Last year, Colorado Democrats championed TABOR refunds as they campaigned for reelection. Yet not a week into the 2023 legislative session, they announced plans to try and halt those refunds indefinitely.

Last year, Colorado Democrats championed TABOR refunds as they campaigned for reelection. Yet not a week into the 2023 legislative session, they announced plans to try and halt those refunds indefinitely.

A forthcoming bill by Rep. Cathy Kipp (D) and Sen. Rachel Zenzinger (D), if passed by the legislature and approved by voters, would allow the state to retain future tax refund dollars mandated under the Taxpayer’s Bill of Rights (TABOR) in Colorado’s Constitution. Kipp says the money would go to fund public schools.

Proponents of this idea have failed in the past to gather the 120,000 signatures required to put the question on the November ballot. The legislature can circumvent this requirement by passing the measure as a bill first.

Every time voters speak on key issues related to TABOR, they send the same unambiguous message: “Leave TABOR alone and let us keep our money!”

Democratic legislators either didn’t get the message, or they just don’t care what voters think.

In 2019 after voters gave Democrats unified control over state government, legislators thanked them by sending Proposition CC–which would have permanently ended TABOR refunds–to the November ballot, where Coloradans soundly rejected it.

Coloradans spoke loud and clear: “Leave TABOR alone and let us keep our money!”

In 2020, voters had the choice between two competing citizen-led ballot initiatives. One would have raised taxes and repealed TABOR’s requirement that Colorado maintains the same income tax rate for all taxpayers. The other, put on the ballot by my organization, Independence Institute, reduced the state’s income tax rate from 4.63 to 4.55 percent. The latter passed with a wide margin. The former failed even to gather enough signatures to appear on the ballot.

Once again, Coloradans spoke loud and clear: “Leave TABOR alone and let us keep our money!”

Fast forward to 2022. If the people of Colorado had not made their will clear enough already, last year left no ambiguity.

To continue reading this story, please click (HERE):

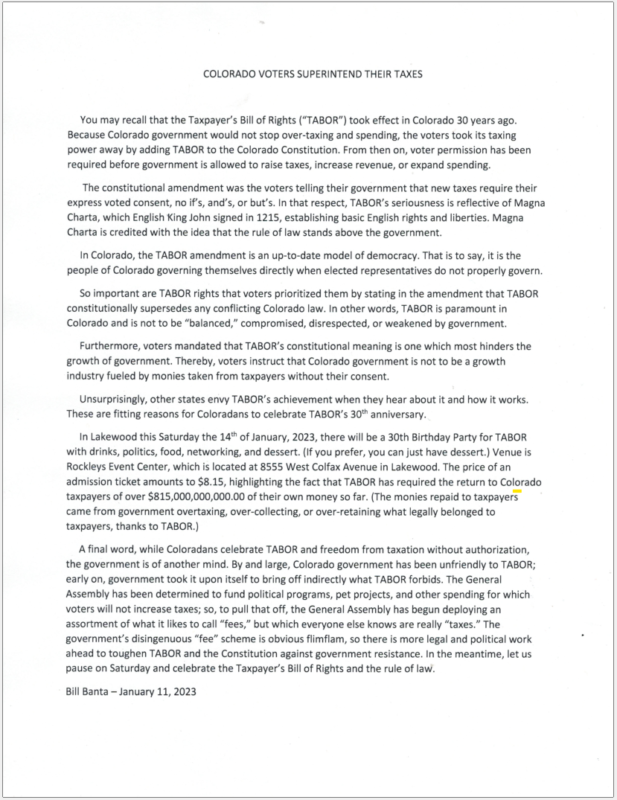

This month marks the 30th anniversary of Colorado’s Taxpayer’s Bill of Rights (TABOR), which was approved by voters in November of 1992 as a constitutional tax and expenditure limit (TEL). TABOR is considered the gold standard of state fiscal rules because it limits the growth of most of Colorado’s spending and revenue to inflation plus population. If the state government collects more tax dollars than TABOR allows, the money is returned to taxpayers as a TABOR refund. The receipt of tax rebates, totaling $8.2 billion since TABOR passed in 1992, has strengthened Colorado citizens’ confidence in the TABOR Amendment over the years. To learn more about TABOR and effective TELs, read our latest report and visit FiscalRules.org.

In celebration of thirty years of the Colorado Taxpayer’s Bill of Rights (TABOR), ALEC today launched its Fiscal Rules campaign, featuring the interactive Fiscal Rules microsite, new Fiscal Rules animated video, and new report, “TABOR Turns 30: Thirty Years of Colorado’s Taxpayer’s Bill of Rights.”

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#ThankGodForTABOR

#FollowTheMoney

#FollowTheLaw

Paul Brady Photography | Shutterstock

(The Center Square) – Colorado’s Taxpayer’s Bill of Rights is the “gold standard” for state tax policy, a new report argues.

The report, by the American Legislative Exchange Council, a free-market group that’s known for drafting model legislation adopted in Republican-led states, comes amid the 30th anniversary of TABOR, the constitutional amendment that Colorado voters passed in 1992.

TABOR requires voter approval for tax increases and limits state revenue growth to inflation plus the rate of population growth. It also requires revenue surpluses to be refunded back to taxpayers.

“TABOR is a resounding success for Colorado, despite ongoing attempts to eliminate it,” said Dr. Barry Poulson, author of the report and a professor emeritus at the University of Colorado Boulder. “TABOR uses a straightforward formula for limiting the size and scope of government by capping the rate of growth in state revenue and spending to inflation plus the rate of population growth.”

TABOR contrasts with California’s Gann Amendment, which the report says was “watered down” by special interests. Continue reading