Proposition CC, on the November 2019 ballot, gives government all extra tax monies collected above the TABOR limits – forever!

Vote No on Prop CC.

If you’re a Colorado taxpayer, you better get a firm grip on your wallet. Once again, the forces of unlimited government and the folks who know how to spend your money better than you do are after it. The dragon they want to slay for the umpteenth time is commonly known as TABOR, The Taxpayer’s Bill of Rights.

This was an amendment added to the state constitution via a ballot question by a direct vote of the people in the general election of 1992. It limits spending by all levels of government under a formula that considers population growth and inflation. It also requires approval by the voters for tax increases.

To read the rest of this story, click (HERE):

FEATURED, GOLD DOME, MICHAEL FIELDS, PROPOSITION CC, TABOR, TAXES, UNCATEGORIZED

July 26, 2019 By Michael Fields

As our state’s roads continue to get worse and worse, Coloradans are wondering when the legislature is finally going to make them a priority.

Earlier this month, a portion of U.S. Highway 36 collapsed, briefly shutting down the main connection between Boulder and Denver. The road was built only a couple of years ago through a public-private partnership – and the estimated cost to fix it is $20 million.

The Colorado Department of Transportation (CDOT) has direct oversight over these road projects, and the legislature has direct oversight over CDOT.

So, it’s worthwhile to look both at CDOT’s performance, and how much focus (or lack of focus) the legislature has been putting on fixing our roads.

A newly released state performance audit looked at CDOT from 2016-17 – and the findings are quite alarming. CDOT spent 37% – $582.7 million – more than its approved budget for 2016-17. In the real world, most of us would get fired from our jobs if we overspent our budgets by 37%.

But that wasn’t CDOT’s only problem. The agency did not properly track how $1.3 billion was spent. While not finding any blatant fraud, the audit did say there was “suspicious patterns and anomalies.”

This was happening around the same time that CDOT decided to build new offices for itself, costing taxpayers $150 million. With tone-deaf decisions like these, it’s no wonder why taxpayers continually shoot down statewide tax increases.

Republican evangelical Kendal Unruh, right, along with Pam and Steve Houser, left, talk election issues with Beverly Hills resident Rusty Fuerst.

By ANNA STAVER | astaver@denverpost.com | The Denver Post

July 25, 2019 at 6:00 am

For weeks the people who oppose a ballot measure that would end state TABOR tax refunds have spent thousands of dollars knocking on doors, passing out flyers and making phone calls.

Those who support Proposition CC, however, are nowhere to be seen.

Transportation and education lobbyists, whose organizations stand to directly benefit from a victory this November, told The Denver Post they hadn’t heard of an active campaign in support of Proposition CC yet. No record of one exists in the Secretary of State’s Office’s online system, and major Democratic firms like Onsight Public Affairs haven’t been hired to assist anyone.

The Post couldn’t find a Democrat who would talk about it on the record.

“For a lot of people we talk to this is the first time they’ve ever heard about (Proposition CC),” said Jesse Mallory, who runs the Colorado arm of Americans for Prosperity. “We get to explain the true impact it would have, and what the legislature is truly asking.”

Gee, we wonder what they’re trying to hide?

Why are they being so sneaky?

Don’t lose your #TABOR Rights.

Vote NO on whatever they call it in 2020

Megan Verlee/CPR News

Megan Verlee/CPR NewsThe Colorado Title Board on Wednesday approved key language for a possible 2020 ballot initiative that would repeal a highly consequential part of the state constitution.

But which part, exactly? If you ask repeal proponents, it’s Article X, Section 20. If you ask repeal opponents, it’s the Taxpayer’s Bill of Rights, or TABOR. How the ballot question is presented to voters is just the latest high-stakes skirmish in a long war over TABOR, a controversial constitutional amendment passed in 1992 that’s limited government growth in the state.

Both sides presented arguments to the title board, a three-member panel with representatives from the Secretary of State’s office, the state Attorney General and the Office of Legislative Legal Services, that decides if ballot measures meet all requirements and how they should appear on the ballot.

The liberal-leaning Colorado Fiscal Institute is backing the repeal effort, which won a significant victory at the Colorado State Supreme Court last month allowing it to inch closer to the 2020 ballot. Carol Hedges, the group’s executive director, said using the specific term, “Article X, Section 20,” is the most clear, neutral way possible to refer to the amendment.

To read the rest of this story, click (HERE):

7 reasons to VOTE NO on Prop CC

#TABORYes

#ThankGodForTABOR

#VoteNoOnPropCC

Q&A with Penn Pfiffner | On standing up for freedom, and TABOR

· Dan Njegomir, Colorado Politics

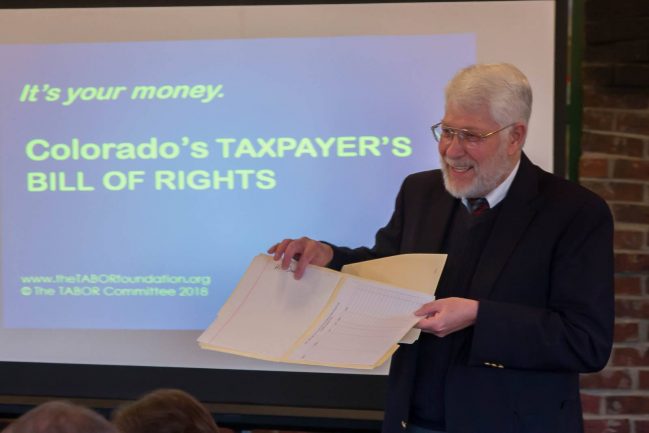

The TABOR Foundation’s Penn Pfiffner addresses the Reagan Club of Colorado earlier this year. (Photo courtesy the TABOR Foundation)

Even if you don’t move in Penn Pfiffner’s center-right political circles, you’re probably familiar with his name as the media’s go-to guy for comment on the Taxpayer’s Bill of Rights whenever it comes up in the news. And it comes up a lot, of course.

The groundbreaking taxing and spending limits — venerated by some and vilified by others — have been stirring debate ever since being enacted into Colorado’s Constitution by voters in 1992. Better known by its acronym TABOR, the constitutional provision has prompted lawsuits, legislation and more ballot issues by wide-ranging interests hoping to elude or at least ease its restraints on state and local budgets.

The perennial back-and-forth over TABOR also spawned the TABOR Foundation, which, along with its advocacy counterpart the TABOR Committee, emerged with the help of Pfiffner and other resolute TABOR supporters to stand up for the policy.

Pfiffner, who served as a Republican state representative from Lakewood in the 1990s, has become as distinctive a voice for TABOR over the years as he has for the advocacy of limited government in general.

He expounds on both of those endeavors and more — as always, in his characteristically eloquent and respectful way — in today’s Q&A.

Colorado Politics: Let’s start with a recent headline. The state Supreme Court ruled June 17 that a pending ballot proposal to repeal TABOR in its entirety may proceed — despite a constitutional “single-subject” stipulation on ballot issues that was long believed to have blocked precisely such an all-in-one-shot repeal.

In a public statement from the TABOR Foundation condemning the ruling, you said, “The court has become dangerously unmoored from the clear meaning of the state constitution.” The statement also said the court ”appears to take sides.”

Recap for us what was fundamentally at issue in the case before court — and why you feel the court missed the mark.

Penn Pfiffner: The recent direction of the Colorado courts on constitutional matters should trouble any citizen. Our American system relies on an honest judicial branch to impartially interpret the law. We have seen an absolutely consistent antipathy from the courts towards the Taxpayer’s Bill of Rights.

It’s an understatement to say that the justices from trial level to the Colorado Supreme Court have appeared to argue backwards from predetermined outcomes. Some of the arguments appeared to me to be even juvenile, like an adolescent trying too hard to argue the impossible.

The central finding in the Bridge Enterprise case that the TABOR Foundation brought is an example. Years from now, I surmise historians of Colorado’s system will be amazed and disgusted that it became so partisan during these recent years. Good, experienced attorneys today are urging the TABOR Foundation not to bring any more constitutional issues to the judicial branch — it’s that futile, and all that we end up with is setting bad precedent. In the case you raise, the court explicitly threw out a generation of precedent. It’s as if they never opened the section on TABOR to read all the different pieces in this comprehensive constitutional measure.

A dissent from the bench pointed out that some activist could now substitute Colorado’s extensive “Bill of Rights” for “Taxpayer’s Bill of Rights” (in a ballot proposal) and in one vote overturn all citizen protections. A leftist court looks ready to use its personal political views to put a thumb on the scales of justice.

Penn Pfiffner

CP: Give us your elevator speech on TABOR’s role, and value, in our state constitution.

To read the rest of this story, click (HERE):