The World Happiness Report provides data and research used around the world to help shape and inform policy.

Among its findings: giving to others is good for you. It makes you feel happy.1-8

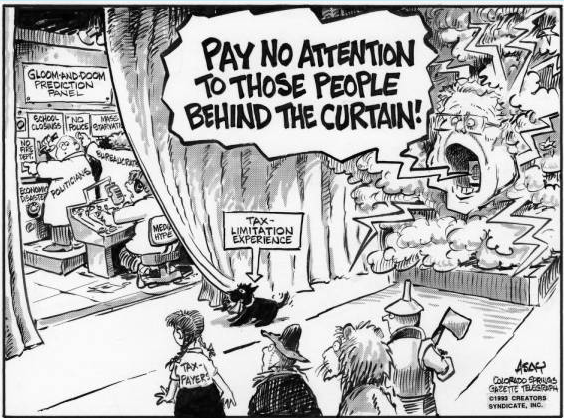

Since 1992, the TABOR Foundation protects the Taxpayer’s Bill of Rights. We educate citizens on why it matters to have a vote on increased taxes and how a formula for predictable growth creates a sound economy.

We are all volunteers.

We give advice and direction to citizens working at their local level to stop TABOR violations. We assist as plaintiffs and “friends of the courts in lawsuits to stop such violations.

The biggest trick of politicians is calling a new tax a “fee” – whether it’s for plastic grocery bags, living in a special district, running a hospital, driving over a bridge, or funding a mandatory family leave program with an insurance “fee.” We’ve responded to inquiries not just in Colorado, but in states like South Dakota, Kansas, Arizona, Alaska and Florida.

Please donate:

- Help fund our Speaker’s Bureau to educate fellow taxpayers about their rights.

- Help produce the TABOR 101 series of policy/how-to videos.

- Help fund the legal fees for amicus briefs.

Please donate. You – and we – will be happy you did.

Thanks – and Happy New Year!

Your friends at the TABOR Foundation