Colorado Democrats’ reckless overspending and financial mismanagement have STOLEN your hard-earned TABOR refunds!

No more gaslighting—time to hold them accountable.

Colorado Democrats’ reckless overspending and financial mismanagement have STOLEN your hard-earned TABOR refunds!

No more gaslighting—time to hold them accountable.

#HandsOffTABOR

#DontBeFooled

#ItsYourMoneyNotTheirs

#TABOR

#FollowTheLaw

#FeesAreTaxes

#VoteOnFees

#ReplaceThemAllForNotFollowingVotersWishes

Michael Fields and Kristi Burton Brown preview Gov. Polis’ upcoming call for another special session. It’s going to be focused on the budget, but why do liberals want to insist on taxing overtime and tips? What does polling say about this? And, there’s no question that a key public safety issue should be added if the legislature returns to the Capitol in August – it’s one that District Attorneys across the political spectrum agree must be fixed in state law.

Here we go again! For the third year in a row, Governor Jared Polis has called the Legislature for a Special Session.

This year, they are meeting to address the nearly $1 billion shortfall that the State of Colorado is facing due to the tax cuts in HR 1, otherwise known as the One Big Beautiful Bill Act.

Natalie Menten is a Colorado politics expert and taxpayer advocate. She joined me to provide background on the Special Session, and explain what bills have already been introduced.

If you want to become an expert on the Colorado Legislature, this is a must-watch!

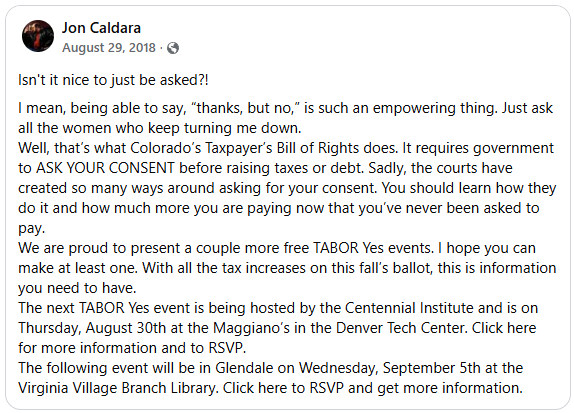

? What Is TABOR?

TABOR is a constitutional amendment passed in 1992 that:

• Limits how much revenue Colorado can collect and spend.

• Requires voter approval for any tax increases.

• Mandates refunds to taxpayers when revenue exceeds a cap based on inflation and population growth.

It’s popular among many voters for its taxpayer protections.

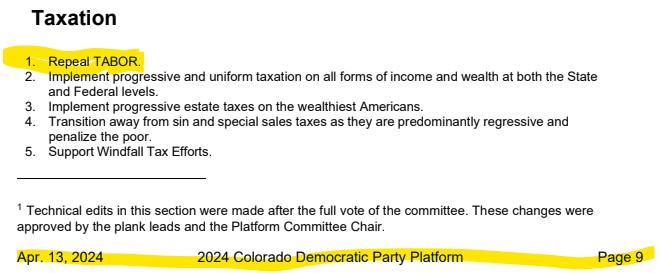

?? Colorado Democratic Party position on TABOR

Colorado Democrats have consistently expressed frustration with TABOR’s constraints since it blocks their unlimited spending. Here’s what recent reporting shows:

• Ongoing Efforts: Democrats have tried for decades to dismantle TABOR. Despite controlling the state government for seven years straight, they’ve made little headway due to TABOR’s popularity and constitutional entrenchment.

• Recent Moves: In 2025, some Democratic lawmakers introduced a resolution to direct the legislature’s legal team to file a lawsuit challenging TABOR’s constitutionality. The argument was that TABOR violates the U.S. Constitution’s guarantee of a “republican form of government” by requiring voter approval for tax increases.

• Internal Disagreement: While many Democrats agree TABOR is problematic, they’re divided on how to address it—whether through legal challenges, ballot measures, or incremental reforms.

• Platform Status: There’s clear evidence that “Repeal TABOR” is an official plank in the statewide Democratic platform and is certainly a recurring theme in their legislative agenda and public statements.

?? Political Reality

Despite Democratic control, TABOR remains intact because:

• Voter Resistance: Ballot measures to retain excess revenue (Propositions CC in 2019 and HH in 2023) were rejected by voters.

• Strategic Caution: Democrats are wary of political backlash, especially in swing districts or rural areas where TABOR is popular.

? Summary

So, while many Colorado Democrats strongly oppose TABOR and some have pursued legal and legislative avenues to weaken or eliminate it, it’s accurate to say the party has officially declared war on TABOR in its platform. The issue is deeply divisive, both within the party and among voters.

#HandsOffTABOR

#DontBeFooled

#ItsYourMoneyNotTheirs

#TABOR

#FollowTheLaw

#FeesAreTaxes

#VoteOnFees

#ReplaceThemAllForNotFollowingVotersWishes

Here we go again!

For the third year in a row, Governor Jared Polis has called the Legislature for a Special Session.

This year, they are meeting to address the nearly $1 billion shortfall that the State of Colorado is facing due to the tax cuts in HR 1, otherwise known as the One Big Beautiful Bill Act.

Natalie Menten is a Colorado politics expert and taxpayer advocate.

She joined me to provide background on the Special Session, and explain what bills have already been introduced.

If you want to become an expert on the Colorado Legislature, this is a must-watch!

ChainsawCaucus @ChainsawCaucus posted this today on X (Twitter):

???Chainsaw Caucus: Dems’ Tax Trick in CO! ???

? Democrats are dodging TABOR with a Motte-and-Bailey scam: claiming taxes haven’t risen or the budget is balanced (motte) while piling on fees that act like taxes (bailey). Coloradans are paying the price! ?

How It Works:

? Motte: “No tax hikes! TABOR ties our hands, so we use fees for roads, schools, healthcare.” They lean on the 4.25% income tax rate and small cuts (0.38% since 2018).

? Bailey: Fees exploded to $25.8B in 2024—$4,322 per Coloradan, a 3,369% jump since 1994. That’s a hidden tax hike equal to a 7.68% income tax rate!

Fee Fallout (2019–2024):

– ? College fees up 26.1% (e.g., CU Boulder + 14.28% to $41,943).

– ? DMV fees up $4 (HB25-1189), plus $3 car insurance fees (HB25-1303).

– ?? Restaurant fees + 25% (SB285).

– ?? $5.4B in transport fees (SB21-260).

– ? Non-education fees hit $1,382 per person (2024), up from $97 (2000).

The Trick: Dems use TABOR-exempt enterprises (10 new ones since 2020, $124.3M in FY24) and cite court rulings to avoid voter approval. They even pushed HJR25-1023 to challenge TABOR’s constitutionality! ?

Impact: Fees cost families ~ $4,500/yr (Advance CO). Voters rejected Prop HH (2023) by **18 pts**, showing **70%+** support TABOR on X. Stop the fee frenzy!

?? Fight Back: Initiative 2025-2026 #136 could require voter OK for big fees by 2027. Demand accountability! How are fees hitting you?

https://x.com/ChainsawCaucus/status/1957092257548648955

#HandsOffTABOR

#DontBeFooled

#ItsYourMoneyNotTheirs

#TABOR

#FollowTheLaw

#FeesAreTaxes

#VoteOnFees

#ReplaceThemAllForNotFollowingVotersWishes

One of Colorado government’s favorite games is to whine about TABOR, while actively subverting it through “fees.”

A report from the Common Sense Institute reveals that Colorado’s state spending exempt from the Taxpayer’s Bill of Rights (TABOR) has risen by nearly 30% since 1996.

TABOR limits the amount of revenue the state can retain each year, but exempts certain sources such as voter-approved changes, federal funds, and state enterprises. State enterprises — lottery, health insurance etc. — generate revenue through providing goods or services.

In 1996, 46% of Colorado’s total state spending (about $5,264 per resident) was “exempt from TABOR;” by fiscal year 2024, that share increased to 74%, amounting to just over $9,000 per resident.

Consider that for a moment. “Exempt from the Taxpayer Bill of Rights.”

Something is deeply wrong with that framing.

Colorado Politics broke this story, quoting the study authors Erik Gamm and Judah Weir, “‘The more that fee increases assume the character of tax increases, especially in the aftermath of Proposition 117, the more appropriate it becomes to characterize them as such,’ …adding that fee revenue growth is driving Colorado’s ‘tax burdens’ without giving citizens a say in the process.”

https://coloradofreepress.com/special-session-study-group-taxes-v-fees/

#HandsOffTABOR

#DontBeFooled

#ItsYourMoneyNotTheirs

#TABOR

#FollowTheLaw

#FeesAreTaxes

#VoteOnFees

#ReplaceThemAllForNotFollowingVotersWishes