ChainsawCaucus @ChainsawCaucus posted this on X

Chainsaw Caucus Alert: Prop LL & MM – TABOR Workaround & Hidden Tax Hike!

Colorado Patriots, it’s time to sharpen your chainsaws! Propositions LL and MM on the November 2025 ballot are being sold as “saving school lunches” and “helping kids,” but don’t be fooled—these are slick moves to bypass TABOR and raise your taxes! Here’s the breakdown from your Chainsaw Caucus crew, ready to cut through the spin.

Prop LL: TABOR’s Backdoor Bust

– What They Say: Prop LL “retains” extra revenue from Prop FF (2022’s school meals tax on high earners) to keep funding free lunches for all kids. Sounds noble, right?

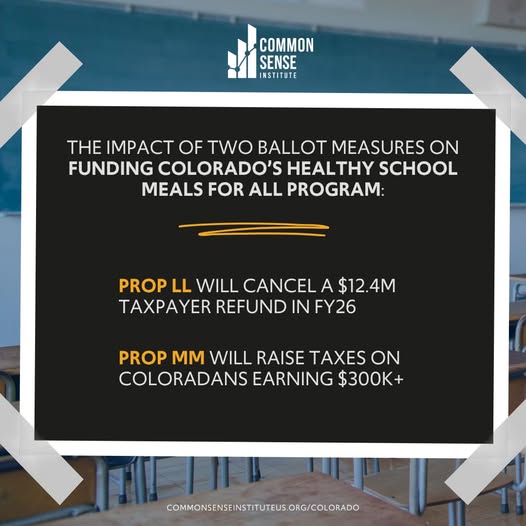

– The Truth: This is a TABOR dodge! TABOR (our Taxpayer’s Bill of Rights) says any revenue over projections must be refunded to YOU, the taxpayer. Prop LL lets the state keep $50-100M a year that should come back to your wallet, no questions asked. They’re calling it “surplus retention,” but it’s a blank check for bureaucrats to lock up funds without voter say. Once it’s gone, good luck getting it back!

– Why It Stinks: TABOR exists to protect us from runaway spending. Prop LL flips the bird to that, tying up your money for a program that’s already ballooned to $200M a year (double what they planned). No accountability, no flexibility for budget crises. Just a feel-good excuse to hoard cash.

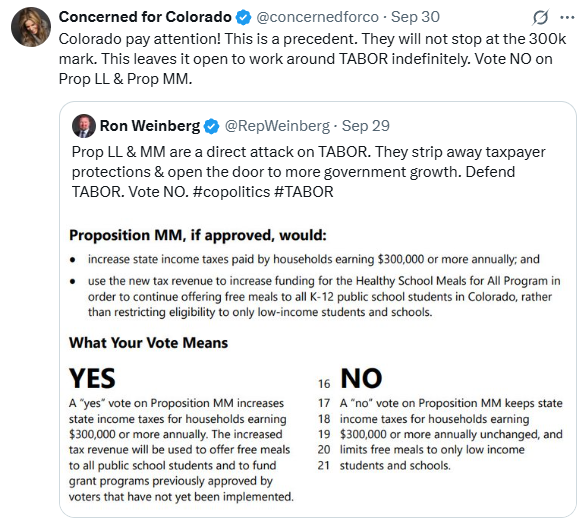

Prop MM: Straight-Up Tax Hike

– What They Say: Prop MM “tweaks” taxes on folks earning over $300K to raise ~$95M for school meals and SNAP benefits. They claim it’s just for kids and won’t hit your pocket.

– The Truth: This is a TAX INCREASE, plain and simple. It caps deductions at $1,000 (single) or $2,000 (joint) for high earners, jacking up their state taxes. Think it won’t affect you? Those 200,000 households (6% of filers) are business owners, job creators, and innovators who might just pack up and leave Colorado, taking jobs with them. Plus, nothing stops the state from lowering that $300K threshold later—today’s “rich” could be YOU tomorrow.

– TABOR Trick: Prop MM dresses up as TABOR-compliant by asking for your vote, but it’s a one-way street. Once approved, that $95M is locked into meals and SNAP forever, starving other priorities like roads or schools when budgets get tight. It’s ballot-box budgeting—handcuffing lawmakers and dodging TABOR’s spirit.

The Big Picture: Together, LL and MM are a masterclass in government overreach. LL keeps your TABOR refunds hostage; MM slaps new taxes on the table. Both prop up a bloated program (meals for all kids, even wealthy ones) that’s already failing to stay on budget. Meanwhile, Colorado’s facing an $800M shortfall, and these measures just make it harder to pivot. They’re not about “kids”; they’re about locking in spending and screwing taxpayers.

Chainsaw Caucus Call to Action

– Vote NO on Props LL and MM on Nov. 4, 2025! Protect TABOR, your wallet, and Colorado’s economic future.

– Spread the Word: Share this post on X and tell your neighbors—these props are a wolf in sheep’s clothing.

– Join the Fight: Follow @ChainsawCaucus for more updates on slashing government waste and keeping Colorado free!

Disclaimer: This post reflects the Chainsaw Caucus’s take—no fluff, just facts. Check ballot language at http://coloradosos.gov. Let’s keep the government’s hands off our money! ?

https://x.com/ChainsawCaucus/status/1973026323502084182

#ItsYourMoneyNotTheirs

#DontBeFooled

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#FollowTheMoney

#FollowTheLaw

#ThankGodForTABOR

#HandsOffTABOR