Category Archives: Ballot Initiative

The Probability Of Getting Fooled On April Fools vs Election Day

Coloradans may face 4 spending questions this year. Will new nicotine tax measure overload the ballot?

Coloradans may face 4 spending questions this year. Will new nicotine tax measure overload the ballot?

The proposal, announced Wednesday by Gov. Jared Polis and Democratic state lawmakers, would set a uniform nicotine tax at 62 percent. That would lift the taxes on a package of cigarettes to $2.49 from 84 cents.

Ending Taxpayer’s Bill of Rights refunds a deservedly tough sell to voters

Sharf: Ending Taxpayer’s Bill of Rights refunds a deservedly tough sell to voters

Another year, another legislative attempt to erode Colorado’s Taxpayer’s Bill of Rights (TABOR).

TABOR opponents, bored with chipping away at the law’s foundations, have broken out the chainsaws. On the one hand, legislative Democrats are ignoring the plain language of TABOR and unilaterally enacting a universal income tax increase without a statewide vote, by calling it a “fee.”

And on the other hand, they are proposing a ballot referendum to waive the law’s taxation restrictions. According to TABOR, any increase in general revenue above the previous year’s plus inflation and population increase must be refunded to the people. House Bill 19-1257 would remove that restriction, allowing the state to keep any and all tax revenue, forever.

In return, the money that was kept would go to transportation, transit, public education, and higher education. Theoretically, anyway. Such a deal might seem to have some superficial appeal to Colorado voters, but recent experience strongly suggests this may be a harder sell than proponents expect.

We don’t know where Referendum C dollars go

HB 1257 is Referendum C on steroids. In 2005, voters approved a temporary “time-out” from TABOR’s spending restrictions, allowing the baseline to grow at the inflation plus population formula regardless of what revenues actually did. Referendum C has allowed the state to keep about $17 billion, including over $1.2 billion in the last fiscal year alone.

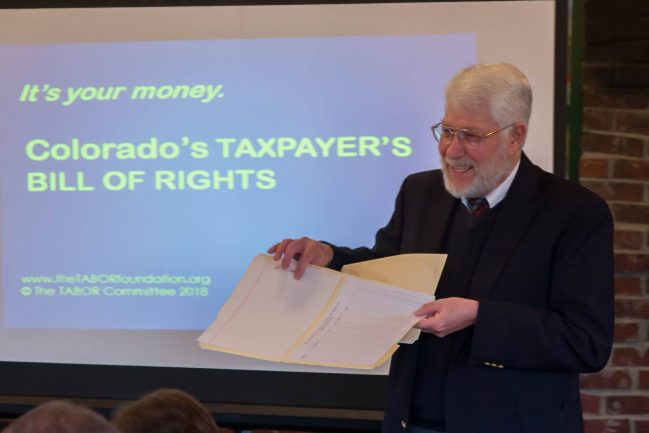

The Reagan Club Hosted Penn Pfiffner To Discuss The Taxpayer’s Bill of Rights

The Reagan Club of Colorado was glad to host Penn Pfiffner at April’s meeting to talk about the Taxpayer’s Bill of Rights. TABOR has kept Colorado fiscally healthy, but look for it to come under assault by the Democrats this year. Learn more about the work that The TABOR Foundation and TABOR Committee do at https://thetaborfoundation.org/.

Guest Opinion: Roads are the losers in 2019 Colorado Legislature

Guest Opinion: Roads are the losers in 2019 Colorado Legislature

Guest Opinion

Fixing the crumbling and crowded roads across our state has been a talking point for politicians in Colorado for years, as the project backlog has grown to more than $9 billion.

Democrats who control the purse in the legislature don’t seem to feel any urgency to fix the funding issues creating the backlog. In his first address to the General Assembly, Governor Polis spent mere seconds talking about the underfunded transportation infrastructure, offering no real solution.

Fiscal conservatives see priority problem in Colorado’s new budget

Fiscal conservatives see priority problem in Colorado’s new budget

The new budget includes $300 million for road funding, which took much negotiating between majority Democrats and minority Republicans. It also includes $175 million for full-day kindergarten, less than Gov. Jared Polis requested, and a 3 percent raise for state employees.

Budget writers also had to pull $40 million from some state reserve funds.

TABOR Repeal Bill Passes Colorado House of Representatives without Single Republican Vote

FOR IMMEDIATE RELEASE

202-380-7114 – MBLyng@NovitasCommunications.com

TABOR Repeal Bill Passes Colorado House of Representatives without Single Republican Vote

House Democrats’ attempt to permanently pocket taxpayer refunds advances on party-line vote

DENVER, April 17, 2019 – Yesterday, Democrats in the Colorado House of Representatives voted to pass House Bill 1257, a measure that would require state taxpayers to permanently forego tax refunds in any year in which they overpay the state.

“Colorado Democrats claim that their proposed theft of taxpayers would fund critical services like education and transportation, but Speaker K.C. Becker admitted in a committee hearing that they couldn’t provide any assurances as to how this supposed ‘excess’ revenue would be allocated in the future,” said Amy Oliver Cooke, Independence Institute Executive Vice President and TABORYes coalition member. “This isn’t even the government’s money in the first place. It’s money that hardworking Coloradans overpaid into the system, as codified by our Taxpayer’s Bill of Rights. Continue reading

TABOR exemption question to be on fall ballot

Vote NO on this attack on your Colorado Taxpayer’s Bill of Rights

TABOR exemption question to be on fall ballot

Under House Bill 1257 and a companion measure, HB1258, all of the taxes and fees the state collects over the revenue cap under TABOR would be evenly divided between transportation, public schools and higher education.

TABOR limits growth in revenue collections year over year based on inflation and population growth.

“In the last 27 years since TABOR was voted into the Constitution, our state population has increased by 50 percent,” said House Speaker KC Becker, D-Boulder, who introduced the bill with Rep. Julie McCluskie, a Democrat whose district includes the eastern half of Delta County.

Colorado House passes plan asking voters to give up their TABOR-driven taxpayer refunds

Editor’s note: Don’t just vote NO but vote HELL NO on this….

Colorado House passes plan asking voters to give up their TABOR-driven taxpayer refunds

House Bill 1257 is a referendum asking voters to allow the state to keep and spend excess revenues that would otherwise be refunded to taxpayers. If approved, the referendum would be on the November ballot.

Voters would be asked this fall if the state should be able to retain surplus revenue over what the Taxpayer’s Bill of Rights allows under a bill that won final approval in the Colorado House on Tuesday.

Voters would be asked this fall if the state should be able to retain surplus revenue over what the Taxpayer’s Bill of Rights allows under a bill that won final approval in the Colorado House on Tuesday.