By: The Gazette editorial

March 2, 2016 Updated: March 2, 2016 at 7:00 pm

Traffic on I-25

Fiscal conservatives, who wisely defend Colorado’s Taxpayer’s Bill of Rights, have a renewed option to fix highways and fund education without a tax hike. A new door opened for granting enterprise status to the state’s Hospital Provider Fee when Colorado Attorney General Cynthia Coffman issued an opinion saying the move would not violate the state constitution.

The Taxpayer’s Bill of Rights, or TABOR, an amendment to the constitution, requires state government to return surpluses to individuals when revenues reach a ceiling established by a complex formula that factors inflation and population growth.

Though TABOR has protected the public from excessive spending, taxation and runaway government growth, the Hospital Provider Fee creates a technical glitch and an illusion of state revenue.

Since 2009, hospitals have paid fees to the state. The cash is used to obtain matching funds from the federal government. The fees and federal funds, combined, are returned to hospitals to help fund indigent care.

Though state government does not have discretion with the money, it appears on the books and contributes to tripping TABOR refunds. Gov. John Hickenlooper wants the Legislature to establish an enterprise fund to collect the fees, which would exempt them from counting toward the refund cap.

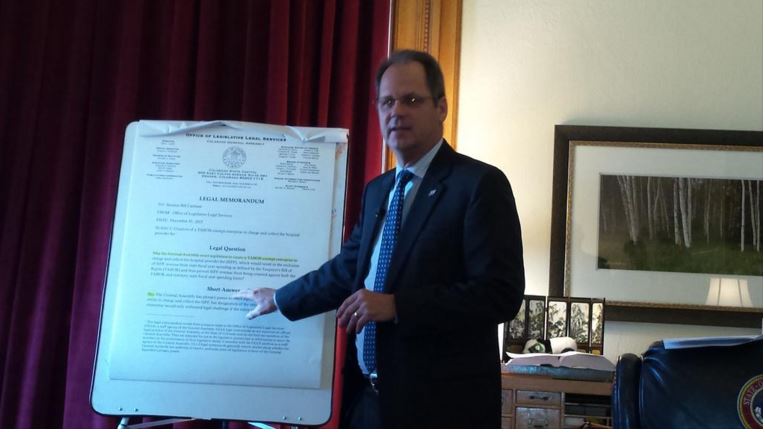

Senate President Bill Cadman, R-Colorado Springs, was cautiously open to considering the idea when Hickenlooper first pitched it early last year. In pursuit of pulling a bill title to create the enterprise in January, Cadman asked for a legal opinion from the nonpartisan Office of Legislative Legal Services – a public firm of several dozen lawyers who craft all legislation. The attorneys handed Cadman an opinion they had written for Democrats in 2013. It said the proposed enterprise would violate TABOR, and it minced no words. Cadman quickly staged a news conference to publicize the opinion and announce he would not support the governor’s plan.

Tuesday’s development could change the outlook. The state’s highest-ranking law enforcement official, a Republican, says enterprise status would not violate the law. Coffman is an unabashed defender of TABOR.

Though conflicting legal opinions cloud the issue, it seems like common sense to sequester hospital fees from TABOR calculations. It is blatant show money, which does not constitute sustained growth of government coffers. Though part of an unseemly federal smoke-and-mirrors scheme to backfill Medicaid, the funds should not trip refunds that were intended to prevent legitimate growth in state revenues.

With the proposed enterprise, state government might retain more than $700 million a year, which could do a lot for our roads.

After hearing of the attorney general’s opinion, Hickenlooper said he would sit down with Cadman and try to strike a compromise. The two men should start with a plan to ensure widening Interstate 25 between Monument and Castle Rock with a portion of the retained revenue. The project would benefit southern Colorado, Denver and the state’s economy. Lock it in by issuing bonds. Republicans also should ensure some of the money benefits K-12 education. And, as Republicans hold all the remaining cards, Cadman should demand better regulations for recreational pot and tuition tax credits for kids.

Retention of refunds, with a simple accounting maneuver, could help Coloradans without raising taxes. Before they make it so, in the spirit of checks and balances, the Senate majority should commandeer control of the funds.

the gazette

Related:

Colorado attorney general OKs removing hospital fee from TABOR

http://gazette.com/editorial-work-with-hick-to-widen-i-25/article/1571323