FYI.

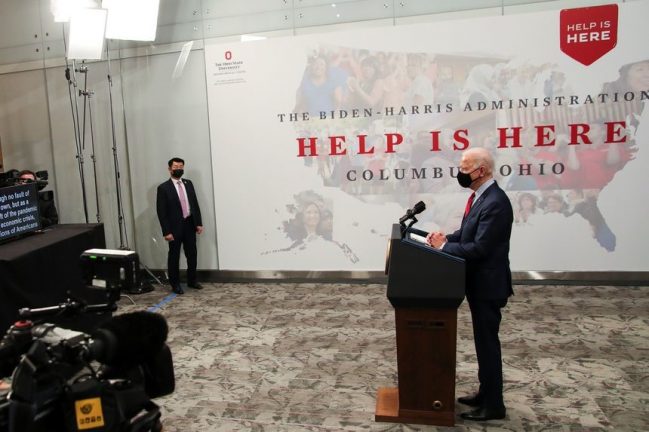

This is similar to President Biden’s Federal program for minority businesses that was ruled unconstitutional by a Federal judge.

Governor Polis is trying to skirt the law with Colorado funds.

Forward this information to your friends who qualify so we can try to get the Colorado program ruled unconstitutional

From: Wen Fa [mailto:WFa@pacificlegal.org]

Subject: RE: Colorado’s Discriminatory Grant Program

Pacific Legal Foundation is looking to identify small businesses in Colorado that may be interested in serving as public interest clients (i.e., with our pro bono representation) in challenging Colorado’s program that prioritizes grants to certain minority owned small businesses. Below is a summation of the issue. If you know of anyone who might be a good fit, we would be very interested in connecting with them.

Colorado is in the process of creating guidelines to distribute 1.7 million dollars in grants to small businesses impacted by the COVID pandemic. The law that authorizes this program expressly gives a preference to “minority-owned business,” and disadvantages businesses owned by someone who is white or Native American. Last week Colorado posted guidelines for the grants: http://oedit.colorado.gov/disproportionately-impacted-business-grant . The grants are for up to $10,000 per business, and applications are open from September 17 to October 3, 2021.

The program will give a preference to minority-owned businesses in distributing the grants, which we still believe is unconstitutional.

Given the short application window, we want to speak with individuals who own small businesses and are interested in applying for these grants as soon as possible. Please let me know if you have any questions.

Wen Fa | Attorney

Pacific Legal Foundation

930 G Street | Sacramento, CA 95814

916.419.7111