GUEST COLUMN: Thanks to TABOR, Colorado works for everyone

- Jesse Mallory

- Aug 27, 2023

Legislative Democrats have been scheming to kill Colorado’s Taxpayer’s Bill of Rights, or TABOR, since before it was added to the state Constitution in 1992. Hardly a year goes by without a bill, proposal, “listening tour,” or lawsuit hatched to enable state legislators to spend money TABOR denies them. Now, they’re at it again.

Legislative Democrats have been scheming to kill Colorado’s Taxpayer’s Bill of Rights, or TABOR, since before it was added to the state Constitution in 1992. Hardly a year goes by without a bill, proposal, “listening tour,” or lawsuit hatched to enable state legislators to spend money TABOR denies them. Now, they’re at it again.

This time, they’ve proposed a Rube-Goldberg ballot initiative called Proposition HH. Some of its superficial details might seem novel — like lipstick on the proverbial pig — but it’s only the latest gambit in a political long-con that has gotten very, very old.

That’s why the bill creating Prop HH was only passed in the last hours of the 2023 legislative session — to avoid public scrutiny and debate. That’s why Prop HH’s fans, including Gov. Jared Polis, are so cagey about what it would actually do, talking up property tax relief while pretending to know nothing about the redistribution of TABOR revenue to Democrat priorities.

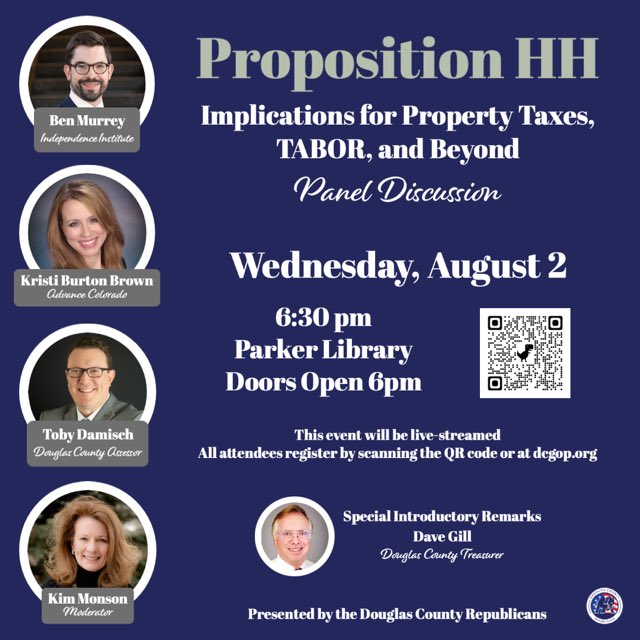

And it’s why Americans for Prosperity and Americans for Prosperity-Colorado Issue Committee have joined up with more than a dozen citizen groups in a new coalition to protect TABOR and fight Prop HH at the ballot box and in state court this year.

What politicians and their special-interest allies are not telling you about Prop HH is that it will eventually eliminate TABOR refunds.

Those are the same refunds they expedited last year to ensure they arrived before the last election — saying that citizens desperately needed the money.

To add insult to injury, Prop HH will also allow local governments to keep money owed to you without voter approval. Now politicians at the local level can now vote to keep your money. Prop HH removes you from this conversation.

For all the excuses, pretenses, and shiny objects politicians offer up to distract Colorado voters, there is only one reason they want to “update” or “tweak” or “modernize” TABOR: It works at holding them accountable. TABOR limits the annual growth of state government spending to population growth plus inflation. It’s a padlock on the state treasury that big-spending politicians have been trying to pick, break or dynamite for a generation.

Since TABOR was passed, and government spending capped, the state’s economy has consistently outperformed the nation as a whole. Between 1997 and 2022, for instance, Colorado’s real gross domestic product grew 109% while the country’s rose only 73%, increasing our share of national GDP by 18%.

Not surprisingly, TABOR is very popular — garnering 77% support in a 2022 survey. And perhaps even more to the point, since TABOR passed, so many Americans have relocated to Colorado that we’ve gained two seats in the U.S. House of Representatives over the last three censuses.

At a certain point, one has to ask whether Colorado has succeeded so spectacularly over the last three decades in spite of our politicians’ limited control over taxpayers’ money — or because of it.

After all, the big-government states that Democrats want to emulate — New York, California, Illinois — are the ones that new Coloradans escaped here from!

Under TABOR, when the state raises more money in taxes than it is permitted to spend, the money is returned to taxpayers — period, end of story. Under our state Constitution, that money is Coloradans’ right, not doled out at the discretion of politicians or the influence of special interests.

Prop. HH’s sole purpose is to gut that right and seize the cash — not for Colorado, but from it.

Gov. Polis and legislative Democrats are certainly right that the government should take measures to lower the high cost of living in the state. But they’re the ones driving it up! If property taxes are too high, they can cut the rates. If education and health-care programs need reforming, other states — including two of our “Four Corners” neighbors — have shown that market-oriented consumer choice and less government control lower costs and improve quality.

Contrary to the elite narrative, TABOR is not an obstacle to opportunity and prosperity in Colorado; it is a wellspring of both. AFP-Colorado and the new TABOR coalition are going to make that case until politicians remember that they work for us, not the other way around.

Jesse Mallory is state director for Americans for Prosperity-Colorado.

https://denvergazette.com/opinion/columns/guest-column-thanks-to-tabor-colorado-works-for-everyone/article_9a246a41-21fc-5cd0-b99a-16fa793c79a8.html

Legislative Democrats have been scheming to kill Colorado’s Taxpayer’s Bill of Rights, or TABOR, since before it was added to the state Constitution in 1992. Hardly a year goes by without a bill, proposal, “listening tour,” or lawsuit hatched to enable state legislators to spend money TABOR denies them. Now, they’re at it again.

Legislative Democrats have been scheming to kill Colorado’s Taxpayer’s Bill of Rights, or TABOR, since before it was added to the state Constitution in 1992. Hardly a year goes by without a bill, proposal, “listening tour,” or lawsuit hatched to enable state legislators to spend money TABOR denies them. Now, they’re at it again. In October 2023, Colorado voters are going to get a ballot information guide, nicknamed the Blue Book (it literally has a blue cover page) in the mail prior to the arrival of their actual ballots.

In October 2023, Colorado voters are going to get a ballot information guide, nicknamed the Blue Book (it literally has a blue cover page) in the mail prior to the arrival of their actual ballots.