Some people bemoan the lack of trust in government officials. Those people should read more. They could start by learning how many of Colorado’s officials ruthlessly manipulate ballot language to mislead voters and skew election results.

Jefferson County’s Ballot Issue 1A—up for a vote next month—is a case in point.

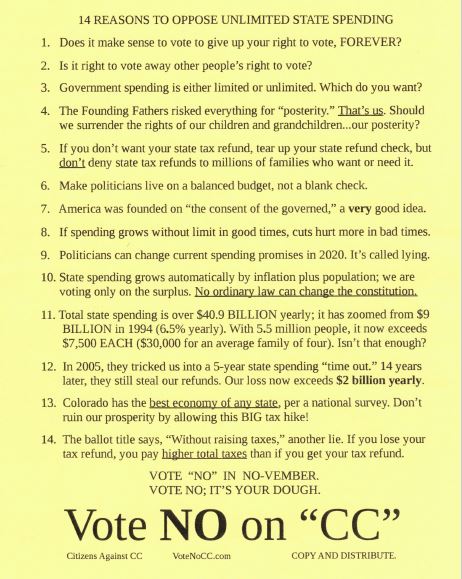

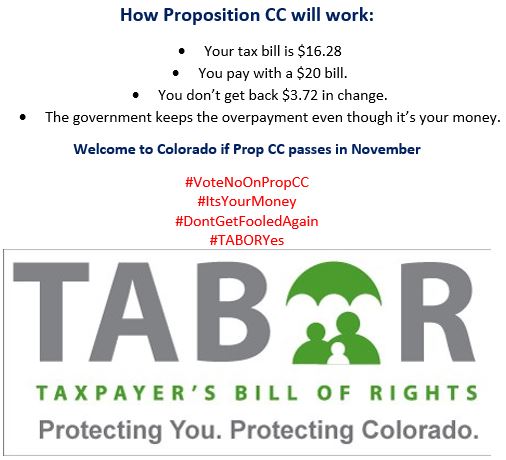

Issue 1A is a referendum under the Colorado Taxpayer’s Bill of Rights (TABOR). TABOR requires officials to ask voter permission, via referendum, for several kinds of fiscal decisions. The most important are (1) raising taxes, (2) creating debt, and (3) waiving caps on government spending (which TABOR sometimes confusingly calls “revenue”).

Knowing that government officials sometimes try to manipulate elections, the TABOR drafters inserted rules governing how tax and debt issues appear on the ballot. But they omitted similar rules for elections to waive spending caps.

The reasons for the omission are not clear. Perhaps it was an oversight. Or perhaps the drafters thought rules were unnecessary, because waivers were to last a maximum of four years. If a waiver was abused, the abuse would soon be over and voters could hold the guilty officials accountable.

But in 2002, the Colorado Court of Appeals issued a case seriously misinterpreting TABOR. The court ruled that once the voters in a particular locale approve a spending cap waiver, the waiver does not necessarily expire. The waiver may specify five years, or seven, or ten. If it does not contain an ending date, the waiver lasts forever. TABOR spending caps never apply in that locale again.

To read the rest of this story, please click (HERE):