Expected TABOR Refunds for Colorado taxpayers

It seems like just yesterday to us that Colorado voters adopted the Taxpayer’s Bill of Rights on the statewide ballot and ensconced it into the state’s constitution. Yet, the groundbreaking policy has been in effect for nearly three decades.

In that time, it has kept state and local government on a diet — and has saved taxpayers untold millions of dollars. And they still love it after all these years, as most credible polls show.

Perhaps more noteworthy: Even some political leaders on the center-left seem to have made their peace with the policy. Our reputedly liberal Democratic governor from Boulder went so far as to laud it just the other day. That’s quite a stride.

Yet, TABOR’s basic premise has always made perfect sense to the general public. It requires voter approval for any tax hike at any level of government in the state. And it set limits on the rate at which government budgets can grow. Any increase in tax revenue that exceeds the rates of growth plus inflation in a given year have to be returned to taxpayers. Elected leaders can keep the overage if they first ask voters’ permission.

Click (HERE) to continue reading this story about TABOR:

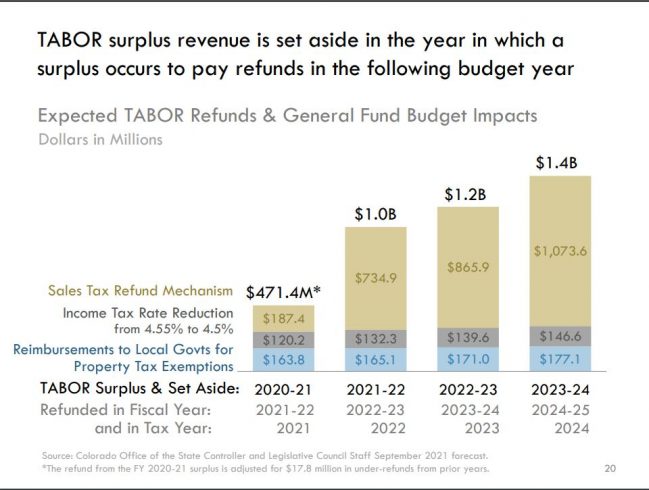

According to the state controller, the cap was exceeded in the 2020-21 fiscal year, which ended in June, by about $454 million

12:14 PM MDT on Sep 2, 2021

The Colorado State Capitol is seen on Thursday, August 19, 2021, in Denver. (Olivia Sun, The Colorado Sun)

Colorado taxpayers will get a break on their income taxes and a refund payment because the state’s cap on government growth and spending under the Taxpayer’s Bill of Rights was exceeded last fiscal year.

The income tax rate will drop to 4.5% in 2021, down from 4.55%, and individual taxpayers will get an additional sales tax refund payment, on average, of about $70. Joint filers will receive $166 on average.

“These tax cuts and refunds are a strong sign that Colorado’s economy is roaring back,” Gov. Jared Polis said in a written statement. “I’m excited that Coloradans will get another income tax cut and refund that Coloradans can put toward bouncing back from the pandemic, a night out, or groceries.” Continue reading

One great, though lesser-known benefit provided in the Colorado Taxpayer’s Bill of Rights (TABOR) is the local ballot issue notice. This guide is sent by mail at least 30-days before the election to all households with one or more registered voters.

The TABOR ballot issue notice includes content and details about upcoming local ballot measures which increase taxes, add debt, or suspend government revenue limits. It includes a section where registered electors have the opportunity to submit FOR or AGAINST comments, up to 500 words each.

You should know that there are two types of TABOR ballot issue notices. One notice is for the statewide elections and commonly referred to as the “Blue Book.” The notice discussed here is for elections held by local governments such as a city, town, school district, or special taxing district. You could potentially get more than one of these notices in the mail.

Several years back, it was discovered that out that of some 300 local tax issues throughout the state during a ballot year, only 15 had the taxpayer’s voice printed in a ballot issue notice. That’s only 5 percent! You can make a big difference and amplify your voice by being an author of the next ballot issue notice where you live. Considering that you reach thousands of voters, being able to submit comments in the TABOR notice costs almost nothing and takes relatively little time & energy.

Click (HERE) to continue reading the rest of this story:

In November, the Town of Castle Rock will ask taxpayers to pause TABOR for 10 years. TABOR, known as the Taxpayer’s Bill of Rights, was approved in the 1990s, changing the state’s constitution to require all tax increases be approved by voters, limiting how much local and state government can spend.

Castle Rock Town Manager David Corliss said he has no problem with the part of TABOR that requires residents to approve tax increases. However, the restrictions and limits TABOR can put on a municipality to keep up with the cost of growth is a problem, he said.

TABOR is a state tax and expenditure limit that includes the following elements: It is a Colorado constitutional amendment; it restricts revenue or expenditure growth to the sum of inflation plus population change; and it requires voter approval to override the revenue or spending limits.

Colorado is the only state in the nation with TABOR.

Castle Rock Town Attorney Michael Hyman is no stranger to how TABOR has created controversy and issues for state and local municipalities trying to balance a budget. In the 1990s when TABOR was passed by voters, Hyman worked for the City of Aurora.

Click (HERE) to continue reading the rest of this story

Helen Robinson

El Paso County residents are invited to attend and participate in two meetings during the month of August in which the Board of El Paso County Commissioners will discuss a possible November ballot question to fund road infrastructure projects and deferred parks maintenance. The meetings will be held during the board’s regularly scheduled Tuesday meetings on Aug. 17 and 24.

Commissioners will refund $7.1 million in excess 2020 revenues to taxpayers regardless of how the question under review moves forward, according to a county-issued news release.

“The 2020 refund is important to ensure full community recovery from COVID-19,” the release said. “Without raising taxes, the proposed ballot question would enable the county to address around $15 million of backlogged road and parks projects by allowing the county to retain funds collected in 2021 above the Taxpayer Bill of Rights (TABOR) cap. The proposal would restrict the $15 million of the revenue for specific road infrastructure and parks projects, reset the cap to reflect 2021 revenue.”

“We want to hear from our citizens as we weigh the possibility of adding a TABOR question to the November ballot,” Stan VanderWerf, chairman of the board of county commissioners, said in the release. “Our Department of Public Works estimates we have hundreds of millions of dollars in deferred maintenance road needs in our county. This is one option to address the problem, but our citizens are smart and informed. We need to hear from them to see what ideas they have.”

Click (HERE) to continue reading this story:

Submitting FOR or AGAINST statements in your local TABOR ballot issue notice

One great though lesser-known benefit provided in the Colorado Taxpayer’s Bill of Rights (TABOR) is the local ballot issue notice. This guide is sent by mail at least 30-days before the election to all households with one or more registered voters.

The TABOR ballot issue notice includes content and details about upcoming ballot issues which increase taxes, add debt, or suspend government revenue limits. It includes a section where registered electors have the opportunity to submit FOR or AGAINST comments, up to 500 words each.

You should know that there are two types of TABOR ballot issue notices. One notice is for the statewide elections and commonly referred to as the “Blue Book.” The other notice is for elections held by local governments such as a town, school district, or special district. You could potentially get more than one of these in the mail.

Several years back, Dennis Polhill challenged the Colorado Union of Taxpayers by pointing out that of some 300 tax issues statewide during a ballot year, only 15 had the taxpayer’s voice printed in a ballot issue notice. That’s only 5 percent! You can make a big difference and amplify your voice by being an author of the next ballot issue notice submittal. May we count on you please to participate? Considering that you reach thousands of voters, being able to submit comments in the TABOR notice costs almost nothing and takes relatively little time & energy.

Jesse Paul and Thy Vo

11:12 AM MDT on Jun 18, 2021

The Colorado Capitol is seen on Monday, June 7, 2021, during the final days of the 2021 legislative session. (Olivia Sun, The Colorado Sun)

Colorado taxpayers will be refunded as much as $2.8 billion in tax revenue collected over the three fiscal years because the state’s economic recovery from the coronavirus crisis has been so swift and strong and because of growth limits under the Taxpayer’s Bill of Rights.

That’s according to two tax-revenue forecasts — one from nonpartisan legislative staffers and another from Gov. Jared Polis’ office — presented to the legislature’s Joint Budget Committee on Friday.

The state’s TABOR cap is calculated through population growth and inflation. When the cap is exceeded, the legislature is required to refund the excess, most often through a future tax break, such as an income tax reduction. Lawmakers can seek voter approval to retain the revenue as well, but that appears unlikely to happen in the near future.

Nonpartisan fiscal analysts and the governor’s office forecast that the cap will be exceeded in the current fiscal year, the 2021-22 fiscal year, which begins in July, and the 2022-23 fiscal year, which begins in July 2022.

“The past quarter’s growth has been truly remarkable and unexpected,” Lauren Larson, director of the Governor’s Office of State Budgeting and Planning, told the JBC.

To continue reading this story, please click (HERE):

North Carolina legislators recently filed a bill that would enable voters to decide if a Taxpayer Bill of Rights should be added to the state constitution.

The main feature of a Taxpayer Bill of Rights is that it would limit the annual growth rate of the state budget to a rate tied to inflation plus population growth. Other provisions would require voter approval of tax increases and mandate that excess revenue collections be used to bolster the state’s Rainy Day fund and refunded back to taxpayers.

The benefits of a Taxpayer Bill of Rights are many, most notable in that it would make permanent the fiscal restraint that conservative lawmakers have exercised over the last decade. Common-sense restraints on spending can smooth out spending cycles, better prepare the state for economic downturns, and enable tax cuts to make North Carolina more competitive for investment and job growth.

To continue reading this story, please click (HERE):