Category Archives: Fees

PLF opposes illegal taxes in Colorado

PLF opposes illegal taxes in Colorado

The Colorado Secretary of State has been illegally charging businesses millions of dollars in unnecessary filing fees every year. Rather than refund those excess fees, the secretary funneled the money into his general budget, converting the fees into general tax revenue in violation of the state’s Taxpayer’s Bill of Rights. The National Federation of Independent Business sued to stop the unconstitutional fees, and the case is now before the Colorado Supreme Court.

PLF partnered with three other liberty organizations in this friend of the court brief, making two important arguments:

- First, PLF urged the Colorado Supreme Court to do away with the “beyond a reasonable doubt” standard for unconstitutional laws, because it neuters the court’s ability to strike down unconstitutional laws and allows many unconstitutional laws to remain on the books.

- Second, PLF argued that the amount of a fee cannot exceed the cost of providing the service or regulation funded by the charge. Here, 90% of the business “fees” fund services and regulations totally unrelated to businesses.

Weekly litigation report: Private property rights and illegal taxation

Legal battles continue over Taxpayer Bill of Rights, hospital fees, transportation taxes

egal battles continue over Taxpayer Bill of Rights, hospital fees, transportation taxes

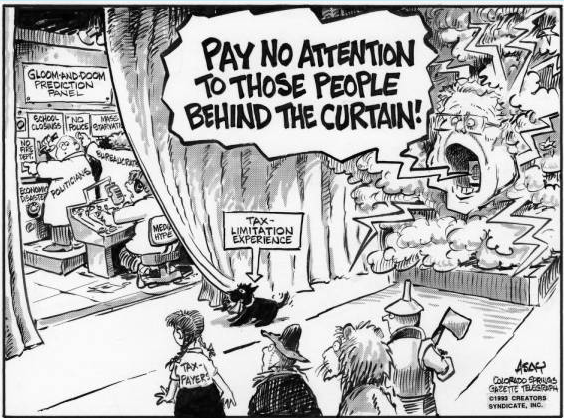

Called the Taxpayer Bill of Rights, or TABOR, it took effect Dec. 31, 1992, and was designed to serve as another check against the growth of government. It requires that any increase in overall revenue from taxes not exceed the rates of inflation and population growth.

The TABOR Foundation, which was instrumental in advancing the amendment, maintains that it has been a successful measure.

Others maintain it interferes with advancing critical public spending initiatives. Sam Mamet, the executive director of the Colorado Municipal League, opposes TABOR. Mamet argued on the 25th anniversary of TABOR that “iIt is one of the most seriously damaging things the voters of the state have done to themselves in the last 25 years, in my humble opinion.”

Since its inception 26 years ago, many attempts have been made to amend, circumvent and litigate TABOR; the foundation counts at least 80 cases between 1993 and 2017.

Pfiffner said a perfect example of this is the 2015 lawsuit it filed, TABOR Foundation, et al. v. Colorado Department of Health Care Policy & Financing, et al. regarding Colorado’s “hospital provider fee,” which it argues is an unconstitutional tax.

Colorado expected to see $1 billion in new revenue in 2019; will taxpayers get a rebate?

The Economic and Revenue Forecast presented to the Joint Budget Committee in June showed that the state’s general fund is projected to close out fiscal 2018 with a $1.2 billion surplus.

Since Colorado’s Taxpayer’s Bill of Rights (TABOR) places a cap on annual state tax revenue the state can keep, spend or save, many wonder whether Coloradans will actually see tax refunds in 2020.

Bed tax law suit gets new life

Bed tax law suit gets new life

DENVER — Ongoing litigation against the Colorado Department of Health Care Policy & Financing, among others, over a 2009 program that raised taxes via a “hospital provider fee,” has new energy after Cause of Action Institute announced earlier this month it would take on the representation of the plaintiffs in the case.

Cause of Action is a Washington D.C.-based 501(c)(3) organization that according to its website advocates for “economic freedom and individual opportunity advanced by honest, accountable, and limited government.”

Plaintiffs, who were originally represented by Mountain States Legal Foundation, had 60 days to find new counsel after Mountain States withdrew for reasons not related to the case or the plaintiffs.

Lee Steven and James Valvo are the lead attorneys. The Colorado-licensed attorney is Michael Francisco, who while working in the Colorado Attorney General’s office helped to write the defense of Colorado’s Taxpayer’s Bill of Rights (TABOR) in Kerr vs. Hickenlooper, which claimed TABOR was a violation of the U.S. Constitution’s guarantee of a republican form of government. That argument lost.

This case was initially filed in 2015. It asserts the state’s Hospital Provider Fee is actually a tax enacted in violation of the TABOR. Continue reading

The Grand Junction Area Chamber of Commerce hailed a court ruling a stormwater drainage fee is actually an unconstitutional tax.

Chamber hails drainage fee court ruling

Article date: Jun 12 2018

The Grand Junction Area Chamber of Commerce hailed a court ruling a stormwater drainage fee is actually an unconstitutional tax.

Drainage remains a problem, however, that will require a collaborative effort to solve, the chamber stated in a news release.

District Court Judge Lance Timbreza ruled a fee assessed by the Grand Valley Drainage District on property owners constitutes a tax imposed without a vote as required under state constitutional provisions. The chamber and Mesa County sued the district in 2016 to halt the fee following eight months of failed negotiations.

“This is a victory for every property owner within the Grand Valley Drainage District boundaries, including many of our business members,” said Diane Schwenke, president and chief executive officer of the chamber. “It upholds the principles of the Taxpayer Bill of Rights and requires the district to convince voters that additional funding is needed, as TABOR clearly intended.”

The district assessed homeowners $3 a month — or $36 a year. Businesses, churches and government entities were charged $3 a month for every 2,500 square feet of roofs and parking lots from which stormwater drains.

Many businesses were assessed annual fees of up to $10,000, Schwenke said.

The chamber remains willing to a play a role in addressing drainage problems, Schwenke said. Collaborative efforts will be required that involve not only the district, but other government entities in the Grand Valley, she said.

The chamber supports a process involving all entities responsible for drainage as well as an exploration of all funding models, she said.

Moreover, more accountability and transparency will be needed regarding how priorities are set for drainage projects, how funds are spent and how funds are leveraged with money from such other sources as grants.

The chamber remains opposed to an impact fee for business expansions, Schwenke said. Business growth improves the economy, creates jobs and adds to the tax base, she said.

http://thebusinesstimes.com/chamber-hails-drainage-fee-court-ruling/