It (The Sun) ignores the fact that TABOR doesn’t direct spending, the politicians running the state do.

#HandsOffTABOR

#DontBeFooled

#ItsYourMoneyNotTheirs

#TABOR

#FollowTheLaw

#FeesAreTaxes

#VoteOnFees

#ReplaceThemAllForNotFollowingVotersWishes

Don’t buy The Sun’s spin: TABOR isn’t the reason Colorado’s roads are failing, it’s lawmakers’ misplaced priorities

August 29, 2025

By Cory Gaines | Commentary, Colorado Accountability Project

The Sun’s Gigafact check tries, but fails spectacularly.

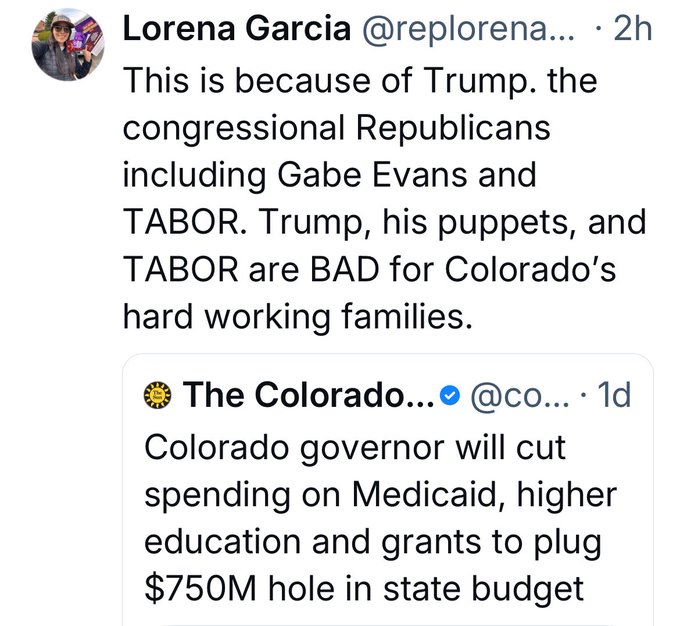

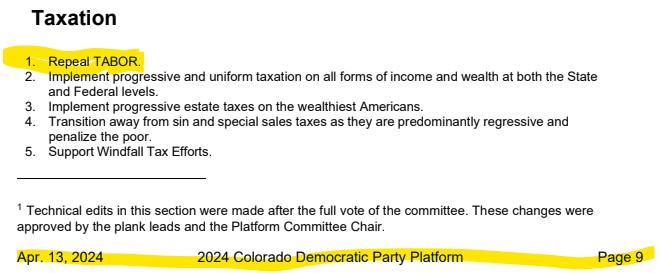

The Sun has been doing yeoman’s work lately to get the progressive talking points on our state’s budget and TABOR out there. Their Gigafact check linked first below is a great example.

In answer to the question, “Has the condition of Colorado’s roads worsened under TABOR?”, their response is a resounding YES.

Let me pull some non-contiguous quotes. As a quick aside, the amount of text below is about 50% of the entire text in the fact check, a point I will return to shortly.

“The percentage of state roads in Colorado rated “poor” by the Federal Highway Administration has risen from 8% to 24% since the agency began collecting data in 1994, two years after the Taxpayer’s Bill of Rights became law.”

“TABOR is a voter-approved constitutional amendment that limits how much tax revenue Colorado can collect and spend. Colorado’s gas tax, which funds much of the state’s $1.55 billion transportation budget — 48% of which goes to pavement maintenance annually — hasn’t changed since 1991 partly due to TABOR restrictions.”

The problems start with what I wrote right prior to the quotes. Determining the truth of a statement, especially one involving road funding in Colorado, is probably going to need a deeper look than than 150-odd words can provide.

If the Sun limited themselves to a literal interpretation of their title question, have the roads gotten worse under TABOR, then it is possible to determine the truth (or not) of the statement. Yes, the two events have indeed been coincident in time. They happened simultaneously.

But if you read that second quoted passage above again, you’ll see that they do not, in fact, limit themselves to such a question; it becomes pretty clear reading it that what they then do is to turn and try to link the condition of the roads to TABOR–an expansion of the question.

This is the failure.

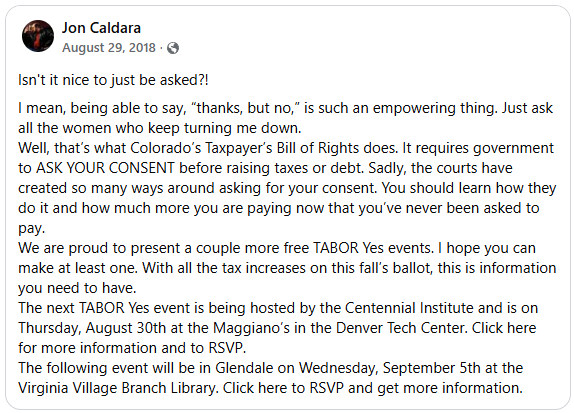

It ignores the fact that TABOR doesn’t direct spending, the politicians running the state do.

It ignores the MULTIPLE fees that the state charges, some of which is supposed to go to the improvement of our roadways. See, for example, the second link below which is CDOT’s Statewide Bridge and Tunnel Enterprise which takes in fees and is supposed to use them to fund bridge and tunnel improvements, bridges and tunnels which are paved (and some of which are in dire need of repair from the pavement on down to the structure).

The last bit of trouble here is the Sun’s use of the recent American Society of Structural Engineer’s (ASCE) report about the condition of Colorado’s infrastructure to help inform their fact check. This ASCE report (see the third link below to an earlier newsletter) was a self-serving effort, also critical of TABOR, and informed by groups that do not like fiscal restraint.

Do not rely entirely on fact checks by any news outlet. There is nothing special about them. There is no heightened sense of fairness or truth involved; they are just as apt to mistakes or bias as any other “news” product.

As you can see above, there is sometimes quite the opposite: there is a redirection of what they originally set out to verify into advocacy.

https://coloradosun.com/2025/08/22/has-the-condition-of-colorados-roads-worsened-under-tabor/

https://www.codot.gov/programs/BridgeEnterprise

Related:

An earlier op ed I wrote about bias in fact checking.

https://completecolorado.com/2024/06/28/gaines-fact-checking-media-check-their-own-biases/

READ THE FULL COMMENTARY AT THE COLORADO ACCOUNTABILITY PROJECT

Editor’s note: Opinions expressed in commentary pieces are those of the author and do not necessarily reflect the opinions of the management of the Rocky Mountain Voice, but even so we support the constitutional right of the author to express those opinions.

https://rockymountainvoice.com/2025/08/29/dont-buy-the-suns-spin-tabor-isnt-the-reason-colorados-roads-are-failing-its-lawmakers-misplaced-priorities/

Posted in Colorado Accountability Project, Approved, Commentary, State

Tagged in Colorado Politics, Colorado Sun, Colorado Supreme Court, Democrat Lawmakers, Fiscal Responsibility, Government spending, Progressive Media, Road Funding, TABOR, Taxpayer Rights