Q&A with Penn Pfiffner | On standing up for freedom, and TABOR

· Dan Njegomir, Colorado Politics

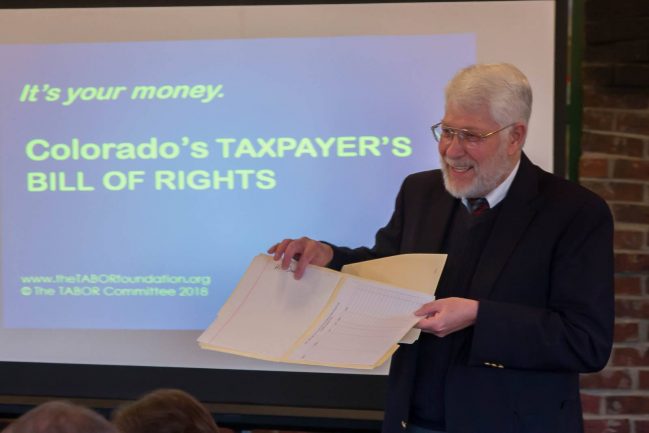

The TABOR Foundation’s Penn Pfiffner addresses the Reagan Club of Colorado earlier this year. (Photo courtesy the TABOR Foundation)

Even if you don’t move in Penn Pfiffner’s center-right political circles, you’re probably familiar with his name as the media’s go-to guy for comment on the Taxpayer’s Bill of Rights whenever it comes up in the news. And it comes up a lot, of course.

The groundbreaking taxing and spending limits — venerated by some and vilified by others — have been stirring debate ever since being enacted into Colorado’s Constitution by voters in 1992. Better known by its acronym TABOR, the constitutional provision has prompted lawsuits, legislation and more ballot issues by wide-ranging interests hoping to elude or at least ease its restraints on state and local budgets.

The perennial back-and-forth over TABOR also spawned the TABOR Foundation, which, along with its advocacy counterpart the TABOR Committee, emerged with the help of Pfiffner and other resolute TABOR supporters to stand up for the policy.

Pfiffner, who served as a Republican state representative from Lakewood in the 1990s, has become as distinctive a voice for TABOR over the years as he has for the advocacy of limited government in general.

He expounds on both of those endeavors and more — as always, in his characteristically eloquent and respectful way — in today’s Q&A.

Colorado Politics: Let’s start with a recent headline. The state Supreme Court ruled June 17 that a pending ballot proposal to repeal TABOR in its entirety may proceed — despite a constitutional “single-subject” stipulation on ballot issues that was long believed to have blocked precisely such an all-in-one-shot repeal.

In a public statement from the TABOR Foundation condemning the ruling, you said, “The court has become dangerously unmoored from the clear meaning of the state constitution.” The statement also said the court ”appears to take sides.”

Recap for us what was fundamentally at issue in the case before court — and why you feel the court missed the mark.

Penn Pfiffner: The recent direction of the Colorado courts on constitutional matters should trouble any citizen. Our American system relies on an honest judicial branch to impartially interpret the law. We have seen an absolutely consistent antipathy from the courts towards the Taxpayer’s Bill of Rights.

It’s an understatement to say that the justices from trial level to the Colorado Supreme Court have appeared to argue backwards from predetermined outcomes. Some of the arguments appeared to me to be even juvenile, like an adolescent trying too hard to argue the impossible.

The central finding in the Bridge Enterprise case that the TABOR Foundation brought is an example. Years from now, I surmise historians of Colorado’s system will be amazed and disgusted that it became so partisan during these recent years. Good, experienced attorneys today are urging the TABOR Foundation not to bring any more constitutional issues to the judicial branch — it’s that futile, and all that we end up with is setting bad precedent. In the case you raise, the court explicitly threw out a generation of precedent. It’s as if they never opened the section on TABOR to read all the different pieces in this comprehensive constitutional measure.

A dissent from the bench pointed out that some activist could now substitute Colorado’s extensive “Bill of Rights” for “Taxpayer’s Bill of Rights” (in a ballot proposal) and in one vote overturn all citizen protections. A leftist court looks ready to use its personal political views to put a thumb on the scales of justice.

Penn Pfiffner

- Chairs the board of directors for the TABOR Foundation and the TABOR Committee, since 2009. The two entities, respectively, educate and advocate on behalf of TABOR.

- Owner, Construction Economics LLC, since 1983; provides financial and managerial consulting to architects, engineers and contractors.

- Senior fellow in fiscal policy at the Denver-based Independence Institute, 2001-2014.

- Served as a Republican state representative from Jefferson County in the Colorado House, 1993-2001.

- Current board member and past president of the Colorado Union of Taxpayers.

- Chaired “Too Taxing for Colorado,” an issue committee to defeat the unsuccessful Proposition 103 tax increase on the 2011 statewide ballot.

- Holds a master’s degree in finance from the University of Colorado Denver and bachelor’s degrees in economics and political science from CU Boulder.

CP: Give us your elevator speech on TABOR’s role, and value, in our state constitution.

To read the rest of this story, click (HERE):

Colorado is ranked one of the worst states in the US regarding the ability to pay state pensions.

Colorado is ranked one of the worst states in the US regarding the ability to pay state pensions.