The Taxpayer’s Bill of Rights (TABOR) is a cornerstone of Colorado’s fiscal policy, enacted in 1992 to limit state and local government revenue growth and return excess funds to taxpayers. The TABOR refund history reflects decades of surplus distributions, evolving mechanisms, and economic impacts, making it a critical topic for Colorado residents. This guide dives deep into the historical context, refund mechanisms, amounts, eligibility criteria, and key milestones of TABOR refunds, offering a detailed, SEO-optimized resource for understanding this unique program. Whether you’re a long-time Coloradan or new to the state, this article provides clear, actionable insights to help you navigate and claim your refunds.

Since its inception, TABOR has mandated that surplus revenue—beyond inflation and population growth limits—be refunded through methods like sales tax refunds, income tax rate reductions, and direct payments. Over the years, refund amounts have varied based on economic conditions, with notable payouts like the $750 single-filer refund in 2022 and the projected $1,700 in 2025. By exploring the history of TABOR refunds, residents can better understand eligibility, filing deadlines, and how to maximize their financial benefits.

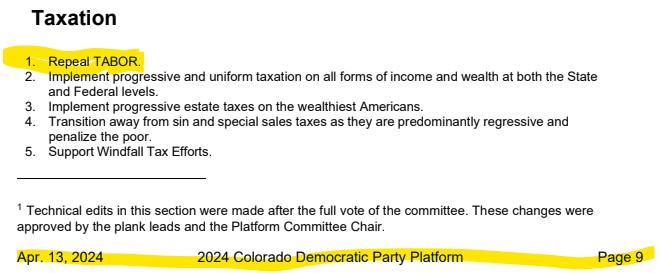

What Is TABOR and Why Does It Matter?

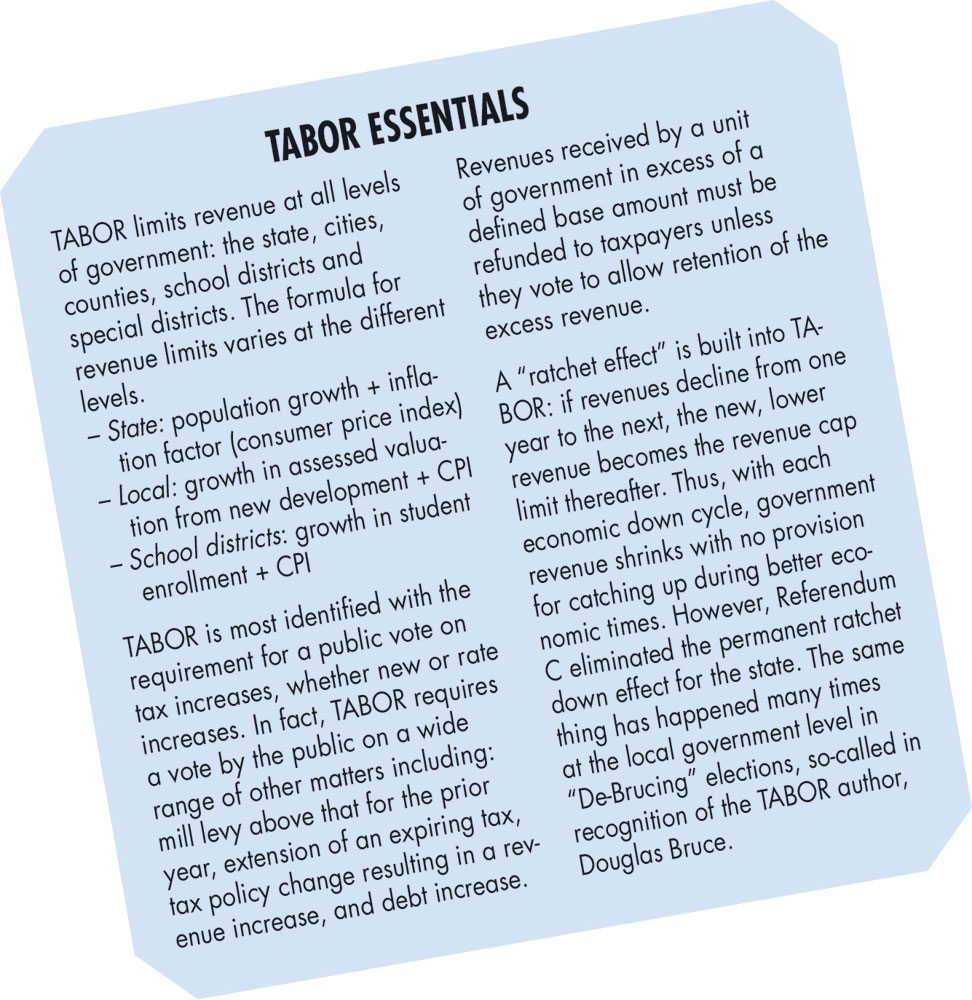

The Taxpayer’s Bill of Rights, approved by Colorado voters in 1992, caps government revenue growth to the rate of inflation plus population growth. When state revenue exceeds this limit, the surplus must be returned to taxpayers unless voters approve retaining it. This mechanism ensures fiscal discipline and directly benefits residents through refunds. Understanding the TABOR refund history is essential for Coloradans to anticipate payments, meet filing requirements, and stay informed about legislative changes that may affect future refunds.

For example, in 2023, eligible taxpayers received $800 (single filers) or $1,600 (joint filers) through sales tax refunds, a shift from earlier years when amounts varied by income. This guide breaks down these changes, offering lists and tables to clarify how refunds have evolved and what to expect in 2025.

Historical Overview of TABOR Refunds

The evolution of TABOR refunds showcases Colorado’s commitment to returning excess revenue to its citizens. Below is a detailed timeline of key milestones in TABOR’s history, highlighting legislative changes, refund mechanisms, and significant payouts.

Timeline of TABOR Refund Milestones

- 1992: Voters approve TABOR, establishing revenue limits and mandating refunds for surplus funds.

- 1997: First TABOR refunds issued, primarily through sales tax refunds, marking the beginning of surplus distributions.

- 2005: Referendum C allows the state to retain some surplus revenue for five years, temporarily reducing refunds.

- 2017: Senate Bill 17-267 prioritizes reimbursements to local governments for property tax exemptions before issuing refunds.

- 2021: Temporary income tax rate reduction from 4.55% to 4.50% for all filers, alongside sales tax refunds.

- 2022: Permanent income tax rate reduction to 4.40% approved by voters, with $750 single-filer and $1,500 joint-filer refunds issued as “Colorado Cash Back” checks.

- 2023: Senate Bill 23B-003 standardizes refunds at $800 (single) and $1,600 (joint), simplifying the process.

- 2024: Income tax rate reduced to 4.25% due to a $1.5 billion surplus threshold, with sales tax refunds projected at $326 (single) and $652 (joint).

- 2025: Forecasted refunds reach up to $1,700 for eligible filers, driven by strong economic growth in technology and tourism sectors.

This timeline illustrates how TABOR refunds have adapted to economic and legislative shifts, ensuring taxpayers benefit from surplus revenue.

TABOR Refund Mechanisms: How They Work

TABOR refunds are distributed through specific mechanisms, which have evolved to balance fiscal responsibility and taxpayer benefits. Below is a comprehensive list of the primary refund methods used historically and their applications.

The ballot measure, which sets up a “graduated” income tax, would also provide a tax break for households with incomes below the $500,000 threshold.

The ballot measure, which sets up a “graduated” income tax, would also provide a tax break for households with incomes below the $500,000 threshold.