Editor’s Note: Denver7 360 stories explore multiple sides of the topics that matter most to Coloradans, bringing in different perspectives so you can make up your own mind about the issues. To comment on this or other 360 stories, email us at 360@TheDenverChannel.com. See more 360 stories here.

DENVER — With more drivers using Colorado roads, there’s not only more traffic, but more wear and tear on the infrastructure. The Colorado Department of Transportation (CDOT) has identified $9 billion in needs from repair and replacement to improvements to help alleviate congestion.

“Without funding, these can’t get fixed,” said CDOT executive director Shoshana Lew.

For decades, the gas tax has served as the state’s main source of funding for transportation projects. Each time a driver fills up their gas tank, 18 cents go to the federal government and another 22 cents go to the state.

However, the state gas tax hasn’t been raised in nearly three decades.

So, is it time to raise the gas tax or are there other ideas to raise money for Colorado roads? Denver7 went 360 to hear multiple perspectives on the issue of transportation funding.

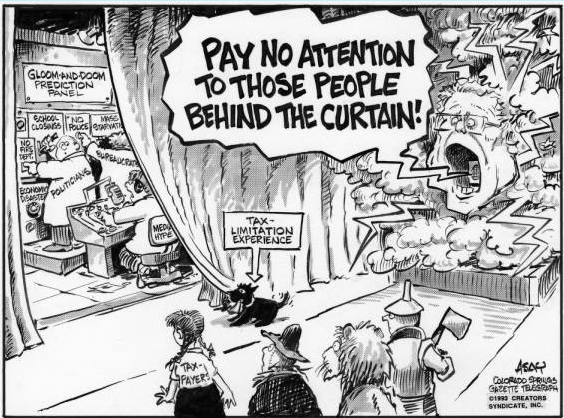

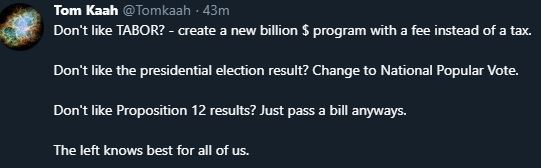

This year’s defeat of Proposition CC was a bitter experience for the state’s Democrats and liberal groups, but apparently not a didactic one, at least for the latter. Proposals are already in the works for some new iterations of the ubiquitous tax-increase ballot measures which crop up every second election or so, just to see if perseverance will ultimately win out over fiscal literacy.

This year’s defeat of Proposition CC was a bitter experience for the state’s Democrats and liberal groups, but apparently not a didactic one, at least for the latter. Proposals are already in the works for some new iterations of the ubiquitous tax-increase ballot measures which crop up every second election or so, just to see if perseverance will ultimately win out over fiscal literacy.