June 22, 2017 9:58 AM· By Brian Vande Krol

Little ole Colorado, you’ve done well for yourself. You were a collection of cow towns when I first moved here in 1988. It was said that yogurt was the only culture in Colorado, and cowboys don’t eat yogurt.

Colorado is wealthy. Not DC wealthy, but quite a step up from the late 80’s. We rank 11th for median household income, have the 10th lowest unemployment rate, and the 14th lowest poverty rate. We have the Denver Performing Arts Center, and a growing system of subsidized trains. Colorado is also healthy, ranking 10th.

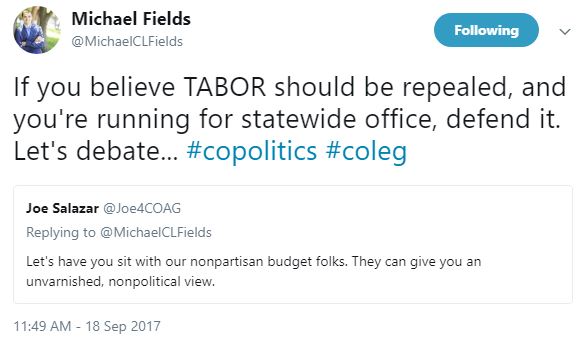

One reason we have done well is our restrained state government. With our balanced budget requirement and the Taxpayer’s Bill of Rights (TABOR), government has a tough time taking more of our money. That means greater economic growth.

But 70% of our state’s roads and bridges are in poor or mediocre condition, and getting worse. And, despite all that wealth and health, 1 in 4 Coloradans depend on the government for healthcare (Medicaid). The legislature wants more of your money, and is willing to close down hospitals to keep it.

The most cynical move of all

The legislature argued for several years about the Hospital Provider Fee, an $800 million program, claiming it is solely responsible for exceeding TABOR revenue limits, a situation that would require refunds to taxpayers. (Yes, it’s actually a tax. They just call it a fee so they don’t have to ask per mission to take the money.) But every revenue source is equally to blame for exceeding the limit. To appease their insatiable appetite for more revenue, the legislature moved the program out of the general fund so it is not subject to the revenue limits. This is a crafty, deceptive scheme to avoid asking permission from voters to take more money, and to avoid refunding excess collections. They threatened to close rural hospitals if they didn’t get their way.

mission to take the money.) But every revenue source is equally to blame for exceeding the limit. To appease their insatiable appetite for more revenue, the legislature moved the program out of the general fund so it is not subject to the revenue limits. This is a crafty, deceptive scheme to avoid asking permission from voters to take more money, and to avoid refunding excess collections. They threatened to close rural hospitals if they didn’t get their way.

TABOR requires a change to the revenue limit if a program’s costs are moved off the books. It also requires TABOR to be interpreted to “reasonably restrain most the growth of government.” Instead of lowering the limit by $800 million, it was lowered only $200 million, resulting in a permanent $600 million per year tax increase. (The $800 million will still be spent, but outside of the budget, leaving more room in the budget, and more taxpayer dollars to be taken and spent.) Senate President Kevin Grantham (R, Canon City) believes that as long as there is a change, he has met the constitutional requirement. Continue reading →