Taxpayer’s Bill of Rights should be strengthened, not repealed

JAY STOOKSBERRY

On Jan. 15, a briefly worded initiative was presented to the Colorado Title Board for consideration to be placed on the 2020 ballot. The brevity of the proposal was commendable. Five words was all it needed: “TABOR – Repeal (Full TABOR Repeal).” Though speculative at this point, defenders of Article X Section 20 of the Colorado Constitution — better known as the Taxpayer’s Bill of Rights (TABOR) — should prepare for a fight in 2020.

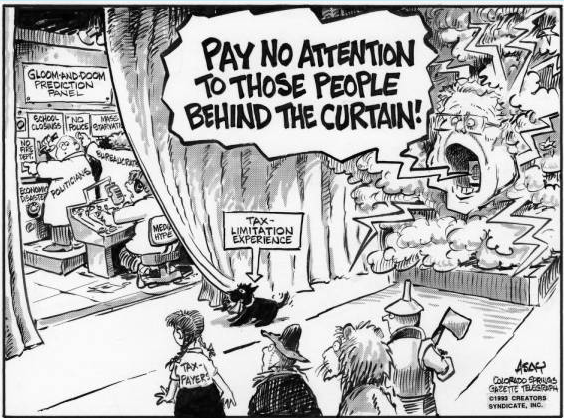

Well before TABOR became law in 1992, opponents concocted every possible scenario as to how this new constitutional amendment would lead to fiscal armageddon in Colorado. Nearly three decades after its passing, most of this hyperbole — as is the case for most hyperbole — never materialized.

Where is Colorado from a fiscal perspective? According to the States Project, Colorado ranks 30th in the country for total state debt (including unfunded liabilities) as a percentage of gross state product. The Mercatus Center ranks our state as 28th in the nation regarding a combination of solvency for cash, budget, long-run spending, service-level flexibility, and unfunded liabilities. U.S. News ranked Colorado 31st in fiscal stability.

It would seem Colorado is middle of the pack at best. TABOR did not ruin our state’s ability to manage the general fund.

Contrary to popular wisdom of the Chicken Littles who warned about how damaging it would be to Colorado, TABOR doesn’t need to be repealed; it needs to be strengthened. Continue reading

Proponents Carol Hedges and Steve Briggs had

Proponents Carol Hedges and Steve Briggs had

“‘Take your success elsewhere’ should be the signs erected if Colorado approves Amendment 73,” Penn Pfiffner, former state legislator and chairman of the board of the TABOR Foundation, told Watchdog.org. “The Taxpayer’s Bill of Rights properly treats everyone equally, requiring the same income tax rate be applied to everyone. Currently, if you make more money, you pay more, but only at the rate that everyone else pays. This proposal would change that, bringing an attitude that the upper middle class and wealthy should be attacked and made to pay increasing amounts. It is the worst concept in raising taxes.”

“‘Take your success elsewhere’ should be the signs erected if Colorado approves Amendment 73,” Penn Pfiffner, former state legislator and chairman of the board of the TABOR Foundation, told Watchdog.org. “The Taxpayer’s Bill of Rights properly treats everyone equally, requiring the same income tax rate be applied to everyone. Currently, if you make more money, you pay more, but only at the rate that everyone else pays. This proposal would change that, bringing an attitude that the upper middle class and wealthy should be attacked and made to pay increasing amounts. It is the worst concept in raising taxes.”