Category Archives: Editorial

Learning from Colorado’s Success, Alaska (and Every Other State) Should Adopt a TABOR-Style Spending Cap

April 7, 2020 by Dan Mitchell

As explained in this short video, a spending cap limits how fast a government’s budget can grow each year.

That’s a very sensible approach, sort of like having a speed limit in a school zone, and even left-leaning international bureaucracies have concluded it’s the best fiscal rule.

That being said, not all spending caps are created equal. A fiscal rule that allows continuous increases in the burden of government spending is akin to an excessive speed limit on the road in front of an elementary school.

is akin to an excessive speed limit on the road in front of an elementary school.

At a minimum, a spending cap should keep the spending burden constant (relative to the economy’s productive sector). Even better, a spending cap should fulfill the Golden Rule of fiscal policy by slowly but surely reducing the size of government.

Let’s learn from a real-world example.

Ben Wilterdink, a Visiting Fellow with the Alaska Policy Forum, explains for readers of the Peninsula Clarion that the state has a spending cap, but one that is set too high.

Alaska is in the midst of a perfect fiscal storm. …Even before the present crisis, our state faced large budget deficits and tough decisions about how to make ends meet. …That’s why adopting a functional limit on the growth in state spending is essential for long-term economic success.

…a functional limit in the growth of state spending decreases the temptation to dramatically increase spending when economic times are good, creating new budget expectations that are difficult to maintain during inevitable economic downturns… Technically, Alaska already has a constitutional spending cap in place, but the formula used renders it basically meaningless. …While Alaskans can’t retroactively adopt a meaningful spending limit, we can ensure that those economic benefits are captured going forward.

So why is a spending cap now an important issue?

“Truth and reason in ballot language!”

“Truth and reason in ballot language!”

April, 2020

The Taxpayer’s Bill of Rights includes good government provisions that improve election procedures.

There was a time when Colorado elected officials could push for passage of a bond, or for new taxes, but bury the cost very deep into the explanation on the ballot, in hopes that many voters might not notice the magnitude of the tax.

The ballot language would promise all kinds of wonderful outcomes. Not only would the new revenues for the government solve the problem in perpetuity, but it would bring world peace and even make the voter more handsome! Then, near the end in the midst of a lot of other promises, would come the information that the cost to the taxpayer would be very, very high.

The Taxpayer’s Bill of Rights stopped that sort of game playing. Now, the government must put the cost right up front. It has no option but to state how much the new tax will weigh annually on the taxpayer. For a new bond, the ballot measure must state at the very beginning how much the total new debt will be and what that means for the total repayment cost. Only then may the government (“district”) present its reasons for the new taxes.

Another game that the Taxpayer’s Bill of Rights anticipated and which it explicitly prohibits is a government underestimating a revenue number. If the new taxes exceed the estimate, the entirety of the overage must be refunded the next year and the rate adjusted downward.

Colorado constitution (Article X, Section 20), paragraph 3(c) states: “Ballot titles shall begin, ‘SHALL (DISTRICT) TAXES BE INCREASED ____ ANNUALLY?’ (or) ‘SHALL (DISTRICT) DEBT BE INCREASED (principal amount) WITH A REPAYMENT COST OF (maximum..)’.” Earlier in the same paragraph is the requirement that “if a tax increase exceeds any estimate… for the same fiscal year, the tax increase is thereafter reduced up to 100% in proportion to the …excess, and the combined excess revenue refunded….”

The paragraph was carefully crafted as a good government improvement, with TABOR protecting the taxpayer in ways beyond just voting on tax rates.

Alaska Voices: It’s time for a spending cap that works

…While more than half of states currently have some form of tax and expenditure limit, the most effective is Colorado’s Taxpayer Bill of Rights (TABOR), which constitutionally limits spending growth to the rate of inflation plus estimated population growth. The stable budget and tax climate created by TABOR has served Coloradans remarkably well. Over the past decade, Colorado’s gross state product (GSP) has grown by 45.5%, personal income has grown by 59.5%, and non-farm payroll employment has grown by 15.8%.

By comparison, during the same time period, Alaska’s GSP growth was 0%, personal income growth was 33.5%, and non-farm payroll employment growth was 0.3%.

But it’s not just Colorado that has benefited from a functional tax and expenditure limit. Nationwide, states with tax and expenditure limits have outperformed states without them in GSP growth, personal income growth, and employment growth…

A free-market approach to reviving the economy amid COVID-19 distress

…Once the COVID-19 crisis subsides, the federal government should wholeheartedly work toward a reduction in both federal spending and the national debt. There are many pro-taxpayer fiscal rules to choose from, including the Taxpayer Bill of Rights (TABOR) in Colorado, or a meaningful balanced budget amendment, like the one Indiana voters overwhelmingly inserted into their state constitution in 2018….

Letters To The Editor About “Lawmakers, Too, Hide Fees”

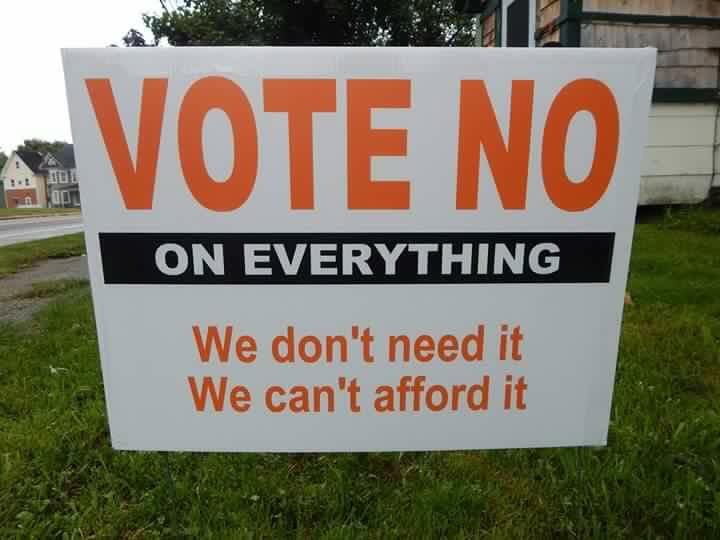

A Good Rule Of Thumb: Vote No On Everything. We Don’t Need It. We Can’t Afford It.

#TABOR

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteNo

#CoLeg

LETTERS: Amend TABOR to include “fees”

Amend TABOR to include ‘fees’

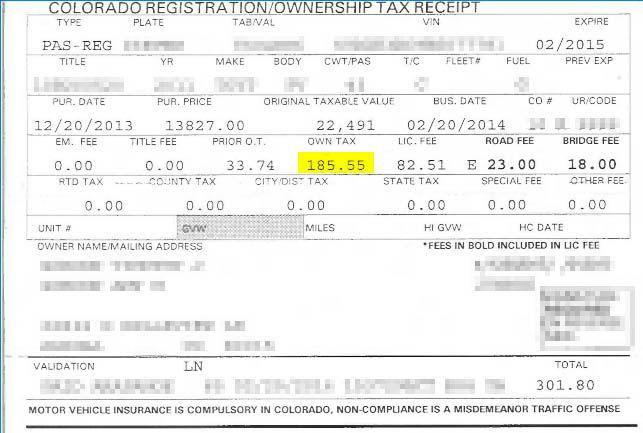

Just received my annual registration for my 2004 Subaru Outback and just reading the receipt my blood again begins to boil. The only “tax” listed is $3 for specific ownership tax, the next 12 items are all “fees”. Age of vehicle fee $7, bridge safety surcharge fee $23, clerk hire fee $4, county road and bridge fee $1.50, emergency medical services fee $2, emissions-statewide air account fee, $0.5 and many more, for a grand total of $70.17.

These are in addition to all of the gas taxes we all pay each time we fill up. I don’t mind being charged for normal needs-based surcharges such as those required to maintain our infrastructure but lets call it what they are.. Taxes! Since I/we are already paying all of these “fees” to the state, it’s another reason why I am appalled at the thought of eventually having to also pay more and more for the myriad of oncoming toll lanes throughout the state.

All Government Expendituress Must Eventually Be Paid Out Of Taxation….

#TABOR

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteNo

#CoLeg

Commissioners’ handling of refunds at odds with TABOR’s long-term survival

Guest blog from Dennis Simpson, retired CPA and TABOR activist. Simpson lives in Mesa County.

There are not many local Colorado governments left that have not relaxed TABOR restrictions. One of the remaining few is Mesa County. Recent action by County Commissioners increased the possibility that anti-TABOR folks (including our local newspaper) soon will mount an effort to remove protections that TABOR provides you.

In this case, TABOR limits the ability of a government to retain excess revenue in two distinct ways. It limits the amount of property taxes collected and additionally limits the overall revenue collected in any year.

In 2018, Mesa County’s collection of property taxes was not an issue. However, the County had a banner year in the collection of sales taxes which resulted in excess revenue exceeding $5 million.

The concept of refunding anything other than excesses caused by property taxes has not happened for many years, presenting a new challenge to staff and Commissioners. The Commissioners ignored helpful suggestions for alternatives and dismissed the issue too rapidly. They decided to take the option that required the least amount of thought. They are giving the $5 million to property taxpayers proportionate to how much property tax each paid. Our largest property taxpayers are oil companies and box stores with main offices far away. Over $2 million of the sales tax refund will be removed from the local economy. Those who do not own property will get zero and those who own lower value homes will get a pittance.

A guest column on this issue, “Commissioners’ handling of refunds at odds with TABOR’s long-term survival,” provides additional discussion.