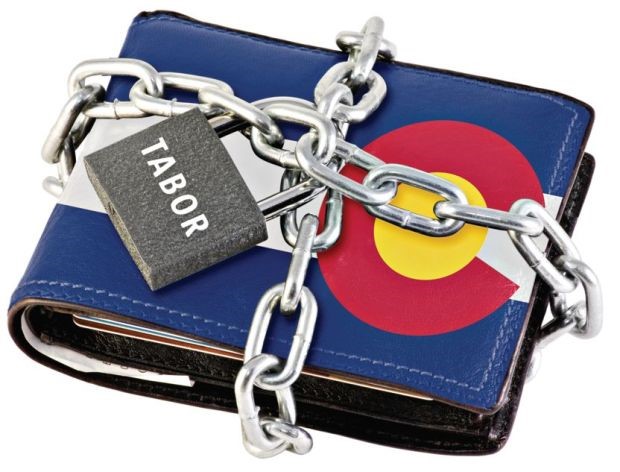

Reflecting on 25 years of the Taxpayer’s Bill of Rights (4 letters)

By DP OPINION | openforum@denverpost.com

March 4, 2017 at 5:00 pm

Jeff Neumann, The Denver Post; photos provided by Thinkstock by Getty Images

Re: “Has TABOR been a good deal?” Feb. 26 Perspective section.

Excellent coverage on both sides of this controversial issue with no surprise in their respective conclusions. Proponents of the Taxpayer’s Bill of Rights simply want the taxpayers to have a voice before taxes are increased beyond TABOR limits. The opponents want to return to the pre-TABOR days with little outside control over government growth and spending. TABOR works as intended. The vast majority of Colorado taxing entities that approached their voters with sound and justifiable projects were met with voter approval, including the statewide Referendum C issue.

Former Secretary of State Scott Gessler’s statement that Democrats are unified in their hatred of TABOR is not true. As The Post reported, “Since 1993, statewide voters have approved only five tax increases out of 17 ballot questions.” Rest assured, countless Democrats (myself included) were among those voters opposing any override or change in TABOR. Moreover, it is two Republican legislators who are currently sponsoring House Bill 1187 to decrease taxpayers’ refunds in future years.

Carl Miller, Leadville

The writer is a former Colorado legislator.

Re: “Break antiquated Colorado tax policy free of TABOR,” Feb. 24 Tim Hoover column.

Tim Hoover contends with spurious logic that changes since 1992 such as the advent of cellphones are a reason to dump TABOR. Sadly, unchanged since 1992 are the motivations of politicians. They avoid prioritization, wanting everything for everyone using our money; that’s how they buy votes for re-election. There is little follow-up on whether programs continue to meet their objectives and operate efficiently. Accountability is invisible, and what audits occur are often ignored.

Our politicians live in the moment, often with little regard for the long-term consequences of their actions. For example, as generous public employee pensions well beyond what is typical in the private sector inflate beyond TABOR funding, voter-sensitive issues such as highway and school funding are pushed to the budget margins as “unaffordable.”

TABOR is the adult in the room. Our politicians should be able to fund necessary services from a revenue stream funded by population growth and inflation. TABOR works daily for taxpayers by motivating better governance, and by keeping Colorado affordable both for its residents and its businesses.

Bob Chapman, Highlands Ranch

Nowhere in the Sunday opinion columns was it noted that since 1876, Colorado has never had a budget deficit. The state constitution has had a balanced budget provision since the beginning. The governor possesses the line-item veto. In more recent years a rainy-day fund was added. These are very substantial provisions that make for fiscal responsibility. TABOR never rescued us. We didn’t need to be rescued.

If TABOR has been so effective, why have hundreds of school districts and special districts de-TABORed in one way or the other? Why do virtually all new special districts included boilerplate language to free their budgets from TABOR’s provisions? Indeed, if TABOR is working so well, why all of the column inches in Sunday’s paper?

The solution is to retain voter approval for tax increases while junking the rest of TABOR and its mangled math.

Barry Noreen, Denver

The League of Women Voters of Colorado (LWVCO) believes that Colorado’s elected representatives should determine the needs of the state and approve an equitable system of funding, including taxes. LWVCO opposed the 1992 TABOR amendment because it requires a vote of the people to increase taxes, it constrains the state’s revenue collection and spending, it mandates that state-collected revenue greater than the rate of inflation plus population growth be refunded, and it requires a flat income tax. With TABOR, elected officials cannot provide adequate funding for K-12 education, higher education, highways, capital improvements and other services.

LWVCO has supported efforts to work within TABOR to gain budget flexibility for the state, including attempts to create an exemption from TABOR for the hospital provider fee. Colorado should not be short of revenue for essential services even in good economic times.

Barbara Mattison, Denver

The writer is president of the League of Women Voters of Colorado.

Submit a letter to the editor via this form or check out our guidelinesfor how to submit by e-mail or mail.

Reflecting on 25 years of the Taxpayer’s Bill of Rights (4 letters)

Leave a Reply