Voting at a time when voting makes sense!

July 2020

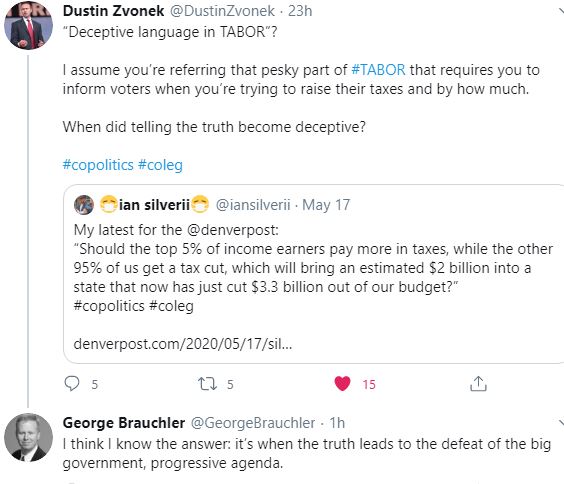

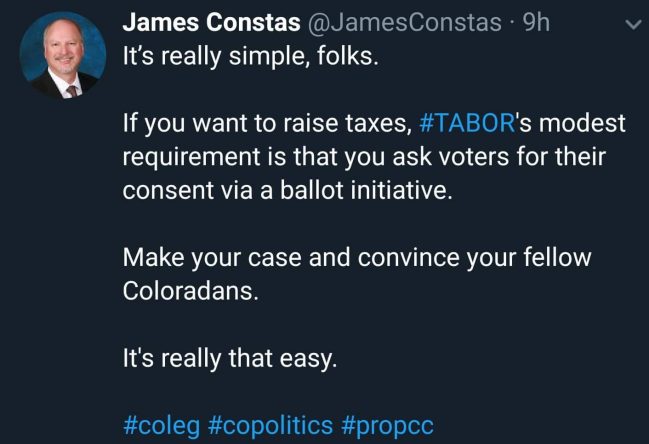

The Taxpayer’s Bill of Rights (TABOR) includes good government provisions that improve election procedures.

We know that voter turnout is highest for those people who will benefit most directly by the ballot measure. One way to suppress voter participation is to hold an election at an unusual time or at an unexpected, inconvenient, or difficult time.

Before the Taxpayer‘s Bill of Rights, Colorado elected officials could schedule a special election for a new tax or for a debt measure. Held in, say, February, the government could hope weather to be really foul, so that even the average taxpayer who thought to vote on the measure might think twice, while those proponents who would benefit from the new tax would be in the majority for whom it was worth the effort to slog to the polls.

The Taxpayer’s Bill of Rights ended that incivility to the citizen. With TABOR, a vote must happen on the November general election ballot, or if there is a standard election in the spring, (common for many town and city elections) the measure can appear on that municipal ballot. The only other time a TABOR measure may go before the voters is in odd-numbered years at about the time in November that a general election would take place.

Colorado constitution (Article X, Section 20) paragraph 3(a) states: “Ballot issues shall be decided in a state general election, biennial local district election, or on the first Tuesday in November of odd-numbered years.”

The Taxpayer’s Bill of Rights greatly improved government operations beyond providing the taxpayer the power to vote on tax increases.

#TABOR

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

#VoteOnTaxesAndFees

#WhyTABORMatters

By: Barry W Poulson

By: Barry W Poulson Blog post by Christine Burtt

Blog post by Christine Burtt