#TABOR

#VoteOnTaxesANDFees

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

AFP Colorado@AFPColorado

AFP Colorado@AFPColorado

#TABOR

#VoteOnTaxesANDFees

#ItsYourMoneyNotTheirs

#ThankGodForTABOR

AFP Colorado@AFPColorado

AFP Colorado@AFPColorado

In December of 2019 the county commissioners in Morgan, Logan, Sedgwick and Washington counties certified the Lower South Platte Water Conservancy District at 1.000 mills, double the amount allocated them on a yearly basis since early in the district’s formation.

Since then a group of property owners have been seeking recourse for the decision, claiming that the increase in mill levy was a violation of the Taxpayer Bill of Rights, which necessitates voter approval of both tax increases and the retention of excess funds if revenues grow faster than the rate of inflation and population growth. On May 19 William Banta, an attorney and legal council for the TABOR committee, sent a letter to the district.

“It has come to our attention that, in spite of TABOR, the Board of Directors of the Lower South Platte Water Conservancy District increased the District’s mill levy for 2020 without having voter approval,” the letter said. “Although we understood that the district received permission from the voters in 1996 to keep and use excess revenues there was no approval to increase a mill levy.”

The 1996 ballot measure is central to the district’s legal argument. The voters approved the ballot measure giving the district the right to retain and spend an additional $13,025 and access “the full proceeds and revenues received from every source whatever, without limitation, in 1996 and all subsequent years.”

To continue reading this story, please click (HERE):

At a moment when state and local governments are already drowning in red ink, Colorado’s constitution is now projected to trigger the second-largest residential property tax cut in modern history.

Under forecasts presented Tuesday, Colorado lawmakers could be asked to cut residential property taxes by nearly 18% in 2021 to comply with a tax-limiting constitutional provision known as the Gallagher Amendment.

For homeowners, it would mean permanent financial relief at a time of rising unemployment and deep economic uncertainty. But if the cut goes through as projected, it would have cascading effects at nearly every level of government in the state, gashing the budgets of property-tax reliant fire districts, county governments and schools.

The reductions would cut total school district revenue by an estimated $491 million. About half of that gap will impact the state budget, which is constitutionally required to backfill certain school funding shortfalls, even as it faces a fiscal catastrophe of its own as sales and income tax revenue plummet. In one fell swoop, it could wipe out all the recent gains the state had made in erasing its unfunded debt to schools, formerly known as the negative factor. At the county level, statewide revenue could drop by $204 million.

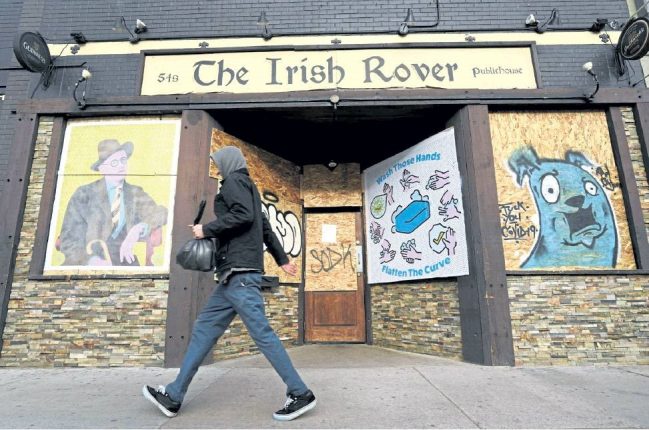

Shelby Meyer passes by The Irish Rover, one of many restaurants and bars now shuttered along South Broadway in Denver on April 14. The coronavirus has caused many businesses to shut their doors during the coronavirus pandemic. Helen H. Richardson, The Denver Post

By Peg Brady

Guest Commentary

Peg Brady is a retired software analyst and designer. She has served on the TABOR Foundation Board of Directors for more than a decade.

The Denver Broncos and Food Bank of the Rockies hosted a mobile pantry at Empower Field at Mile High on April 27 to help people in need during the pandemic. RJ Sangosti, The Denver Post

The Taxpayer’s Bill of Rights (TABOR) has provided welcome stability to Coloradans as we all deal with the coronavirus pandemic. This provision of our state constitution allows all governments throughout Colorado an automatic but reasonable annual budget increase. The limits keep governments from growing too fast.

Therefore, when the economy gets into trouble, Colorado state and local governments have a more firm base for their spending and do not need to cut as drastically as other states. Government programs are more sound, strong and sustainable than if they had grown as fast as ambitious politicians often wanted. TABOR helps us to confront the current crisis.

Moreover, just when families and businesses are struggling, the Taxpayer’s Bill of Rights has led to timely tax relief. The state tax system has evolved so that, when times are good, it over-collects tax revenue. Last year, Colorado over-collected $428 million. TABOR mandates that the state rebates to you excess revenue collected during a fiscal year. So, the 2019 tax rate has been reduced from the usual 4.63% to 4.5% — a 0.13% drop.

You won’t receive a tax refund check; instead, the legislature reduced the income tax rate. Because the rebate is being accomplished through the lower tax rate, you may not recognize how much money you saved. Still, because the state will not incur the cost of issuing and mailing checks, we save that expense as well.

To continue reading this TABOR article, please click (HERE):

The impact of the coronavirus pandemic on the $30 billion-plus state budget begins to take shape this week as lawmakers consider massive spending cuts.

How much tax revenue Colorado will lose to the paralyzed economy remains uncertain, but the governor’s budget office is projecting $3 billion in lost revenue for the current fiscal year and the next.

The General Assembly’s budget writers on Monday will start reviewing recommendations from legislative analysts for potential spending cuts across all government agencies. The documents are expected to include scenarios for slashing budgets as much as 20% and force legislators to make hard choices that will impact most Colorado families, according to drafts reviewed by The Colorado Sun.

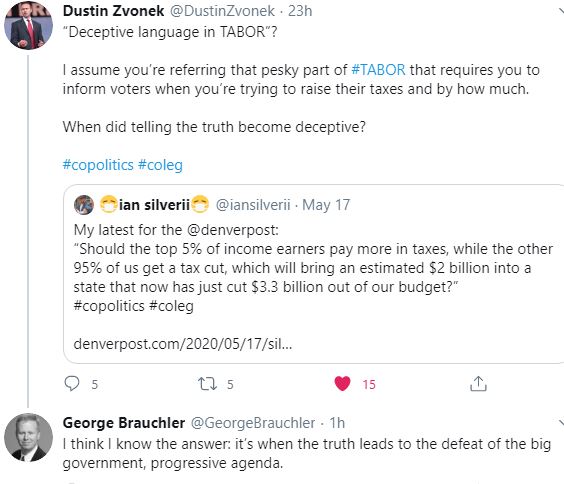

“Truth and reason in ballot language!”

April, 2020

The Taxpayer’s Bill of Rights includes good government provisions that improve election procedures.

There was a time when Colorado elected officials could push for passage of a bond, or for new taxes, but bury the cost very deep into the explanation on the ballot, in hopes that many voters might not notice the magnitude of the tax.

The ballot language would promise all kinds of wonderful outcomes. Not only would the new revenues for the government solve the problem in perpetuity, but it would bring world peace and even make the voter more handsome! Then, near the end in the midst of a lot of other promises, would come the information that the cost to the taxpayer would be very, very high.

The Taxpayer’s Bill of Rights stopped that sort of game playing. Now, the government must put the cost right up front. It has no option but to state how much the new tax will weigh annually on the taxpayer. For a new bond, the ballot measure must state at the very beginning how much the total new debt will be and what that means for the total repayment cost. Only then may the government (“district”) present its reasons for the new taxes.

Another game that the Taxpayer’s Bill of Rights anticipated and which it explicitly prohibits is a government underestimating a revenue number. If the new taxes exceed the estimate, the entirety of the overage must be refunded the next year and the rate adjusted downward.

Colorado constitution (Article X, Section 20), paragraph 3(c) states: “Ballot titles shall begin, ‘SHALL (DISTRICT) TAXES BE INCREASED ____ ANNUALLY?’ (or) ‘SHALL (DISTRICT) DEBT BE INCREASED (principal amount) WITH A REPAYMENT COST OF (maximum..)’.” Earlier in the same paragraph is the requirement that “if a tax increase exceeds any estimate… for the same fiscal year, the tax increase is thereafter reduced up to 100% in proportion to the …excess, and the combined excess revenue refunded….”

The paragraph was carefully crafted as a good government improvement, with TABOR protecting the taxpayer in ways beyond just voting on tax rates.

Denver, CO – New taxes may be on their way to the ballot. Colorado Initiative Title Setting Review Board approved language for 12 new taxes. The next step will be collecting the two hundred thousand or more signature to have these ballot initiatives appear on your November 2020 ballot.

After the sound defeat of Proposition CC in 2019, the tax and spend crowd would go away for a while. The simple answer is no. As long as liberal billionaires fund “think tanks” like the Colorado Fiscal Policy Institute and the Bell Center For Policy, they will always be pushing for tax increases and the repeal of the Taxpayer’s Bill of Rights (TABOR).

From Colorado Politics:

The board also approved 12 initiatives from Carol Hedges and Steve Briggs of Denver that would create a graduated income tax system, raising approximately $2 billion to $2.4 billion. The money would go toward education and addressing “the impacts of a growing population and a changing economy.”

Voters have turned down tax increases and eliminating spending caps every election they have been on the state-wide ballot. The last successful attempt was Referendum C in 2005 after too many Republicans campaigned hard for it. In a related note, those Republicans political careers ended that day.

Guest blog from Dennis Simpson, retired CPA and TABOR activist. Simpson lives in Mesa County.

There are not many local Colorado governments left that have not relaxed TABOR restrictions. One of the remaining few is Mesa County. Recent action by County Commissioners increased the possibility that anti-TABOR folks (including our local newspaper) soon will mount an effort to remove protections that TABOR provides you.

In this case, TABOR limits the ability of a government to retain excess revenue in two distinct ways. It limits the amount of property taxes collected and additionally limits the overall revenue collected in any year.

In 2018, Mesa County’s collection of property taxes was not an issue. However, the County had a banner year in the collection of sales taxes which resulted in excess revenue exceeding $5 million.

The concept of refunding anything other than excesses caused by property taxes has not happened for many years, presenting a new challenge to staff and Commissioners. The Commissioners ignored helpful suggestions for alternatives and dismissed the issue too rapidly. They decided to take the option that required the least amount of thought. They are giving the $5 million to property taxpayers proportionate to how much property tax each paid. Our largest property taxpayers are oil companies and box stores with main offices far away. Over $2 million of the sales tax refund will be removed from the local economy. Those who do not own property will get zero and those who own lower value homes will get a pittance.

A guest column on this issue, “Commissioners’ handling of refunds at odds with TABOR’s long-term survival,” provides additional discussion.