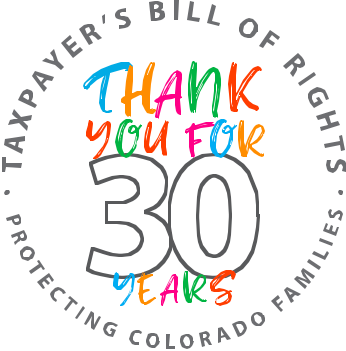

Bill Banta’s comments on TABOR’s 30th anniversary, “Colorado Voters Superintend Their Taxes”