Why TABOR Matters On September 26

If you’re in the Colorado Springs area, join Paul Prentice as he’s speaking on the Taxpayer Bill of Rights (TABOR) and Referendum CC

at Church For All Nations (CFAN)

6540 Templeton Gap Rd, Colorado Springs, CO 80923

Tuesday, October 8 from 7:00-9:00 pm

“In November 2018, the TABOR Foundation joined the Colorado Union of Taxpayers and others in filing a “friend-of-the-court” brief. The lawsuit was brought by the National Federation of Independent Business against the Colorado Secretary of State. The issue was about whether the fees charged by that government department are excessive and used to cover government activities that should be funded by general fund taxes.

Jim Manley, the attorney who represented the TABOR Foundation et al, commented on the substance and importance of our brief: “(On September 23) the Colorado Supreme Court issued a narrow ruling against NFIB in its TABOR challenge to the Secretary of State’s business licensing “fees.” The Court’s narrow ruling sidestepped the two issues we addressed in our amicus brief: (1) the proper standard of review for constitutional challenges and (2) the definition of fees vs. taxes. The Court ruled that the business licensing fees were authorized before TABOR’s enactment and—despite changes to the fees since TABOR—the fees were therefore not subject to TABOR’s prospective limits. The ruling reinstates the trial court’s summary judgment in favor of the Secretary of State and likely ends the case.”

The TABOR Foundation chairman observed, “This narrow ruling does little mischief to the Taxpayer’s Bill of Rights,” said Penn Pfiffner. He continued, “The Court could have, and should have, used the opportunity to honor the TABOR mandate to rule such that the outcome ‘reasonably restrain(s) most the growth of government’.”

To read the Summary Judgement opinion, click (HERE):

To read the Amicus from the Colorado Supreme Court website, please click (HERE):

NFIB filed a lawsuit five years ago arguing that fees levied by the secretary of state’s office violated the Taxpayer’s Bill of Rights. The ruling left them unsatisfied.

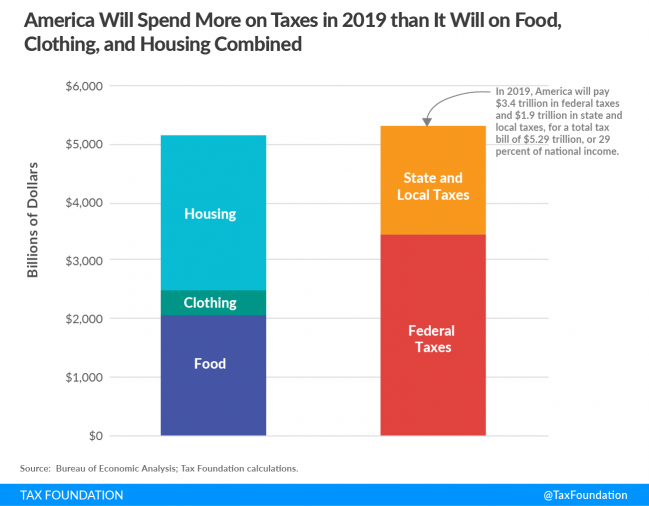

New economic forecasts show the state may refund as much as $1.7 billion to taxpayers in the next three fiscal years — but not all will benefit the same

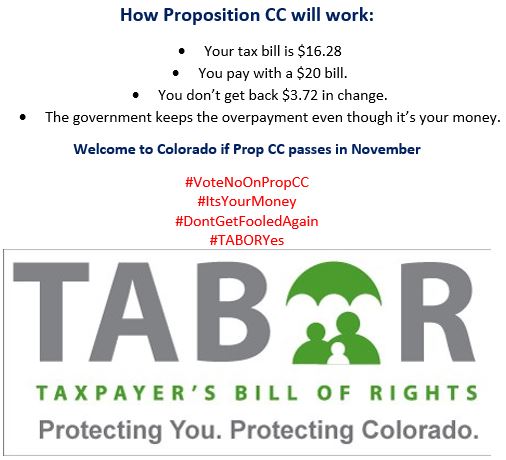

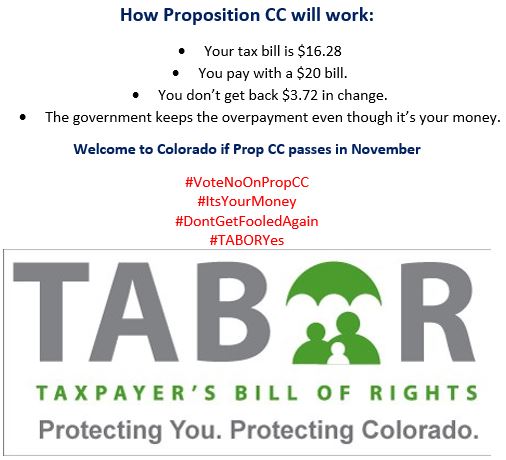

This November, Colorado voters will decide the fate of a deceptively worded measure — Proposition CC, a blank check for a tax increase drawn on our pocketbooks, with zero accountability, that would permanently cripple our Taxpayer’s Bill of Rights. It deserves an overwhelming “NO” vote.

For those who aren’t familiar with our Taxpayer’s Bill of Rights, also known as TABOR, it’s simple. TABOR promotes transparent, consensual and good, fair government. Ever since voters approved it in 1992, this constitutional amendment has been an indispensable voter check and balance on state government growth. TABOR provides reasonable limitations on revenue collection (population growth plus inflation) and general government debt.

If government wants to grow, all it has to do is ask voters. Coloradans are lucky to live in a state in which we get to decide on the size and scope of government.

First, there is no budget crisis.