By Rep. Ryan Gonzalez / March 21, 2025 / | Guest Commentary, Rocky Mountain Voice

In the state of Colorado, we are facing over a $1.2 BILLION dollar shortfall. As we are now halfway through the 2025 legislative session, we have seen little progress from the lawmaking majority on making hard and significant cuts to our budget.

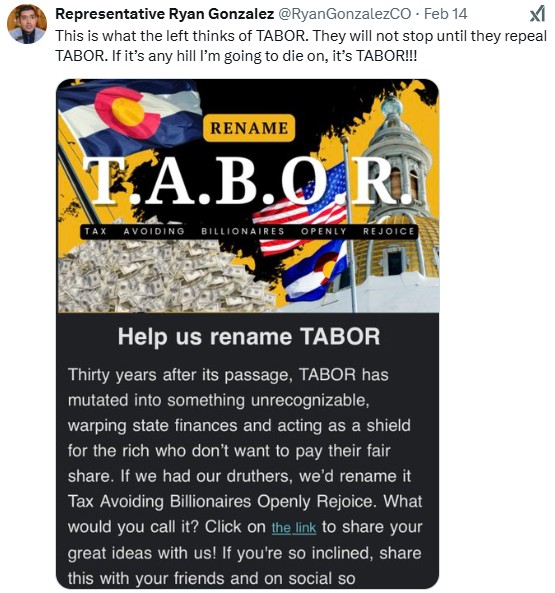

Rather than admit the improper allocation of taxpayer dollars, the majority uses this predicament to go after and attack our Taxpayer Bill of Rights (TABOR).

Our state budget this year is over 43 BILLION. In the last 6 years they have gone from a budget surplus to a very progressive spending spree at the expense of taxpayers.

More offices, tax credits, and programs that require funding and eat away at TABOR refunds have been – and continue to be – the norm for the majority rule in Colorado.

Much of this is due, in part, to the COVID ripple effect that we are seeing now, just years in the making. As a first term legislator, I can see – firsthand – many problems in how things are being managed and run under the Gold Dome.

We do not, and I cannot stress this enough, we do not have a revenue problem.

We have a spending problem, a big one.

To continue reading this story, please click (HERE) to go to the Rocky Mountain Voice: