Rob Natelson wrote THE BOOK on Colorado’s Taxpayer’s Bill of Rights. As he puts it, “It’s everything you could ever want to know about TABOR.” Check it out here: https://www.i2i.org/the-colorado-taxp…

Rob Natelson wrote THE BOOK on Colorado’s Taxpayer’s Bill of Rights. As he puts it, “It’s everything you could ever want to know about TABOR.” Check it out here: https://www.i2i.org/the-colorado-taxp…

Ben Murrey@benamurrey

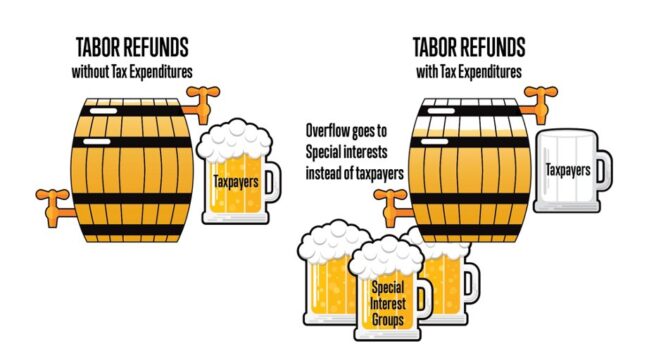

Colorado is over-collecting taxes.

Instead of refunding the excess to everyone, #coleg gives a chunk of the extra money away to special interests first.

The #1 BEST WAY to prevent this is to cut the income tax rate for EVERYONE.

You can read my column on this by clicking the following link:

https://i2i.org/colorado-tax-expenditure-modifications-2023/

#ColoradoRejectedPropHH

#ItsYourMoneyNotTheirs

#DontBeFooled

#VoteOnTaxesAndFees

#FeesAreTaxes

#TABOR

#FollowTheMoney

#FollowTheLaw

#ThankGodForTABOR

House Republicans launched a brief filibuster on Friday morning over legislation to double a tax credit using Taxpayer’s Bill of Rights surplus dollars.

House Bill 24-1084 is actually a repeal and re-enactment of a measure from the special session in November that dealt with property taxes. The 2023 measure doubles the Earned Income Tax Credit.

The filibuster, which occurred on just the third day of the new legislative session, lasted about 45 minutes. Republicans’ opposition centers around the bill’s use of TABOR surplus dollars, which they view as an attack on TABOR by reducing refunds by about $182.5 million.

Last year’s bill is the subject of a lawsuit from Rep. Scott Bottoms, R-Colorado Springs. He filed the challenge in Denver District Court on Dec. 28 against House Speaker Julie McCluskie and Gov. Jared Polis, who signed the bill into law, claiming he had been denied his constitutional right to have the measure be read at length during its final vote on Nov. 9.

To continue reading this story, please click (HERE):

TABOR, or the Taxpayer’s Bill of Rights, can be confusing for many residents, even though it plays a big role in the amount of services a city can offer. Check out this video for a quick and easy explanation.

This month marks the 30th anniversary of Colorado’s Taxpayer’s Bill of Rights (TABOR), which was approved by voters in November of 1992 as a constitutional tax and expenditure limit (TEL). TABOR is considered the gold standard of state fiscal rules because it limits the growth of most of Colorado’s spending and revenue to inflation plus population. If the state government collects more tax dollars than TABOR allows, the money is returned to taxpayers as a TABOR refund. The receipt of tax rebates, totaling $8.2 billion since TABOR passed in 1992, has strengthened Colorado citizens’ confidence in the TABOR Amendment over the years. To learn more about TABOR and effective TELs, read our latest report and visit FiscalRules.org

Economist Dr. Paul Prentice explains Colorado’s Taxpayer Bill of Rights (TABOR) amendment. TABOR allows the state budget to grow each year at population plus inflation, while giving taxpayers the ability to vote on all tax and debt increases.