Category Archives: Editorial

14 REASONS TO OPPOSE UNLIMITED STATE SPENDING

- Does it make sense to vote to give up your right to vote, FOREVER?

- Is it right to vote away other people’s right to vote?

- Government spending is either limited or unlimited. Which do you want?

- The Founding Fathers risked everything for “posterity.” That’s us. Should we surrender the rights of our children and grandchildren…our posterity?

- If you don’t want your state tax refund, tear up your state refund check, butdon’t deny state tax refunds to millions of families who want or need it.

- Make politicians live on a balanced budget, not a blank check.

- America was founded on “the consent of the governed,” a very good idea.

- If spending grows without limit in good times, cuts hurt more in bad times.

- Politicians can change current spending promises in 2020. It’s called lying.

- State spending grows automatically by inflation plus population; we are voting only on the surplus. No ordinary law can change the constitution.

- Total state spending is over $40.9 BILLION yearly; it has zoomed from $9 BILLION in 1994 (6.5% yearly). With 5.5 million people, it now exceeds $7,500 EACH ($30,000 for an average family of four). Isn’t that enough?

- In 2005, they tricked us into a 5-year state spending “time out.” 14 years later, they still steal our refunds. Our loss now exceeds $2 billion yearly.

- Colorado has the best economy of any state, per a national survey. Don’t ruin our prosperity by allowing this BIG tax hike!

- The ballot title says, “Without raising taxes,” another lie. If you lose your tax refund, you pay higher total taxes than if you get your tax refund.

Ferry: Prop CC is a blank check with no expiration date

Even though I don’t write a column anymore, some issues demand attention. Today, it’s Proposition CC. The question is, where to start.

The deceptive wording is as good a place as any.

“Without raising taxes and to better fund public schools, higher education, and roads, bridges, and transit, within a balanced budget, may the state keep and spend all the revenue it annually collects after June 30, 2019, but is not currently allowed to keep and spend under Colorado law, with an annual audit to show how the retained revenues are spent?”

“Without raising taxes and to better fund public schools, higher education, and roads, bridges, and transit, within a balanced budget, may the state keep and spend all the revenue it annually collects after June 30, 2019, but is not currently allowed to keep and spend under Colorado law, with an annual audit to show how the retained revenues are spent?”

It seems to me if the legislature wants to strip one of the fundamentals of the Taxpayer’s Bill of Rights, our lawmakers should have the nerve to say so.

For those of you who don’t know, in 1992 voters amended the Colorado Constitution to limit the growth of government by limiting spending — a bill affectionately known as TABOR.

To read the rest of this TABOR editorial, please click (HERE):

If Prop CC passes, prepare for a full repeal of TABOR

Kevin McCarney of Mesa County reminds voters “All tax revenue goes to the general fund” with #PropositionCC.

Colorado is a unique state for many reasons. Beautiful land, bountiful waters, the Rocky Mountains. However the most unique thing about our state is not physical. It’s a law passed in 1992.

Colorado is a unique state for many reasons. Beautiful land, bountiful waters, the Rocky Mountains. However the most unique thing about our state is not physical. It’s a law passed in 1992.

No other state in the union has one.

It is a most simple law. If the politicians want to raise our taxes, they have to put to a vote of the citizens. If they want raise our debt, they have to put it to a vote of the citizens. If the tgovernment collects more tax revenue than permitted they have to return the money to us. Simple as that.

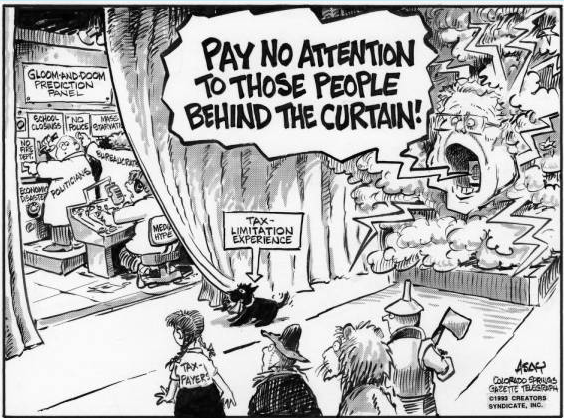

Bureaucrats hate this law. So do most lawmakers. You see, they think they know how to spend our money better than we do and want the right to spend without limits.

Our Taxpayer’s Bill of Rights has led to a backlash at every level of government, and it stretches across party lines. Our people who represent us in government have one thing in common: They can never get their hands on enough of our money to spend.

The Truth Behind The “Yes on CC” Proponents and Why It’s A Lie

Four reasons to vote no on Proposition CC

Four reasons to vote no on Proposition CC

There are many reasons to vote no on Proposition CC, but for the sake of brevity, I will stick with the basics.

Reason No. 1: It does raise taxes.

Reason No. 1: It does raise taxes.

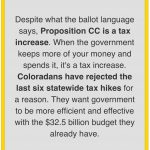

While the first three words of the ballot language for Proposition CC are “Without raising taxes,” this simply isn’t true. And it’s hard to understand how proponents can keep a straight face with this one. If the state owes us money in the form of a refund because we’ve overpaid our taxes, and if they don’t give us the refund, we will in fact pay more taxes than we would have without Proposition CC. Period. Continue reading

Proposition CC Comes Up Short So VOTE NO!

Editorial endorsement: @ColoradoNewsCCM, which has 18 local newspapers, says to vote “No” on Prop CC.

Mike Rosen: NO on Proposition CC, YES on Proposition DD

Mike Rosen: NO on Proposition CC, YES on Proposition DD

2019 Colorado ballots have already been mailed out to voters. This year there are no candidate races and only two state-wide propositions as compared to the raft of complicated ballot measures in 2018. Proposition CC and DD were referred to the voters by the state legislature rather than generated by citizens through petition campaigns. Here are my recommendations.

Proposition CC – Retaining State Government revenue. VOTE NO.

A “yes” vote would allow the state to retain any surplus of revenues in excess of spending not only in fiscal year 2018-2019 but in all years to come. A “no” vote requires the state to refund budget surpluses to taxpayers as now required under current law.

In the Colorado Constitution, The Taxpayer’s Bill of Rights (TABOR) limits state government spending and taxation through a formula tied to population growth and inflation. Direct voter approval is required to change the limit. Article X, Section 20 (7) (d) reads: “If revenue from sources not excluded from fiscal year spending exceeds these limits in dollars for that fiscal year, the excess shall be refunded in the next fiscal year unless voters approve a revenue change as an offset.”

Through that last clause, Prop CC is asking voters to give up their prospective TABOR refunds permanently. It would spend those budget surpluses in equal shares on K-12 education, higher education and transportation without specifying how the money will be spent within those categories, leaving that to legislative whims now and in the future. Look at it this way: state government spending on K-12 in FY 2018-2019 exceeded $7 billion. Eliminating taxpayer refunds would direct an additional $103 million to K-12 education starting in FY 2020-2021. Seven billion is seven thousand million. One hundred million is a comparative drop in the bucket.

Conservative think tank opposes tax refund, sports betting ballot measures

Conservative think tank opposes tax refund, sports betting ballot measures

The think tank, part of Colorado Christian University, says it’s opposing Propositions CC and DD because they aren’t fiscally responsible and don’t help families in the state. The state constitution’s Taxpayer’s Bill of Rights (TABOR) requires voter approval for all tax increases.

“Colorado is more free, families are stronger, and our state budget is healthier if both Proposition CC and Proposition DD are rejected,” Centennial Institute Director Jeff Hunt said.

When state government collects revenue above its spending cap, TABOR requires that money to be refunded back to taxpayers. Proposition CC asks voters to allow state government to permanently keep the occasional tax refunds.

Don’t give Legislature a blank check

DON’T GIVE LEGISLATURE A BLANK CHECK

In your upcoming mail ballot you will be asked to give the state of Colorado a blank check. Don’t be tricked into believing the initial language “without raising taxes…”

Proposition CC is a tax increase forever. Colorado taxpayers will no longer receive (forever) any of their tax rebates (refunds) of their hard earned money if Proposition CC passes.

Colorado Legislature has tricked us in the past by saying requested tax increases would fund roads, bridges, education, teacher pay, and on and on, but when our taxpayer money was spent, the Legislature decided to divert it elsewhere due to lobby and special interest groups pressure. The Legislature has consistently broken promises to Colorado voters. Recently, Colorado voters rejected 13 ballot measures at the state level by a wide margin. Because Colorado voters defeated the Colorado Legislature’s request for more funds, the Legislature now proposes to “trick” Colorado voters again.

This Proposition will “gut” the Taxpayer Bill of Rights (also known as TABOR). The Taxpayer Bill of Rights requires voter approval for any increase in taxes or debt. This is our Taxpayer Bill of Rights, not the Legislature’s, do not vote to give it away forever.

The Taxpayer Bill of Rights has been the only way voters have kept Colorado from spending taxpayer funds to the maximum, as done in California.

Proposition CC will forever remove Colorado seniors and veterans property tax exemptions. This will put seniors and veterans at risk, and place more pressure on local budgets.

Colorado communities have individually voted property tax increases to fund local schools and other services such as fire departments (we can locally determine if funds are being spent as represented), and if Proposition CC passes, those seniors and veterans on fixed incomes will have a difficulty paying local property tax bills.

Colorado has a top ranked economy. The Taxpayer Bill of Rights has contributed to Colorado’s success. Colorado has one of the lowest tax rates in the country providing a positive location for business investment and jobs.

If our Taxpayer Bill of Rights is repealed, over $1.7 billion collected over the next 3 years will not be refunded to Colorado taxpayers.

The Legislature already has a $32.5 billion budget… enough is enough! This budget automatically increases with population and inflation. The Legislature has enough of our money.

The Legislature must be held to account and budget just as we do with our personal budgets.

Mary Ann Smith

Pagosa Springs