Under the scrutiny of the national media, John Hickenlooper’s official campaign for President has gotten off to a rocky start. Most of the national media coverage following his announcement has focused on his refusal to be labeled a capitalist during an interview on MSNBC. In a characteristic Colorado style, local TV anchor Kyle Clark tweeted, “’I may be a capitalist,’ @Hickenlooper writes. His 180 turned into a 360 now a 540. That’s @SeanWhite-level rotation.”

In his prepared launch video, and in media appearances since then, Colorado’s former governor has been regularly touting his role in Colorado’s booming economy. It’s true that Colorado has been ranked as the nation’s #1 economy. We’re consistently on lists of the best places to live and work in the U.S., and we attract hundreds of thousands of new residents every year.

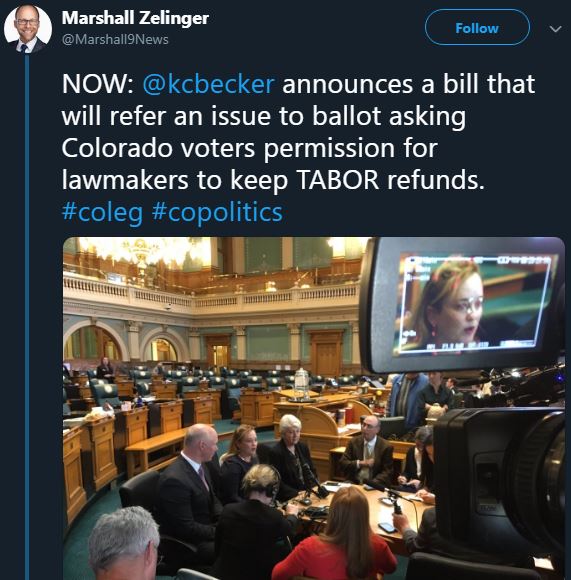

Still, the fact is that our economy isn’t thriving because of John Hickenlooper. In actuality, a majority of the credit goes to the Taxpayer’s Bill of Rights (TABOR) – a unique law that allows Coloradans to vote on any and all tax increase.

It’s a simple concept – lawmakers have to make the case to voters in order to get more of their hard-earned money. TABOR also provides guardrails for the size of government. State spending still grows every year, but it’s limited to inflation plus population growth. The end result of TABOR is to keep the government truly serving the people. Continue reading

Michael Fields

Michael Fields