Dear Friend,

Even though times may seem more polarizing now than ever, one thing most Coloradans can agree on is that they want every citizen of our state to be allowed to flourish. They may have strong opinions on the issues, but surprisingly, there are still several key principles the majority of Coloradans support.

After conducting extensive statewide polling, I outlined 10 practical ideas the GOP should embrace to address some of the big issues that Coloradans care about:

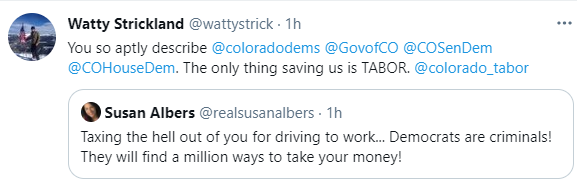

- Continue to protect our Taxpayer’s Bill of Rights (TABOR). Few things are more popular than people being allowed to vote on any tax (or large fee) increase.

- Lower taxes. Coloradans overwhelmingly support a property tax cut for both residential and commercial property. With housing costs on the rise, low-income families would especially benefit from this tax cut.

- Increase teacher pay. More of the existing money we spend on education should go to teachers instead of the bureaucracy.

- School choice. The impact of the pandemic on our education system has led to even more support for parental choice. Colorado should also pass a stipend for families to use for out-of-school learning opportunities – like tutoring.

- Public safety. With crime on the rise in many Colorado communities, voters are looking for leadership on this issue. They strongly oppose any destruction of property. And while they are open to reforms within the law enforcement system, they certainly don’t want to dismantle or defund it.

Read all 10 of my ideas here.

With 42% of Coloradans choosing to be unaffiliated with a political party, it’s more important than ever for candidates to be clear about their plans if voters entrust them with power. If Colorado Republicans unite around a few key issues, and drive their message home with voters, I believe the party will quickly begin to make a comeback.

Sincerely,

Michael Fields

Executive Director of Colorado Rising State Action

By Christine Burtt, TABOR Foundation Board Member

By Christine Burtt, TABOR Foundation Board Member