DENVER (AP) — The Latest on a bill to loosen a Taxpayer’s Bill of Rights limit on Colorado state revenues (all times local):

5:20 p.m. p.m.

A proposal by two Republican lawmakers to potentially increase how much revenue the state can keep without issuing tax refunds has passed a Colorado House committee.

The Democrat-led House Finance Committee voted 10-3 Monday to refer the bill by Republican Rep. Dan Thurlow and GOP Sen. Larry Crowder to the House Appropriations Committee.

Their bill would ask voters in November to change the way annual state revenue limits are calculated under the Taxpayer’s Bill of Rights.

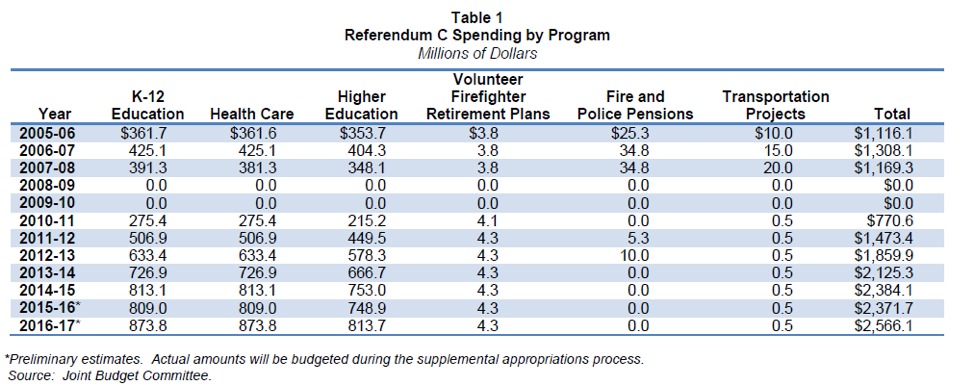

It could allow the state to keep hundreds of millions of dollars for roads, education and other priorities.

Opponents argued that any proposed change to TABOR, a constitutional amendment passed by voters in 1992, should be in the form of a constitutional amendment — not a statutory change called for by the bill.

Constitutional changes carry tougher ballot qualification and voter passage benchmarks.

___

11:35 a.m.

Two Colorado Republicans want to loosen a constitutional restriction on how much revenue the state can receive without having to issue tax refunds.

Rep. Dan Thurlow and Sen. Larry Crowder say it’s time to have a conversation about those limits 25 years after voters approved them under the Taxpayer’s Bill of Rights.

Republicans long have opposed TABOR tampering, arguing excess revenues belong to taxpayers.

But Thurlow and Crowder say individual refunds would be pocket change when the state faces a $500 million budget deficit.

Their bill would ask voters in November to change the way TABOR’s annual revenue limits are calculated. It would potentially allow the state to keep hundreds of millions of dollars for roads, education and other priorities.

A House committee hears testimony on the bill Monday.

http://www.thechronicle-news.com/news/ap_news/the-latest-panel-oks-bill-to-ask-voters-about-tabor/article_9bc10e21-8358-5db0-b641-368887a6a572.html

An effort to reform the Taxpayer’s Bill of Rights, or TABOR, passed its first test on Monday with Republican support. File photo.An effort to reform the Taxpayer’s Bill of Rights, or TABOR, passed its first test on Monday with Republican support, though the legislation faces an uphill battle.

An effort to reform the Taxpayer’s Bill of Rights, or TABOR, passed its first test on Monday with Republican support. File photo.An effort to reform the Taxpayer’s Bill of Rights, or TABOR, passed its first test on Monday with Republican support, though the legislation faces an uphill battle.