Meanwhile, in the state known for its historic gold rush, a coalition of California businesses gathered enough signatures for a ballot measure that would require two-thirds of voters to approve most local tax increases and roll back some already in place.

California Businesses Take On Gavin Newsom Over Tax Hikes

Governor says ballot measure would decimate funding for basic services; backers say it is needed in the high-cost state

By Christine Mai-Duc

April 4, 2024 9:00 pm ET

California Gov. Gavin Newsom was featured in an ad calling the tax measure ‘dangerous, an overreach and irresponsible.’ PHOTO: DAMIAN DOVARGANES/ASSOCIATED PRESS

A coalition of California companies is going to war with Gov. Gavin Newsom and his Democratic allies over taxes it says have grown out of control in the Golden State.

The businesses have gathered enough signatures to put a measure on November’s ballot that would require two-thirds of voters to approve most local tax increases and roll back some recently enacted ones. If passed, it would be one of the most significant changes to the way California funds its government since 1978’s Proposition 13, a voter-approved law that severely limited property tax increases.

Backers say it is necessary to stop continued tax increases that are making it too expensive to operate in California and pushing companies to leave the state. Real estate businesses in Southern California are among the biggest funders, according to state campaign finance records, partly in response to a surcharge on luxury home sales that Los Angeles voters passed in 2022.

Newsom, local officials and labor unions say the proposal would decimate funding for basic services such as trash collection and firefighting and would make budgeting decisions near-impossible.

The companies spent some $16 million to gather signatures to put their proposal before voters and are gearing up for a fight political analysts say could draw tens of millions of dollars in advertising by both sides.

“The business community is fed up, they want to start stepping up to make a positive change. And they recognize that if they don’t do it, nobody will,” said Rob Lapsley, president of the California Business Roundtable, an advocacy group representing some of the state’s biggest businesses and leading the “yes” campaign.

Mike Roth, a spokesman for the “no” campaign, said his side “will not only have the financial resources but the boots on the ground needed for a robust campaign to educate voters about this deceptive and dangerous measure.”

How the measure would work

Currently, many local tax increases in California can become law with a majority vote by the public. The measure, which proponents are calling the Taxpayer Protection Act, would raise that threshold to two-thirds. It would also require any tax hikes passed by the legislature to be approved by a majority of voters statewide.

In addition, it would retroactively invalidate some local and state tax increases passed since 2022 that don’t meet the new law’s requirements—a provision opponents say would be particularly destabilizing.

“It’s a complete revision to the Constitution and to how we currently do government in the state of California,” said Kyle Packham of the California Special Districts Association, whose members include utility districts and major transit agencies.

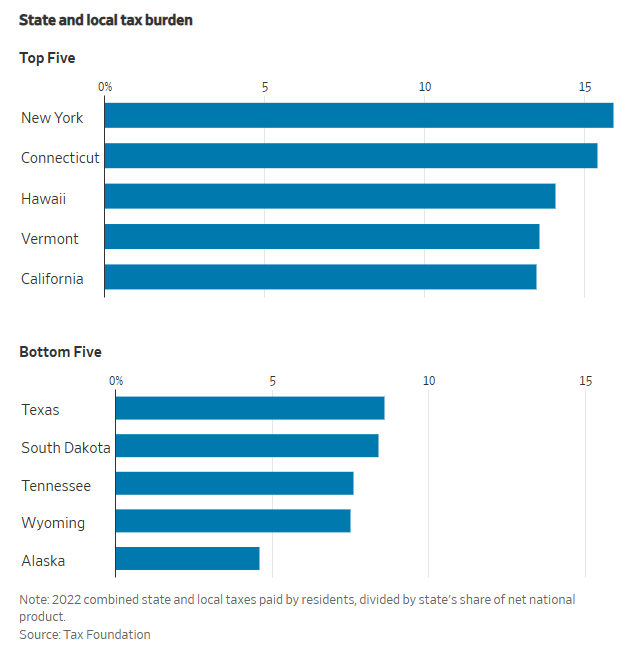

The fight is the latest manifestation of a long-running conflict between those who want to fund generous services in a state known for its progressive policies and those who argue high costs make California unattractive to families and businesses.

“It has been an ongoing process of trying to have your cake and eat it, too—low taxes and high services,” said Kirk Stark, a law professor at the University of California, Los Angeles who researches state and local taxes. “What has been less of a focus, until now, is what power the people have to propose taxes on themselves.”

In a recent full-page ad in the Los Angeles Times and San Francisco Chronicle, Newsom and a group of state and local government leaders called out prominent corporations that belong to or support the California Business Roundtable including Chevron, Blackstone, United Parcel Service and Santa Monica-based real-estate firm Douglas Emmett, saying they were supporting a measure that is “dangerous, an overreach and irresponsible.”

Representatives for Chevron, Blackstone and Douglas Emmett declined to comment. A representative for UPS didn’t respond to requests for comment.

In the Bay Area suburb of Walnut Creek, local leaders fear the measure’s passage would force them to revoke a half-cent sales tax increase that passed in 2022 with 65% of the vote. Keeping the tax, they said, would likely require a new vote and higher than two-thirds approval.

The money is already being used to fund five additional police officers, extend library hours and renovate the town’s 50-year-old swimming pool complex.

“Best case scenario, we could have a gap in funding of more than one year,” said city council member Cindy Silva. “Worst case scenario, we’ll have no funding.”

Voters in Los Angeles recently passed a real estate surcharge on property sales above $5 million, which could be rolled back if the new tax measure passes. PHOTO: DAMIAN DOVARGANES/ASSOCIATED PRESS

Not the first try

The Walnut Creek tax increase is one of more than 100 that could be overturned if the new measure passes, according to opponents. Lapsley’s group has said the number is closer to three dozen.

Newsom and other top Democrats have asked the California Supreme Court to take the rare step of removing the antitax measure from the ballot, arguing that it should be considered a constitutional revision, which can’t be done via voter initiative. That case is expected to be decided by June 27, the state’s deadline for certifying measures for the November ballot.

Meanwhile, Democratic legislators are trying to counter the business group’s effort by placing a competing measure on the ballot. If passed by a simple majority, it could subject the Taxpayer Protection Act itself to a two-thirds threshold to become law.

Making it harder for voters to raise taxes on themselves isn’t a new idea, nor is the California Business Roundtable’s advocacy for it. The group spent millions in 2018 qualifying a similar measure for the ballot with significant backing from the American Beverage Association, which wanted to block local taxes on high-sugar drinks.

That summer, the Roundtable yanked the antitax measure from the ballot after the soda industry struck a deal with then-Gov. Jerry Brown and Democratic legislators on a law banning new local beverage and food taxes for 12 years.

Any possible deal this time around would likely involve the real-estate industry, which wants to revoke Los Angeles’s surtax on property sales of more than $5 million that passed with 58% of the vote in 2022 and prevent similar measures from passing elsewhere.

Lapsley, the president of the California Business Roundtable, acknowledged that the real-estate industry is “under full-scale frontal assault,” but he said his group isn’t holding out for a compromise in the Legislature this time.

“We are full steam ahead,” he said.

Write to Christine Mai-Duc at christine.maiduc@wsj.com

Copyright ©2024 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Appeared in the April 6, 2024, print edition as ‘California Businesses Fight Newsom Over Tax Increases’.

Leave a Reply