#HandsOffTABOR

#DontBeFooled

#ItsYourMoneyNotTheirs

#TABOR

#FollowTheLaw

#FeesAreTaxes

#VoteOnFees

#ReplaceThemAllForNotFollowingVotersWishes

#HandsOffTABOR

#DontBeFooled

#ItsYourMoneyNotTheirs

#TABOR

#FollowTheLaw

#FeesAreTaxes

#VoteOnFees

#ReplaceThemAllForNotFollowingVotersWishes

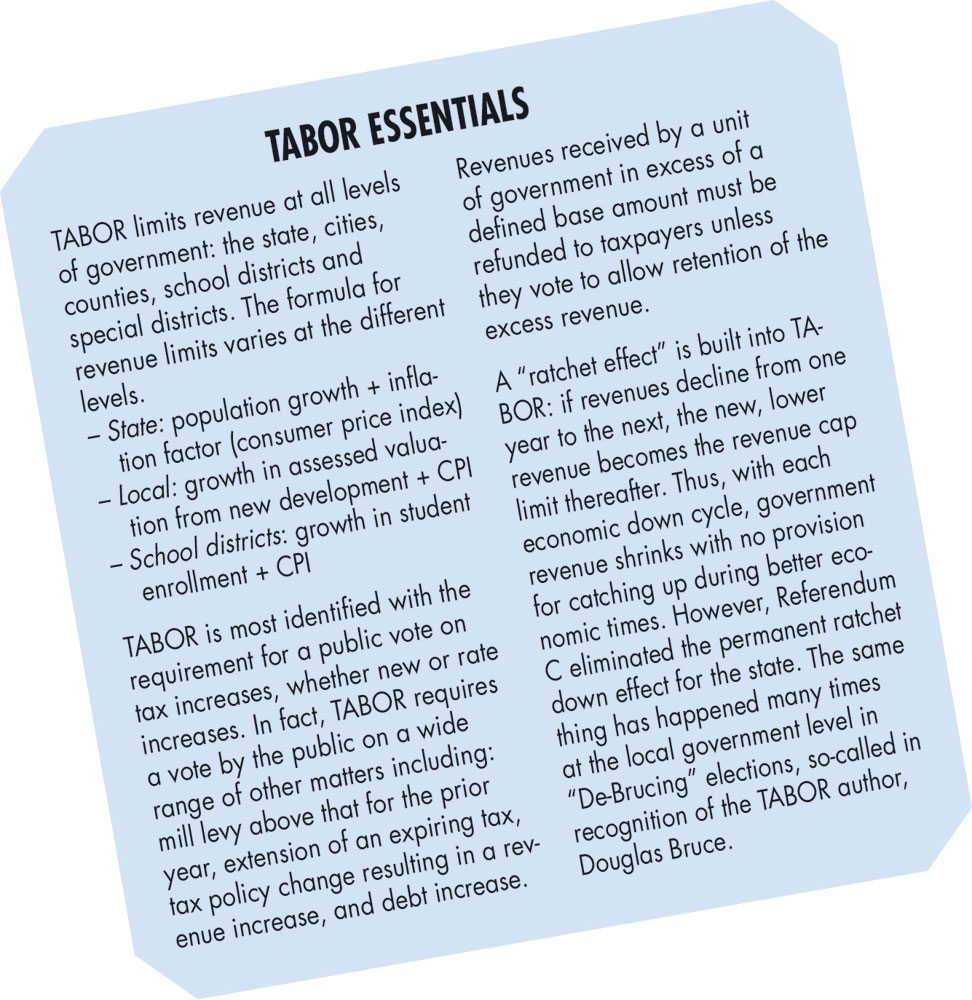

The Taxpayer’s Bill of Rights (TABOR) is a cornerstone of Colorado’s fiscal policy, enacted in 1992 to limit state and local government revenue growth and return excess funds to taxpayers. The TABOR refund history reflects decades of surplus distributions, evolving mechanisms, and economic impacts, making it a critical topic for Colorado residents. This guide dives deep into the historical context, refund mechanisms, amounts, eligibility criteria, and key milestones of TABOR refunds, offering a detailed, SEO-optimized resource for understanding this unique program. Whether you’re a long-time Coloradan or new to the state, this article provides clear, actionable insights to help you navigate and claim your refunds.

Since its inception, TABOR has mandated that surplus revenue—beyond inflation and population growth limits—be refunded through methods like sales tax refunds, income tax rate reductions, and direct payments. Over the years, refund amounts have varied based on economic conditions, with notable payouts like the $750 single-filer refund in 2022 and the projected $1,700 in 2025. By exploring the history of TABOR refunds, residents can better understand eligibility, filing deadlines, and how to maximize their financial benefits.

Table of Contents

The Taxpayer’s Bill of Rights, approved by Colorado voters in 1992, caps government revenue growth to the rate of inflation plus population growth. When state revenue exceeds this limit, the surplus must be returned to taxpayers unless voters approve retaining it. This mechanism ensures fiscal discipline and directly benefits residents through refunds. Understanding the TABOR refund history is essential for Coloradans to anticipate payments, meet filing requirements, and stay informed about legislative changes that may affect future refunds.

For example, in 2023, eligible taxpayers received $800 (single filers) or $1,600 (joint filers) through sales tax refunds, a shift from earlier years when amounts varied by income. This guide breaks down these changes, offering lists and tables to clarify how refunds have evolved and what to expect in 2025.

The evolution of TABOR refunds showcases Colorado’s commitment to returning excess revenue to its citizens. Below is a detailed timeline of key milestones in TABOR’s history, highlighting legislative changes, refund mechanisms, and significant payouts.

This timeline illustrates how TABOR refunds have adapted to economic and legislative shifts, ensuring taxpayers benefit from surplus revenue.

TABOR refunds are distributed through specific mechanisms, which have evolved to balance fiscal responsibility and taxpayer benefits. Below is a comprehensive list of the primary refund methods used historically and their applications.

The TABOR refund for seniors in Colorado is a vital financial benefit under the Taxpayer’s Bill of Rights (TABOR), ensuring eligible residents, particularly those aged 65 and older, receive a portion of surplus state revenue. For 2023, single filers can claim an $800 refund, while joint filers may receive $1,600, with additional benefits like the Property Tax/Rent/Heat (PTC) Rebate for low-income seniors. This guide provides a detailed, step-by-step roadmap to maximize your refund, including eligibility criteria, filing requirements, and free tax assistance options, optimized for seniors navigating Colorado’s tax system in 2025.

Understanding the TABOR refund process can feel daunting, but it’s a straightforward opportunity to boost your finances. Whether you’re a retiree living on Social Security or a senior with modest income, this article breaks down everything you need to know in clear lists and tables. From filing deadlines to income thresholds, we’ll ensure you’re equipped to claim your refund confidently. Let’s dive into the specifics to help you secure your Colorado TABOR refund without stress.

Table of Contents

The Taxpayer’s Bill of Rights, enacted in 1992, mandates that Colorado refunds excess state revenue to taxpayers when collections exceed a constitutional cap. For seniors, this refund is particularly significant, as many rely on fixed incomes. In 2023, the state simplified the process with the DR0104EZ form for those with minimal income, making it easier for older adults to claim their share. Additionally, seniors aged 65 or older with low income may qualify for the PTC Rebate, enhancing their financial relief.

Bobbie Daniel

Mesa County is proud of how we’ve managed our local budget. We’ve kept spending in check, rebuilt our reserves since the Great Recession and honored the Taxpayer’s Bill of Rights (TABOR) by refunding tens of millions of dollars back to the people who earned it.

Just last December, we returned $11.5 million to Mesa County taxpayers. A few years earlier, it was $12 million. That’s money staying right here in our local economy, funding family businesses, school clothes and food on the table instead of disappearing into bigger bureaucracies.

When the property tax crisis hit last year, Mesa County was also one of the few local governments in Colorado that actually lowered its mill levy, deliberately reducing taxes for our residents at a time when they needed relief most. That’s a concrete example of how we put taxpayers first and honor the spirit of TABOR, while still balancing our budget and funding essential services.

But even as we work diligently to protect your dollars, there’s a troubling dynamic unfolding that every taxpayer in Colorado should understand. Local governments across our state, from Mesa County to the Eastern Plains, are being forced to shoulder more and more costs from mandates dreamed up in Denver, while the state quietly walks away from the bill.

During just the past two years, Mesa County identified nearly $10 million annually in unfunded mandates from the state. That’s money redirected from public safety, roads and essential community services.

It’s like the state government going out for a lavish dinner, ordering everything on the menu, and then slipping out the back door, leaving counties and local taxpayers stuck picking up the tab.

And these costs keep piling up. Each new layer of rule making and regulation becomes another invoice sent straight to local communities.

The most glaring example right now is Rule 31, which imposes sweeping new methane rules on landfills. Mesa County already complies with rigorous federal standards on methane. Yet this new state rule would force us to spend $9 million up front, plus another $1 million every single year after, to fix a problem we’ve already solved. Only the state could figure out how to “fix” what’s already fixed — and still send you the invoice.

It’s the same story with the sudden law requiring all landfills to install new liners, forcing us to shell out $2 million on infrastructure we didn’t even need.

Colorado’s new overtime law, which requires overtime deducted from federal gross income to be added back to a taxpayer’s federal taxable income for state income tax, violates TABOR….

To read the rest of this story, please click (HERE) to go to Law360.