Category Archives: Legal Issues

EDITORIAL: Rebate grabbers at Colorado Capitol try a new scheme

EDITORIAL: Rebate grabbers at Colorado Capitol try a new scheme

Prop CC, referred to the ballot by the 2019 Legislature, would gut the Taxpayer’s Bill of Rights. Surveys show TABOR, passed by voters in 1992, is more popular than ever.

Taxpayers like TABOR because voters do not trust politicians on either side of the aisle. They are tired of legislators passing laws that counter their will, such as jobs-killing regulations of oil and gas that voters rejected on the ballot. They are tired of state officials acting broke while the economy generates mountains of surplus cash.

Colorado Governor Jared Polis Is Working On A New Plan To Block Tax Relief

Colorado Governor Jared Polis Is Working On A New Plan To Block Tax Relief

DENVER, CO – MAY 3: Governor Jared Polis speaks during a press conference to tout the accomplishments of the Colorado General Assembly on last day of the regular assembly, May 3, 2019, in Denver, Colorado. (Photo by Joe Amon/MediaNews Group/The

DENVER POST VIA GETTY IMAGES

Colorado Governor Jared Polis (D) welcomed conservative economist Art Laffer to the state capitol in Denver today to help gin up Republican support for a potential deal intended to avert taxpayer refunds projected to be sent to Colorado taxpayers in the coming year, with Polis’ ultimate goal being the wounding of the nation’s strongest taxpayer protection measure so that it remains in effect in name only, not in practice.

Colorado’s Taxpayer Bill of Rights (TABOR), approved by voters in 1992 as an amendment to the state constitution, is the sturdiest taxpayer safeguard in the nation. Under TABOR, state revenue cannot grow faster than the combined rate of population growth and inflation.

Any state revenue collected in excess of the TABOR cap must be refunded to taxpayers. Thanks to healthy state revenue collections coming in above the cap allowed by Colorado’s Taxpayer Bill of Rights, current projections show the state will have to refund roughly $500 million to Colorado taxpayers next year. That won’t happen if Proposition CC, a measure ending TABOR refunds, is rejected by Colorado voters this November.

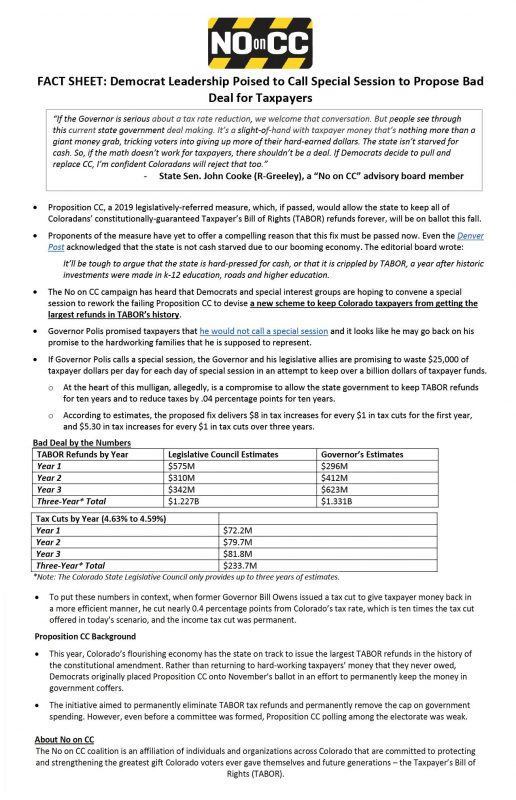

Democrat Leadership Poised to Call Special Session to Propose Bad Deal for Taxpayers

FACT SHEET: Democrat Leadership Poised to Call Special Session to Propose Bad Deal for Taxpayers #NoOnPropCC #copolitics #coleg

Network of Colorado groups ramp up effort to diminish Taxpayer Bill of Rights

Don’t mess with TABOR.

TABOR protects you from Tax & Spend politicians.

Vote NO on Proposition CC in November and NO on repealing TABOR in November 2020.

Don’t lose your rights!

Network of Colorado groups ramp up effort to diminish Taxpayer Bill of Rights

The network is called Vision 2020, and so far it includes the Bell Policy Center and Colorado Fiscal Institute, and Great Education Colorado, among others.

The network recently praised a Colorado Supreme Court ruling that said a proposed measure to repeal TABOR outright doesn’t violate the state constitution’s single-subject requirement. The ruling means TABOR, passed by voters in 1992, could be repealed with one vote.

Proponents of repeal would still need to collect signatures to get the question on the ballot for 2020.

TABOR Override in Trouble

Friday, June 28, 2019

TABOR Override in Trouble

Caldara: Cowboy up and repeal of Taxpayer’s Bill of Rights

Caldara: Cowboy up and repeal of Taxpayer’s Bill of Rights

In this file photo, volunteers pile up signs for backers of the 2005 ballot measures that aimed to lift some TABOR restrictions. Referendum C passed which allowed the state to retain expected refunds for five years and reset the TABOR base.

By JON CALDARA | Columnist for The Denver Post

PUBLISHED: June 28, 2019 at 2:14 pm

Come on you taxpayer-hating, consent-loathing, voter-fearing pantywaists.

Cowboy up and put a full repeal of our Taxpayer’s Bill of Rights on the ballot. You know you want to. So just do it.

I’m talking to you in the Colorado Legislature who’ve been calling tax increases “fees” because you don’t trust the people who elected you to vote on their own taxes. You who want another “TABOR time out” to nibble away consent and jack up spending limits permanently.

You’ve always hated TABOR because you hate asking for permission to raise taxes. You hate asking to raise debt. You hate asking to keep excess tax revenue above the rate of population growth and inflation.

You’ve used every conceivable loophole the courts have pried open for you to keep what would have been refunded to working families.

And now you never want to have to ask again.

Don’t Lose Your Rights!

TABOR tussle: Colorado Supreme Court hears case on whether fees are taxes

TABOR tussle: Colorado Supreme Court hears case on whether fees are taxes

Jun 25, 2019

The Ralph L. Carr Colorado Judicial Center in downtown Denver is the home of the Colorado Supreme Court, the state Court of Appeals and the office of the state attorney general.

(istock/getty images)

The National Federation of Independent Business said its state Supreme Court case has exposed licensing fees for what they are: Taxes.

And as taxes, they should be covered by the state constitutional Taxpayer’s Bill of Rights, meaning the government can’t raise them without a vote of the people.

How much Colorado taxpayers will get in TABOR refunds depends on these two wildcards

How much Colorado taxpayers will get in TABOR refunds depends on these

How much Colorado taxpayers will get in TABOR refunds depends on these two wildcards

A ballot measure in November will ask voters a key question, and now lawmakers are talking about a special legislative session, too