Category Archives: Fiscal Policy

Polis Pitches Tax Cuts, But His Democrat-Run Statehouse Isn’t On Board

Polis Pitches Tax Cuts, But His Democrat-Run Statehouse Isn’t On Board

Patrick Gleason, Contributor

I cover the intersection of state & federal policy and politics.

Dec 15, 2023,05:40am EST

Colorado Governor Jared Polis (Photo by Michael Ciaglo/Getty Images)

GETTY IMAGES

If Texas Governor Greg Abbott (R) were to coauthor a New Republic column with Paul Krugman or another famous progressive economist touting the benefits of greater government spending, that would surprise many. Yet the ideological analog to that occurred recently, with Colorado Governor Jared Polis (D) coauthoring an article with economist Arthur Laffer, in which they tout the benefits of reduced tax rates. Governor Polis and Dr. Laffer also contend that the Taxpayer’s Bill of Rights (TABOR), Colorado’s thirty one year old constitutional amendment that prevents state spending from growing faster than population growth plus inflation and requires tax hikes to receive voter approval, is flawed.

In their op-ed, published in National Review on December 7, Polis and Laffer lament that tax limitation measures “such as Colorado’s Taxpayer’s Bill of Rights, that focus on tax payments rather than tax rates totally miss the opportunity to address the damage done by high tax rates.” Polis and Laffer bemoan the fact that TABOR surpluses are not automatically refunded in the form of tax rate reductions and instead go out as rebate checks.

“If there is an excess in tax revenues above population growth and inflation, as defined by TABOR, that means tax rates should have been lower but were not,” write Polis and Laffer. “The law serves as a signal that tax rates have been too high. The proper response to this signal is not to have it keep signaling, but to get the message and cut tax rates permanently.”

What’s more, Governor Polis’s stated desire for tax rate reductions is belied by his enactment of a bill that will make it more difficult to pass income tax cuts in the future by ballot measure. That new law, which was signed by Polis in 2021, mandates that citizen-initiated income tax cuts feature poison pill ballot language claiming the measure will reduce funding for education, healthcare, and other priorities, even when that’s not true.

Colorado House Minority Leader Mike Lynch (R) and Senator Byron Pelton (R) introduced a bill during last month’s special legislative session that would have reduced Colorado’s income tax rate from 4.4% to 4.0%. Governor Polis acknowledges the economic benefits of lowering income tax rates in his recent column, yet he did not support that bill, which was killed in committee along party lines.

Click (HERE) to go to Forbes to read the rest of this article

Only tax INCREASES have to go on the ballot. Vote NO on Prop HH

Only tax INCREASES have to go on the ballot.

Tax DECREASES do not.

Prop HH is on the ballot. . . .

Don’t be fooled by Leftist smoke and mirrors.

This is one of the biggest money grabs in Colorado history.

#ItsYourMoneyNotTheirs

#DontBeFooled

#VoteNoOnPropHH

#TABOR

Menten: Honest voter guide needed to counter Proposition HH deception

Menten: Honest voter guide needed to counter Proposition HH deception

August 15, 2023 By Natalie Menten

In October 2023, Colorado voters are going to get a ballot information guide, nicknamed the Blue Book (it literally has a blue cover page) in the mail prior to the arrival of their actual ballots.

In October 2023, Colorado voters are going to get a ballot information guide, nicknamed the Blue Book (it literally has a blue cover page) in the mail prior to the arrival of their actual ballots.

This year the Blue Book will cover the two statewide tax increases – Proposition II and HH.

Common questions during the election include who phrases the ballot questions and who writes the Blue Book. This is especially true when ballot questions are deceptively worded like Proposition HH, which paints pictures of pies in the sky without disclosing the real intent to screw you out of your Taxpayer’s Bill of Rights (TABOR) refunds for at least the next 10 years, and likely forever.

The Blue Book is where you can make a difference. You get to participate and no expertise is needed. There’s a special reason that you’re especially needed this year.

Slick politicians wrote the Prop HH ballot language and rushed it through the state legislature without responsible notice to the public. A recent survey indicates 2/3 of voters will vote for Proposition HH if they read only the deceptive and misleading ballot question that state Representatives Chris deGruy Kennedy and Mike Weissman, and Senators Steve Fenberg and Chris Hansen cunningly wrote.

It’s up to us to ensure content in the ballot guide provides a full and clear picture to voters. Otherwise, the majority of the players at the table are the very politicians who hate spending limits and TABOR, like the sponsors of Prop HH (Senate Bill 23-303). Continue reading

David Flaherty CEO of Magellan Strategies Talks About Proposition HH

David Flaherty is CEO of Magellan Strategies, a CO-based public opinion polling and survey research firm. He recently did an interesting poll about Proposition HH, a measure on this November’s ballot which will slightly lower property tax rates while all but eliminating (over several years) TABOR refunds. It’s a disgusting and cynical ploy which I will work hard to defeat. The poll’s findings are interesting: in short, people like HH until they understand it. The implications are obvious.

Colorado Proposition HH Opinion Survey | Magellan Strategies

Colorado Proposition HH poll shows mixed support, opposition (denverpost.com)

I also want to know: How do pollsters inform respondents about an issue, to test uninformed vs informed, without injecting bias into the question?

Click the following link to hear a recording of the show:

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteNoOnPropHH

#TABOR

Voters Polled On Proposition HH

It’s important to educate the voter on Prop HH. 44% of people will vote against it if they know enough about it.

2 key takeaways that every voter should know:

- Prop HH will take away your TABOR tax refund.

- Local governments will be able to keep money owed to you without asking your permission.

Here are the results of Magellan’s Polling survey: https://magellanstrategies.com/proposition-hh-survey/

And the Polling presentation: https://magellanstrategies.com/wp-content/uploads/2023/07/Colorado-Proposition-HH-Voter-Opinion-Survey-Presentation-071223.pdf

Here are some stats at a glance:

Prop HH Familiarity

- 41% of total voters are unfamiliar with the proposal

- 42% of men are not familiar at all with the proposal

- 41% of women are not familiar at all with the proposal

- 48% of Democrat voters are not familiar at all with the proposal

- 38% of Unaffiliated voters are not familiar at all with the proposal

- 38% of Republicans are not familiar all with the proposal

- 47% of Latinos are not familiar at all with the proposal

- 44% of Blacks are not familiar at all with the proposal

Uninformed Ballot (of people who don’t understand what HH will do).

- 68% of Democrat voters approve

- 50% of Unaffiliated voters approve

- 44% of Republican voters approve

Losing TABOR refunds and letting the state retain the money

- 26% of Democrats voters reject

- 55% of Unaffiliated voters reject

- 75% of Republican voters reject

- 44% of Latino voters reject

- 52% of Black voters reject

Participatory Taxation *

- 61% of men reject the proposal

- 54% of women reject the proposal

- 52% of voters 18 -34 reject the proposal

- 63% of voters 35 – 44 reject the proposal

- 44% of Democrat voters reject the proposal

- 61% of Unaffiliated voters reject the proposal

- 67% of Republicans reject the proposal

- 54% of Hispanic voters reject the proposal

- 69% of Black voters reject the proposal

* If Prop HH is approved, a new process called “Participatory Taxation” or “Truth in

Taxation” would be created for local governments to consider. This process would allow a

majority of local government elected officials to vote to retain property tax revenue that

would otherwise be refunded to taxpayers. To clarify, elected officials, rather than voters,

would decide to keep property tax revenue.

#DontBeFooled

#ItsYourMoneyNotTheirs

#VoteNoOnPropHH

#TABOR

Protecting Colorado Taxpayers and Preserving TABOR: Jonathan Williams on American Radio Journal

ALEC Executive Vice President of Policy and Chief Economist Jonathan Williams discusses an upcoming Colorado ballot measure that would expand government spending and weaken Colorado Taxpayer’s Bill of Rights (TABOR), the nation’s strongest taxpayer protection.

The progressive push to undermine common sense checks on government spending is never-ending. It’s evidenced recently by the debate over the federal debt limit in Washington DC. The latest push is happening in Colorado as progressives are once again attempting to undermine the taxpayers’ Bill of Rights or TABOR, which is the gold standard of a state constitutional limit on overspending and overtaxing. It was adopted by voters as a state constitutional amendment back in 1992. It has helped restrain the growth of government and return billions of dollars to Colorado taxpayers.

However, the upcoming ballot measure in Colorado if approved, would gut TABOR in exchange for small, short-term cuts to property tax. Known as Proposition HH, this proposal tempts voters with the allure of a property tax cut with its real purpose is to clearly to water down TABOR’s tax and spending limits. My friend Ben Murray, Director of fiscal policy at the Independence Institute, described the package as a boondoggle of a property tax plan. The attacks on TABOR aren’t new. The property tax cut quote unquote, is the only latest gimmick to attempt to unleash the leviathan of big government on hardworking Coloradoans.

As the ALEC team explained in the National Review on the recent 30th anniversary of TABOR, TABOR has seen no shortage of progressive attacks which serves as an acknowledgement of the danger it presents to those that would like no constraints on the government’s ability to grow. Though all states except Bernie Sanders of Vermont have some sort of a balanced budget requirements in state law or their constitution, most don’t have robust protections such as that what TABOR offers.

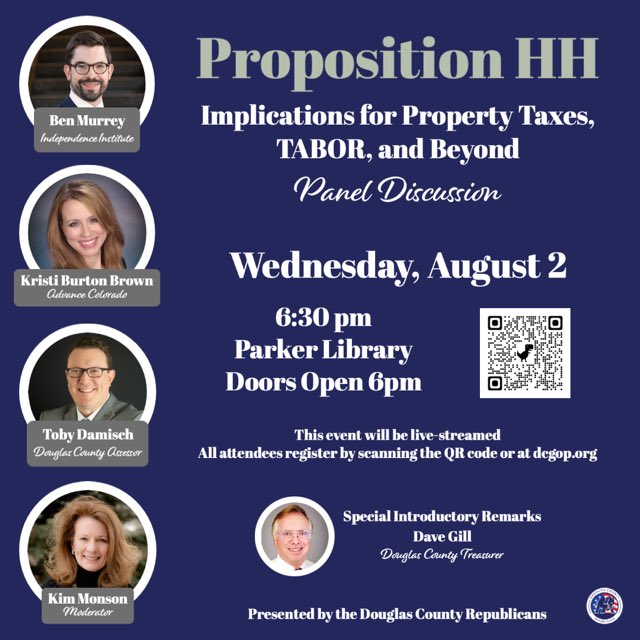

Proposition HH Panel Discussion On Wednesday, August 2

Hear Ben Murrey, Kristi Burton Brown, Douglas County Assessor Toby Damisch and Treasurer Dave Gill take questions from Kim Monson on Property Taxes, TABOR, mill rates, and Assessed values.

Coloradans can expect another TABOR windfall. How much depends on voters in November

Coloradans can expect another TABOR windfall. How much depends on voters in November

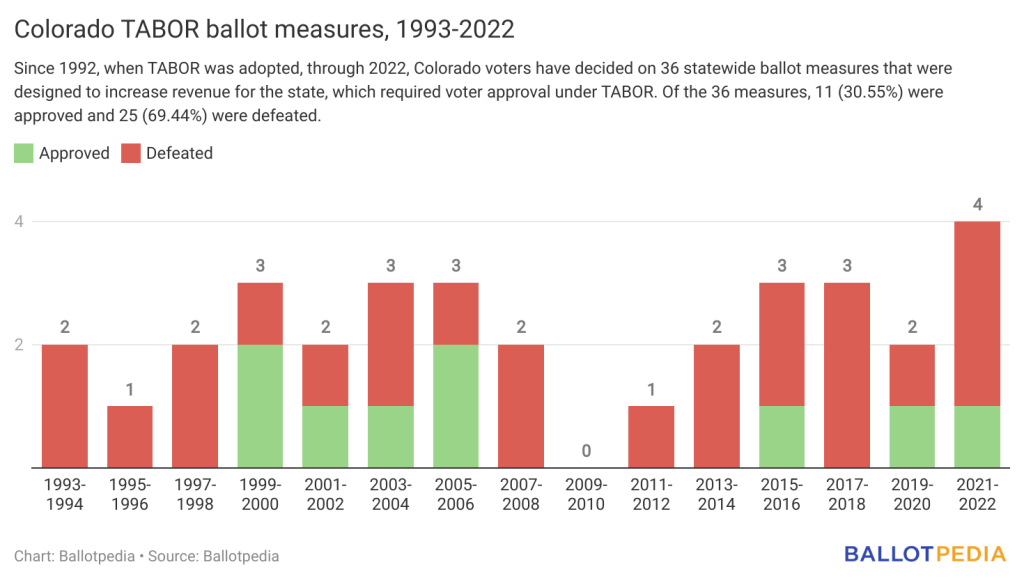

Coloradans have voted on 36 TABOR-related ballot measures since 1993, rejecting 69% of them

Coloradans have voted on 36 TABOR-related ballot measures since 1993, rejecting 69% of them

Coloradans have decided on 36 statewide ballot measures that were designed to increase revenue for the state, which required voter approval under TABOR. Of the 36 measures, 11 (30.56%) were approved and 25 (69.44%) were defeated.

Colorado’s Taxpayer’s Bill of Rights (TABOR), adopted in 1992, was designed to require statewide voter approval of all new taxes, tax rate increases, extensions of expiring taxes, mill levy increases, valuation for property assessment increases, or tax policy changes resulting in increased tax revenue.

Of the 36 measures, 17 were referred to the ballot by the state legislature and 19 were placed on the ballot through citizen initiative petitions. Of the 11 approved measures, 10 were referred to the ballot by the state legislature and one was a citizen initiative.

Highlights:

- 14 of the measures were designed to increase a tax. Of the 14 measures, two were approved and 12 were defeated. In 2004, voters approved an initiative to increase the tobacco tax to fund educational and healthcare programs. In 2020, voters approved a measure placed on the ballot by the state legislature to increase tobacco taxes and create a tax on nicotine products to fund health and education programs.