The Bell Policy Center is another group behind repealing TABOR.

They consistently support tax increases and more government regulations.

They lied to us in 2005, and they are doubling down on this lie in 2019. Colorado voters were sold a bill of goods with Referendum C in 2005, and it is of the utmost importance that we aren’t fooled again with Proposition CC in 2019.

Proponents of Referendum C originally claimed that their measure was “temporary.” The measure was supposed to offer a five-year reprieve from the constitutional limitations created by the Taxpayer’s Bill of Rights (TABOR), allowing some fiscal flexibility for Colorado lawmakers to invest heavily in education and transportation.

Or so they claimed.

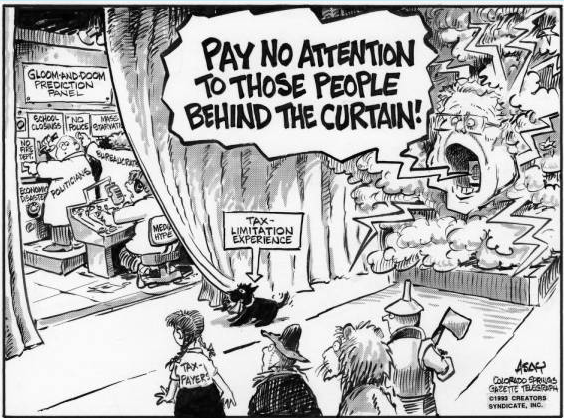

Over the next few months, the Takings Coalition, with its insatiable appetite for OUR money, will use every propaganda trick available to convince Colorado voters to give up our Taxpayer’s Bill of Rights (TABOR) refunds – FOREVER! One vote and state government can keep all of our money – FOREVER!

That’s why we are fighting back against the ballot measure Proposition CC, and we need YOUR help today!

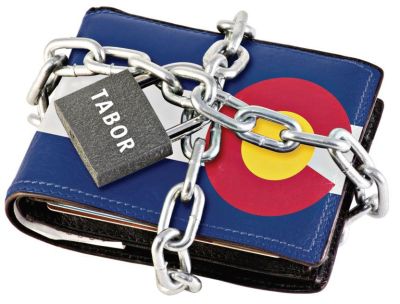

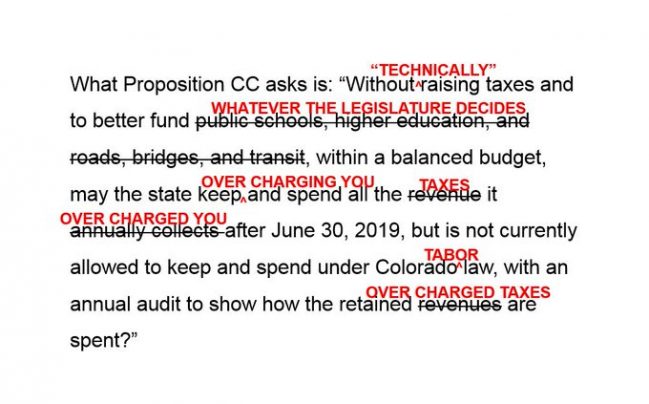

First, what is Prop CC? Simply, it’s a legislatively-referred ballot measure we’ll be deciding this fall. If voters say yes, then the state government will keep all of our TABOR refunds forever. It will cost Colorado taxpayers billions of dollars in perpetuity. It’s a forever tax increase on all of us, our children, and our grandchildren.

Prop CC is blank check for the legislature’s pet projects. Supporters say it will go to roads and schools, but there’s no guarantee. And we’ve seen the legislature play fast and loose with extra money from taxpayers such as Ref C dollars. Likely this money will go to backfill lost revenue from the oil and gas industry, an industry this legislature is trying to destroy.

Prop CC is a big step to total repeal of the greatest gift voters ever gave themselves and future generations – TABOR. Passed by voters in 1992, TABOR puts Coloradans, not politicians, in charge of the size and scope of government we want. It’s no wonder 71 percent of Colorado voters support TABOR.

No doubt the Prop CC proponents will claim the state is broke even though the budget will be nearly $32 billion. Since voters gave the initial thumbs up to TABOR, our budget has grown 300 percent. The state doesn’t need more of our money. The legislature needs to do its job and prioritize!

While voters love TABOR, the political elite, the professional Left, and special interests hate it. Over the last few days they’ve called TABOR and its supporters “brainwashed” “destructive” and “unconstitutional.”

After the November 5 election, they’ll be calling us winners because we will defeat Prop CC.

Lots of good people like former Governor Bill Owens, former U.S. Senator Hank Brown, CU Regent Heidi Ganahl, District Attorney George Brauchler, former State Treasurers Walker Stapleton and Mark Hillman and more all agree that Prop CC is bad for Colorado. We must get the word out to every Colorado voter! WE MUST SAVE OUR TAXPAYER’S BILL OF RIGHTS!

Will you join us? The other side will have lots of special interest money, but we have you! The No On CC issue committeeneeds $25,000 to get our digital campaign started and yard signs printed. Even $5 helps pay to print two signs!

Can we count on you to help us save TABOR now and for future generations? Can we count on you to contribute to this fight against the extremist overreaching majority at the Colorado State Legislature?

If you prefer to mail your contribution, please do so. Make the check payable to No On CC issue committee and mail to: No On CC Issue Committee, C/O Independence Institute, 727 E 16thAve, Denver, CO 80203.

For more information visit our Website VoteNoOnCC.com. Click herefor more information on our Taxpayer’s Bill of Rights