The Truth About Proposition CC and What The Politicians Aren’t Telling You

DENVER — Democrats who control Colorado’s Statehouse are asking voters in November to dismantle part of a state tax regime that for decades has served as a model for fiscal conservatives nationwide.

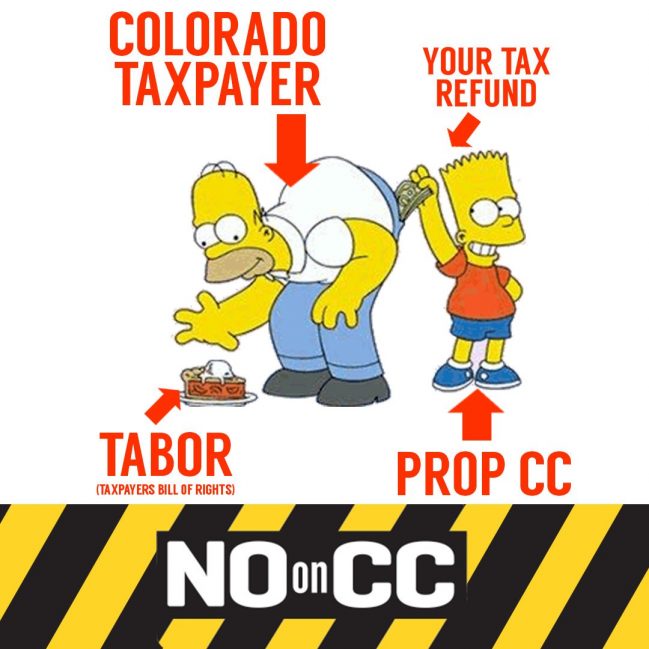

Coloradans will decide if the state can permanently keep tax revenue that otherwise would be refunded under limits set by a 1992 constitutional amendment called the Taxpayer’s Bill of Rights, or TABOR.

Democratic lawmakers who won a substantial legislative majority in 2018 elections that pushed this onetime swing state to the left placed Proposition CC on the ballot. They say it’s time to chip away at a formula has led to a multi-billion dollar under-investment in fast-growing Colorado’s schools and roads.

TABOR requires that proponents go to the ballot to let voters decide.

DENVER (AP) – Democrats who control Colorado’s statehouse are asking voters to dismantle part of a state tax regime which for decades has served as a model for fiscal conservatives nationwide.

Coloradans will decide Nov. 5 if the state can permanently keep tax revenue that otherwise would be refunded under limits set by a 1992 constitutional amendment called the Taxpayer’s Bill of Rights.

There are many reasons to vote no on Proposition CC, but for the sake of brevity, I will stick with the basics.

Reason No. 1: It does raise taxes.

Reason No. 1: It does raise taxes.

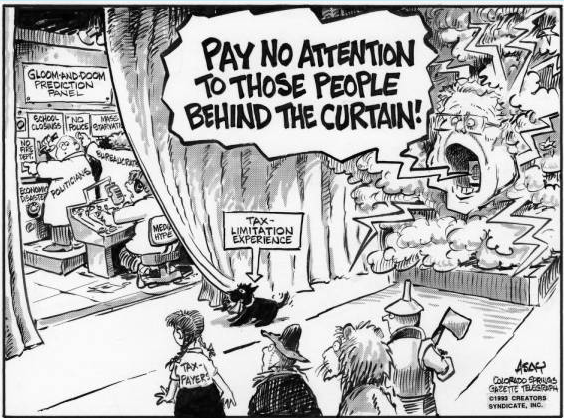

While the first three words of the ballot language for Proposition CC are “Without raising taxes,” this simply isn’t true. And it’s hard to understand how proponents can keep a straight face with this one. If the state owes us money in the form of a refund because we’ve overpaid our taxes, and if they don’t give us the refund, we will in fact pay more taxes than we would have without Proposition CC. Period. Continue reading

Editorial endorsement: @ColoradoNewsCCM, which has 18 local newspapers, says to vote “No” on Prop CC.

2019 Colorado ballots have already been mailed out to voters. This year there are no candidate races and only two state-wide propositions as compared to the raft of complicated ballot measures in 2018. Proposition CC and DD were referred to the voters by the state legislature rather than generated by citizens through petition campaigns. Here are my recommendations.

Proposition CC – Retaining State Government revenue. VOTE NO.

A “yes” vote would allow the state to retain any surplus of revenues in excess of spending not only in fiscal year 2018-2019 but in all years to come. A “no” vote requires the state to refund budget surpluses to taxpayers as now required under current law.

In the Colorado Constitution, The Taxpayer’s Bill of Rights (TABOR) limits state government spending and taxation through a formula tied to population growth and inflation. Direct voter approval is required to change the limit. Article X, Section 20 (7) (d) reads: “If revenue from sources not excluded from fiscal year spending exceeds these limits in dollars for that fiscal year, the excess shall be refunded in the next fiscal year unless voters approve a revenue change as an offset.”

Through that last clause, Prop CC is asking voters to give up their prospective TABOR refunds permanently. It would spend those budget surpluses in equal shares on K-12 education, higher education and transportation without specifying how the money will be spent within those categories, leaving that to legislative whims now and in the future. Look at it this way: state government spending on K-12 in FY 2018-2019 exceeded $7 billion. Eliminating taxpayer refunds would direct an additional $103 million to K-12 education starting in FY 2020-2021. Seven billion is seven thousand million. One hundred million is a comparative drop in the bucket.

What it asks: “Without raising taxes and to better fund public schools, higher education, and roads, bridges, and transit, within a balanced budget, may the state keep and spend all the revenue it annually collects after June 30, 2019, but is not currently allowed to keep and spend under Colorado law, with an annual independent audit to show how the retained revenues are spent?”

What it means: Proposition CC would allow the state to retain revenue it refunds under the Taxpayer’s Bill of Rights for education and transportation purposes. The measure would require the state auditor to hire a private entity to conduct an annual financial audit regarding use of funds as provided under the measure.

It will allow state government to keep the money it collects from existing sources annually instead of refunding some to taxpayers when annual revenue growth, which is tied to inflation and the percentage change in state population, exceeds that. Any money collected above this limit is refunded to taxpayers unless the voters allow the state to spend it.

Proposition CC would eliminate that cap allowing the state to keep and spend all future excess revenue on transportation, K-12 schools and higher education rather than refunding it to taxpayers.