Why #TABOR Matters On September 2

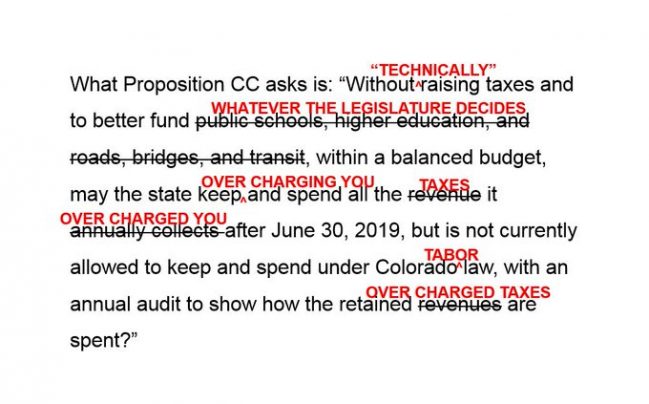

They lied to us in 2005, and they are doubling down on this lie in 2019. Colorado voters were sold a bill of goods with Referendum C in 2005, and it is of the utmost importance that we aren’t fooled again with Proposition CC in 2019.

Proponents of Referendum C originally claimed that their measure was “temporary.” The measure was supposed to offer a five-year reprieve from the constitutional limitations created by the Taxpayer’s Bill of Rights (TABOR), allowing some fiscal flexibility for Colorado lawmakers to invest heavily in education and transportation.

Or so they claimed.

The Taxpayer’s Bill of Rights is under attack. For at least a decade, Democrats in the Colorado legislature — backed by the Colorado Supreme Court in erroneous rulings and occasionally supported by faithless Republicans — have thwarted some of the protections afforded to Coloradans by the Taxpayer’s Bill of Rights.

Typically, these successful assaults against TABOR have come from taxes disguised as “fees.” In fact, this past legislative session Democrats even proposed financing a paid family leave program with a payroll tax (like the Social Security tax) that they would again have labeled a “fee.” (This legislation is likely to return next session.)

But this year’s attack — Proposition CC, put on the ballot by the Democrat-controlled General Assembly and backed by Gov. Jared Polis (D) — is particularly troublesome. Recall that the Taxpayer’s Bill of Rights was passed in 1992 and provides two essential protections for Coloradans. First, the amendment requires a vote of the people to raise taxes (unless legislators call it a “fee,” as discussed).

Ex-Basalt mayor touts new ‘social capital’ group

Tim Belinski, developer of Willits Town Center, supports Rick Stevens’ idea of starting a social capital group in Basalt.

Madeleine Osberger/Aspen Daily News

A potentially positive proposal to salve some of the wounds caused by the contentious and increasingly expensive TABOR controversy in Basalt may end up butting heads with the same town government that had been inadvertently collecting property tax revenues for 10 years in violation of the state’s constitution.

All told, town officials estimate that about $2 million had been collected illegally, according to the fine print of TABOR — the so-called Taxpayer Bill of Rights — which was added to the state constitution by citizens’ referendum in 1992.

TABOR restricts revenues for all levels of government — state, local, special districts and schools. Under TABOR, state and local governments cannot raise tax rates without voter approval.

Two years after TABOR was enacted, Basalt voters approved a property tax rate of 6.151 mills. Soon thereafter, given the increase of real estate values in town, that rate was lowered, finally bottoming out at 2.56 mills in 2010. As real estate values struggled to recover from the Great Recession, Basalt was forced to gradually raise the mill levy to meet its basic operating costs.

Colorado has awarded $7.6 million in Enterprise Zone tax credits to Comanche Solar PV in Pueblo County. The 156-megawatt Comanche solar array, shown here on Jan 20, 2019, is the largest solar project in the state of Colorado. (Mike Sweeney, Special to The Colorado Sun)

Colorado has awarded $7.6 million in Enterprise Zone tax credits to Comanche Solar PV in Pueblo County. The 156-megawatt Comanche solar array, shown here on Jan 20, 2019, is the largest solar project in the state of Colorado. (Mike Sweeney, Special to The Colorado Sun)

A Colorado Sun analysis of $223 million in tax credits awarded from 2013 to 2018 found that the state is often doling out taxpayer dollars without much evidence that each tax credit is producing economic activity that wouldn’t have occurred otherwise