https://x.com/FreeStateColor1/status/1927389090237776158

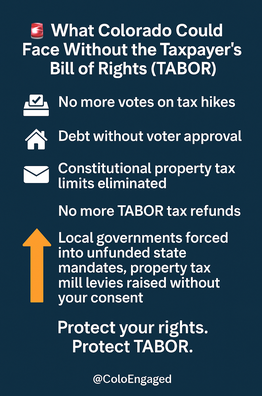

Advance Colorado Executive Vice President Kristi Burton Brown gives a brief history and explanation of Colorado’s unique taxpayer protection: the Taxpayer’s Bill of Rights. This revenue cap limits the state government’s ability to spend taxpayer dollars and requires refunds to be sent to Coloradans when the government collects beyond the limit.

#HandsOffTABOR

#DontBeFooled

#ItsYourMoneyNotTheirs

#TABOR

#FollowTheLaw

#FeesAreTaxes

#VoteOnFees

#ReplaceThemAllForNotFollowingVotersWishes

The group trying to overturn TABOR is already speaking at town halls—and they’re likely headed to your community next. Get prepared. Join our speaker’s bureau and help defend Colorado’s Taxpayer’s Bill of Rights.

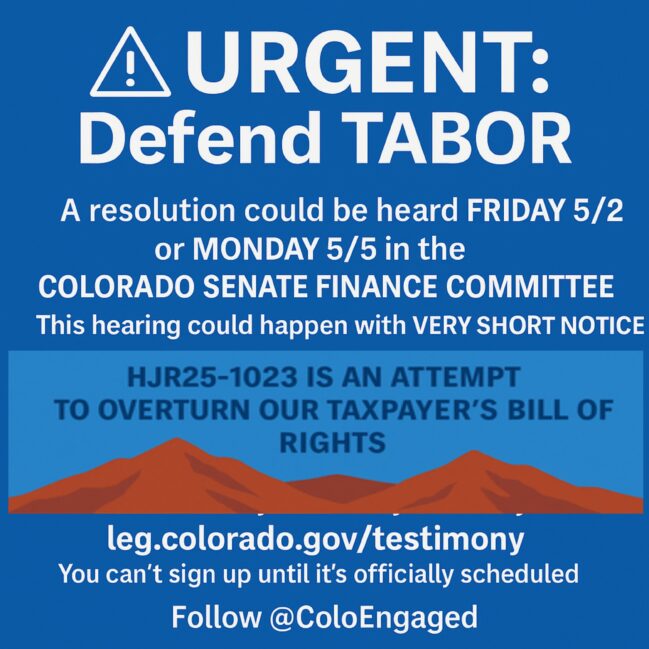

Colorado taxpayers and voters are on high alert after the introduction of House Joint Resolution HJR25-1023, sponsored by Democrat Representatives Sean Camacho and Lorena García and Democrat Senators. Lindsey Daugherty and Iman Jodeh. This resolution would initiate a taxpayer-funded lawsuit to challenge the constitutionality of the Taxpayer’s Bill of Rights (TABOR). TABOR was a citizen-initiated, and Colorado voter-approved, constitutional measure in 1992 and has been protecting taxpayers for over thirty years. Republican Representatives and Senators have publicly and vigorously expressed opposition to the resolution.

Colorado taxpayers and voters are on high alert after the introduction of House Joint Resolution HJR25-1023, sponsored by Democrat Representatives Sean Camacho and Lorena García and Democrat Senators. Lindsey Daugherty and Iman Jodeh. This resolution would initiate a taxpayer-funded lawsuit to challenge the constitutionality of the Taxpayer’s Bill of Rights (TABOR). TABOR was a citizen-initiated, and Colorado voter-approved, constitutional measure in 1992 and has been protecting taxpayers for over thirty years. Republican Representatives and Senators have publicly and vigorously expressed opposition to the resolution.

Ironically, this legal attack, led by Democrat sponsors, would be paid for by the very people TABOR was designed to protect.

The sponsors argue that TABOR violates the U.S. Constitution’s guarantee of a “republican form of government” — claiming that only elected lawmakers should decide tax policy, not voters. But that argument flatly contradicts Colorado’s own history and the words of a former Democratic governor.

In August 1910, Governor John F. Shafroth called a special legislative session to enshrine the citizen right to initiative and referendum into the Colorado Constitution. His message to the General Assembly, reprinted in The Walsenburg World (Aug. 11, 1910), made the purpose clear:

“The law of the Initiative and Referendum places the government nearer to the people, and that has always been the aim of the framers of all republican forms of government.”

A Democrat said that. And yet in 2025, Democrats are sponsoring a resolution to sue the people for using those very rights.

Last Thursday, I hand-delivered that quote and the historical context to legislators — sliding it under many office doors in hopes it would be read without me there. In the chaos of the session’s final days, I can only hope some of them reflect on how far their party has drifted.

There are rumors the sponsors might delay action on the resolution this session out of political caution and risking their seats in fiscally conservative districts. But don’t relax — they’ve already said they are preparing a 2026 ballot measure to dismantle TABOR. It’s predicted to resemble 2005’s Ref C, so voters should brace for misleading ballot language and long-term consequences.

Here’s what Ref C did: Taxpayers forfeited TABOR refunds for 5-years and let the state permanently keep billions beyond the voter-approved revenue cap.

REF C fiscal impact:

From 1992 – 2004, TABOR has refunded about $11.98 billion to taxpayers.

In contrast, Ref C has allowed the state to retain over $37.23 billion. That’s three times more money kept by government than returned to the people.

That $37.23 billion is in addition to the allowed reasonable TABOR cap of letting government tax revenue grow by inflation + population.

That’s what’s at stake — not just dollars, but your constitutional right to say no.

Natalie Menten

TABOR Board Member

#HandsOffTABOR

#DontBeFooled

#ItsYourMoneyNotTheirs

#TABOR

#FollowTheLaw

#FeesAreTaxes

#VoteOnFees

#ReplaceThemAllForNotFollowingVotersWishes

Colorado House Joint Resolution HJR25-1023 seeks to challenge the constitutionality of TABOR (Taxpayer’s Bill of Rights) by authorizing a lawsuit to determine whether TABOR deprives Colorado of a republican form of government. The resolution argues that TABOR limits legislative authority over taxation and spending, shifting power to direct voter approval rather than elected representatives.

Colorado House Joint Resolution HJR25-1023 seeks to challenge the constitutionality of TABOR (Taxpayer’s Bill of Rights) by authorizing a lawsuit to determine whether TABOR deprives Colorado of a republican form of government. The resolution argues that TABOR limits legislative authority over taxation and spending, shifting power to direct voter approval rather than elected representatives.

Impact on TABOR

This resolution is part of a broader legislative effort to redefine Colorado’s tax policies, sparking debate over whether TABOR is a safeguard for taxpayers or an obstacle to government flexibility.

#HandsOffTABOR

#DontBeFooled

#ItsYourMoneyNotTheirs

#TABOR

#FollowTheLaw

#FeesAreTaxes

#VoteOnFees

#ReplaceThemAllForNotFollowingVotersWishes

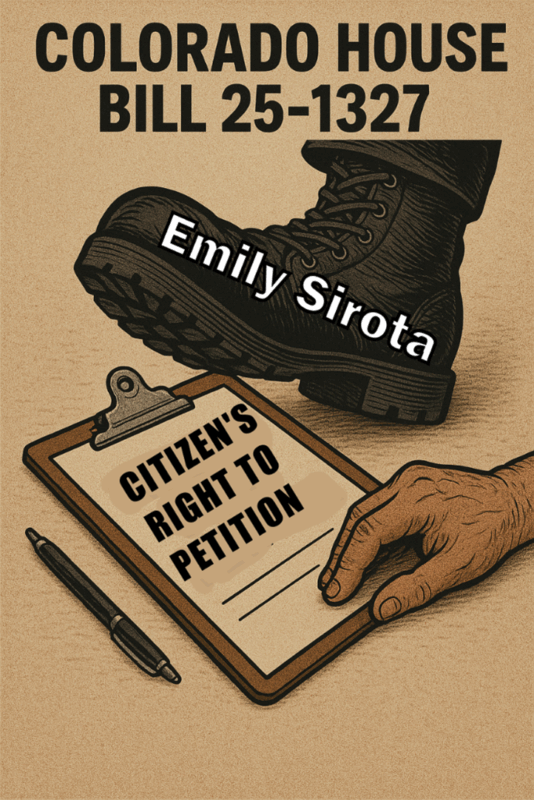

A new Democrat-backed bill moving rapidly through the Colorado legislature poses a serious threat to one of the most fundamental rights in our state Constitution: the right of citizens to initiate laws through the petition process.

And hot on the heels of that is yet another legislative attack on the Colorado Taxpayer’s Bill of Rights (TABOR).

House Bill 25-1327, which has already passed both the House and the Senate State, Veterans, and Military Affairs Committee, would significantly restrict the ability of Coloradans to bring citizen initiatives forward. Among other provisions, it shortens an already tight timeline for title-setting, imposes new procedural hurdles, and adds new fines of up to $1,500 on petition organizers for non-compliance with reporting requirements. Continue reading

TABOR is under a coordinated, two-prong attack — and both aim to silence voters.

TABOR is under a coordinated, two-prong attack — and both aim to silence voters.

First, HJR25-1023 seeks to sue the taxpayers by asking the courts to overturn the Taxpayer’s Bill of Rights entirely. It’s waiting for debate on the House floor and is backed by lawmakers who can’t stand that voters get the final say on tax increases. Even worse — they want to force taxpayers to fund the lawsuit that overturns their own will. This is a direct assault on constitutional rights and basic democratic principles. Continue reading