State’s unfunded mandates leave local taxpayers holding the bill

Bobbie Daniel

Mesa County is proud of how we’ve managed our local budget. We’ve kept spending in check, rebuilt our reserves since the Great Recession and honored the Taxpayer’s Bill of Rights (TABOR) by refunding tens of millions of dollars back to the people who earned it.

Just last December, we returned $11.5 million to Mesa County taxpayers. A few years earlier, it was $12 million. That’s money staying right here in our local economy, funding family businesses, school clothes and food on the table instead of disappearing into bigger bureaucracies.

When the property tax crisis hit last year, Mesa County was also one of the few local governments in Colorado that actually lowered its mill levy, deliberately reducing taxes for our residents at a time when they needed relief most. That’s a concrete example of how we put taxpayers first and honor the spirit of TABOR, while still balancing our budget and funding essential services.

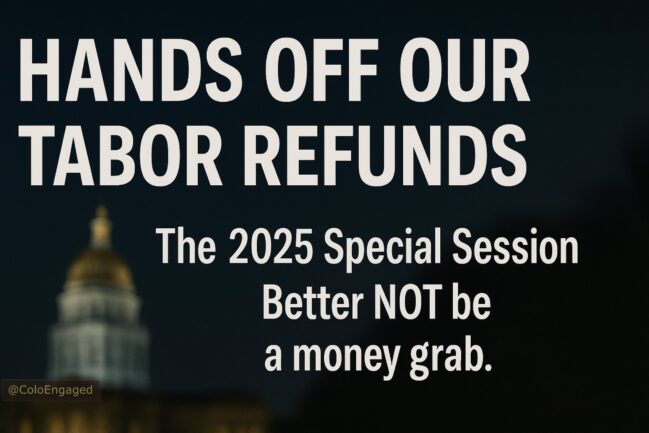

But even as we work diligently to protect your dollars, there’s a troubling dynamic unfolding that every taxpayer in Colorado should understand. Local governments across our state, from Mesa County to the Eastern Plains, are being forced to shoulder more and more costs from mandates dreamed up in Denver, while the state quietly walks away from the bill.

During just the past two years, Mesa County identified nearly $10 million annually in unfunded mandates from the state. That’s money redirected from public safety, roads and essential community services.

It’s like the state government going out for a lavish dinner, ordering everything on the menu, and then slipping out the back door, leaving counties and local taxpayers stuck picking up the tab.

And these costs keep piling up. Each new layer of rule making and regulation becomes another invoice sent straight to local communities.

The most glaring example right now is Rule 31, which imposes sweeping new methane rules on landfills. Mesa County already complies with rigorous federal standards on methane. Yet this new state rule would force us to spend $9 million up front, plus another $1 million every single year after, to fix a problem we’ve already solved. Only the state could figure out how to “fix” what’s already fixed — and still send you the invoice.

It’s the same story with the sudden law requiring all landfills to install new liners, forcing us to shell out $2 million on infrastructure we didn’t even need.