Both The TABOR Foundation and TABOR Committee have received huge numbers of requests for assistance and participation.

Your Colorado TABOR team is overwhelmed!

We need your help!

Would you be willing to assist us?

- Be a media producer! Create six podcasts in 2019

- A person to take charge of strategy, tactics, planning, coordination, and management

- We need someone with great perseverance and tenacious determination to assist in generating invitations for TABOR speakers

- Monitoring the Family Leave Act bill: This idea probably will be the next direct attack on TABOR. Some volunteer needs to stay on top of developments

You can make a big difference by volunteering your skills and activism.

Contact us and let’s talk.

Either email TheTABORFoundation@gmail.com or call Penn at his office (303-233-7731).

Thank you for any help you can provide!

Your TABOR Foundation and TABOR Committee team

Read below to see if you can provide any help!

- Podcasts

Be a media producer! The TABOR Foundation’s mission includes outreach to people who have not heard about the Taxpayer’s Bill of Rights and to supporters who want more intellectual ammunition to talk about TABOR. At one point, we had the facility, the interview talent and eight guests scheduled. A technical barrier to posting our podcasts then took some time to overcome. We would like to proceed, but now, for want of leadership and management, we have been unable to move forward. Please help us solve that problem and continue the program.

Requirements: We seek a volunteer who in 2019 will donate about 40 hours between now and early November. The time demands most likely would be in “spurts,” that is, six different projects in which about six hours of your time would be needed over the course of about three weeks, with breaks in between during which little or no time would be asked. The individual we seek has to be well organized and able to gently but persistently move other volunteers to act. You would get to know the people who supply both the taping equipment and the interview skills. For each podcast, you would coordinate the schedule to bring together the person to be interviewed, the taping technician and the interviewer. You would obtain in advance from the Foundation the questions that should guide the interview. You would attend the interview and address any problems. You would work with others or on your own to edit the podcasts for content and flow, with the help of the taping technician. You would coordinate with the web master to post the completed podcast. You would solicit other advocacy groups to link to the podcast and notify other media of its availability. Throughout the year you would report to, and keep apprised, the Foundation’s Executive Director.

- Speakers Bureau – Communications

The TABOR Foundation needs to replace an activist who has excellent skills in defining the TABOR outreach message but must relinquish that role. She also has been organizing the resources necessary for successful presentations.

Requirements: A volunteer who in 2019 will donate an average of one to two hours a week to manage the Speakers Bureau and continue to weigh political developments and reactions to keep the speakers group prepared. There is also a need to organize one-time training sessions to improve the preparation of speakers. One training session would be for TABOR content, delivered by an experienced TABOR speaker. A second session would be to hone the speakers’ presentation skills, to be led by a professional trainer. Time would also have to be given to ensure consistent promotion is ongoing.

- Speakers Bureau – Outreach

There are more speakers ready to make more TABOR 101 presentations than we have venues to deliver the message. One person has been active in soliciting invitations, but needs assistance. The TABOR Foundation needs another person to call political clubs and civic clubs along the Front Range, and perhaps eventually to expand into other areas of the state. The objective would be to generate four invitations per month, which then would have to match the invitation with an available speaker and communicate the key logistical information and coordinate use of the PowerPoint equipment. The individual doing this work needs to be a self-starter with a commitment to keep after the goals, in what often proves to be a frustrating and drawn-out effort to identify program directors, ensure that duplicative calls are not going out in conflict with the other caller, and the need to recruit the best person to speak from our portfolio of volunteers.

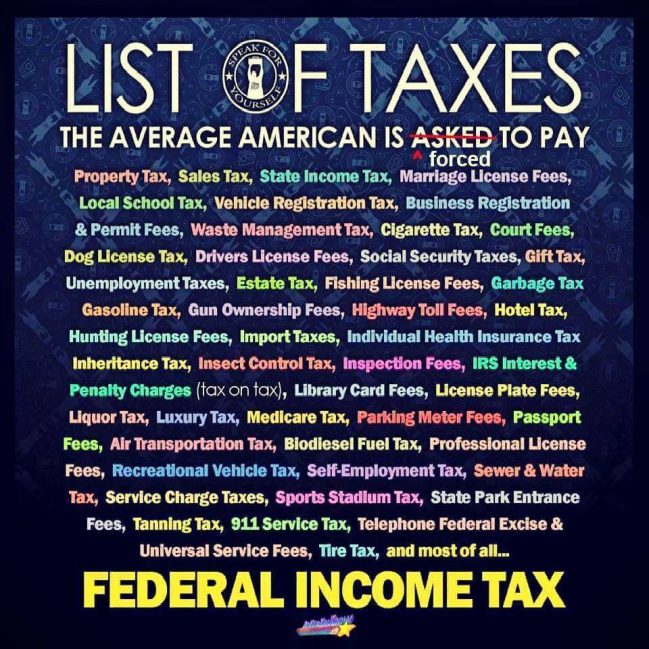

- Monitor Family Leave Bill

Rumor has the TABOR Committee expecting that a new 1% payroll tax will be called something else by the legislature, so no voter approval will be allowed. Learn how to track the introduction of new bills throughout the session (or exercise your knowledge if already familiar). Once introduced, notify the Committee and keep us apprised of the progress of the legislation – when people can testify, revisions to the fiscal note, and so on. Very likely there will be additional collaboration / coordination with other groups concerned about the bill. A wild guess is that tracking will take 15 minutes a day until the bill dies, is passed, or session ends in May. Additional communication may take one or two dozen hours. A related task would be to generate guest columns in several major newspapers, a task that could double the time you contribute.