TABOR’s Penn Pfiffner Talks With Famed Economist Dan Mitchell About Prop HH

Category Archives: Ballot Initiative

TABOR’s Penn Pfiffner Talks With Famed Economist Dan Mitchell About TABOR

Proposition HH

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteNoOnPropHH

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

Colorado Democrats Play Tax Games

Ever since the state turned Blue, Democrat politicians have been trying to get at the Taxpayer Bill of Rights (TABOR), which is in the Colorado Constitution.

They are at it again. This time, Democrat legislators and Governor Jared Polis seem to be trying to trick voters into giving away TABOR refunds they are due to get a little property tax relief.

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteNoOnPropHH

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

Click (HERE) to continue reading this story

TABOR Coalition Launches to Protect Refunds, Taxpayers

NEWS RELEASE

FOR IMMEDIATE RELEASE: MAY 24, 2023

CONTACT: Caitlin Gallagher Blundell,?cgallagher@standtogether.org??

TABOR Coalition Launches to Protect Refunds, Taxpayers

Organizations across Colorado have come together to protect taxpayers & oppose any attempt to take away TABOR refunds

DENVER, CO – Today a coalition of organizations came out in opposition to any attempt by the legislature or special interest groups to take away Taxpayer’s Bill of Rights (TABOR) refunds. Colorado is expected to return $2.7 billion to taxpayers in the coming year.

“While special interests and politicians have been busy looking for ways to withhold TABOR refunds over the last several months, Americans for Prosperity, our activists and coalition partners have been busy contacting voters across the state,” said AFP-CO State Director Jesse Mallory. “Families have already received two rounds of TABOR refunds and polling has shown TABOR is more popular than ever. Trying to convince voters to weaken TABOR and eliminate refunds will be a nearly impossible ask.”

Coloradans benefit from TABOR refunds and these organizations have pledged their support to protect taxpayers from any attempt to interfere with them. The organizations are:

- Advance Colorado

- Americans for Prosperity-Colorado

- Broomfield Taxpayer Matters

- Centennial Institute

- Colorado Union of Taxpayers

- Colorado Women’s Alliance

- Independence Institute

- Liberty Scorecard

- Lincoln Club Colorado

- Springs Taxpayers United

- Steamboat institute

- TABOR Committee

BACKGROUND:

The coalition came out in opposition to any attempts by the legislature or special interest groups to take away TABOR refunds from the taxpayers they belong to. Colorado is expected to return $2.7 billion to taxpayers in the coming year.

Recently, Governor Polis and lawmakers tied TABOR refunds to the state’s skyrocketing property tax.

For more than 30 years, Coloradans have benefited from TABOR refunds. The coalition and its members pledge support to protect taxpayers from any attempt from Gov. Polis and the General Assembly to take away their rightful, hard-earned return.

For further information or an interview, reach CAITLIN GALLAGHER at cgallagher@standtogether.org or (206) 402-8432.

Through broad-based grassroots outreach, Americans for Prosperity (AFP) is driving long-term solutions to the country’s biggest problems. AFP activists engage friends and neighbors on key issues and encourage them to take an active role in building a culture of mutual benefit, where people succeed by helping one another. AFP recruits and unites Coloradans behind a common goal of advancing policies that will help people improve their lives. For more information, visit www.AmericansForProsperity.org

To view this release online click here.

Proposition HH Will Take Your Constitutionally Guaranteed TABOR Refunds & Increase Your Taxes

Imagine if the IRS proposed issuing ‘equitable’ income tax refunds, instead of returning what was owed to individual taxpayers.

Americans would revolt!

Yet, if the Polis Property Tax Scheme passes, Colorado Legislators will redistribute your TABOR refunds just that way.

#PropHH

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteNOonPropHH

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

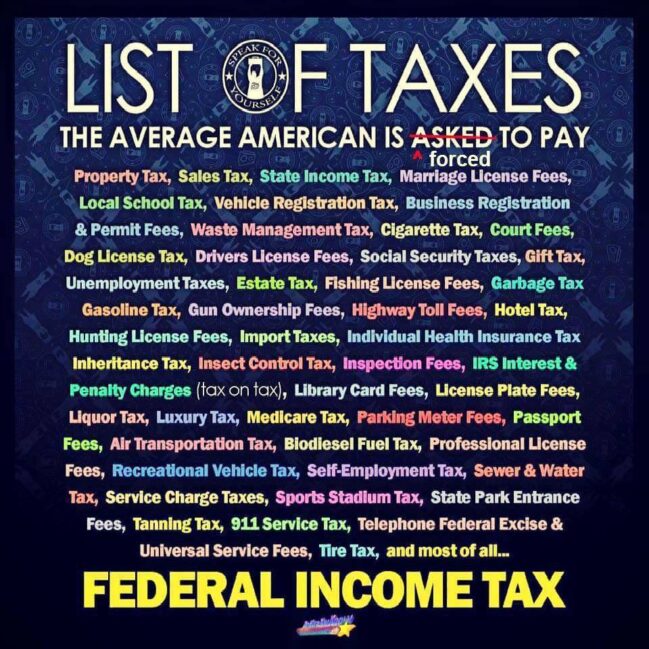

List Of Taxes The Average American Is Asked–No, Forced–To Pay

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteNOonPropHH

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

Dem’s last hour bill promises $600 TABOR refund for one year, then kills TABOR

The devil is in the details behind all the weekend media headlines proclaiming equal TABOR refunds, but only if voters approve Prop HH that is disguised as a property tax cut.

It’s a con job that would make Charles Ponzi proud.

The last hour bill comes as the legislative session grinds to a close today. It came with zero review or input from the public and most of your elected lawmakers.

The bill — sponsored by Democratic Reps. Chris deGruy Kennedy and Mike Weissman, as well as Democratic Sens. Chris Hansen and Nick Hinrichsen — was immediately heard Saturday afternoon in the House Appropriations Committee, where it passed on a 6-4, party-line vote. The measure’s introduction was such a surprise that the bill wasn’t posted on the legislature’s website when the committee hearing began.

Republicans in the House said they had no idea House Bill 1311 was coming and were furious. “Buckle your seatbelt,” said Rep. Rod Bockenfeld, a Watkins Republican, signaling the GOP will mount major opposition of the legislation.

Click HERE to read the rest of this story